Crypto World November 2019: Bitcoin Lightning, BTC ATMS, Ripple acquired MoneyGram

Bitcoin’s Lightning Network Can Be Used for Private Messaging

Lightning Labs revealed an experimental project: Whatsat, an application of the lightning network which may be utilised to send private messages.

Just like bitcoin, it is censorship-resistant. However, unlike encrypted programs that morph messages to info, securing the text to keep the messages private from prying eyes, there is no central thing to prevent users from using the system.

The developer Joost Jager said:

“Lightning is a peer to peer network in which anyone can participate. There is no central entity that has the ultimate power to decide on [what] users are allowed to communicate.”

Personal messaging is a huge thing in the electronic era, but it is still simple for bad intentioned actors to intercept messages which are not encrypted.

Ghana May Issue Digital Currency in ‘Near Future’

The governor Ghana’s central bank, Ernest Addison, stated that Ghana might issue an electronic form of the country’s currency, the cedi in the”near future”. He also said they are in discussions to develop a pilot project in a “sandbox environment”.

Addison’s opinions, made in Ghana’s Annual Banking Conference, were revealed in a public transcript.

The Bank of Ghana governor said Ghana is experiencing rapid digitization with the help of the mobile banking industry. “Mobile cash” transfers grew by 70% from 2017 to 2018.

Addison said he’d approved that the central bank to issue digital money backed 1:1 by cedi and held electronic wallets Monday. But the digital money is different from cryptocurrency. The governor stated in the press conference:

“It is just electronic money backed by currency,”

So [the central bank] cannot create money; they are only having an electronic representation of the cedi that the Bank of Ghana puts into circulation. So it is not crypto.”

Simon Malls Has 5 New Bitcoin ATMs

Bitstop set up five bitcoin ATMs at Simon Property Group locations within the last month: Carlsbad Premium Outlets in Carlsbad, California, Mall of Georgia in Buford, Georgia, Miami International Mall in Miami, Sawgrass Mills in Sunrise, and The Avenues at Jacksonville, Florida.

They are a part of Bitstop’s drive to woo crypto beginners: individuals who shop at malls, do not know much about blockchain and have a bitcoin wallet.

The co-founder and CEO Andrew Barnard explained these places are similar to the old cliche: “If you build it, they will come.”

“Once you put these ATMs down and you give people easy access, the people go and figure out how to use it,”

With these new places, Bitstop is continuing to build out vulnerability among novices and handhold them through the process of purchasing their very first bitcoin. He explained the kiosks represent a gateway to first-timers.

He said individuals buy from an ATM within an investment, but also to then purchase on the internet or send remittance payments residence.

The average purchase is $160 bucks. And Barnard said traffic is particularly heavy around the 1st and 15th day of every month, which he explained is money back for many consumers.

China’s Digital Yuan Will Target Retail Payments First

Speaking in the Caixin Hengqin Forum at Zhuhai, former leader of the People’s Bank of China Xiaochuan Zhou said the nation will highlight the retail usage of electronic payment to the electronic yuan.

“There are two goals for international digital currencies,”

“The first one, which is also what China envisions is to develop digital payment and its use for retail system in the country, while the other goal is to cross-border payment for international financial institutions.”

According to Zhou, both of these aims will need different technical designs for the electronic yuan, and China may expand its capacities once it implements the electronic payment role.

Zhou said China is a challenging environment to try the new electronic money, and a country with a smaller population might be better because the cycle for money flow is briefer.

“In case there is something wrong, it will be easier to steer the boat into a different direction,”

Ripple Has Acquired MoneyGram For $50 Million

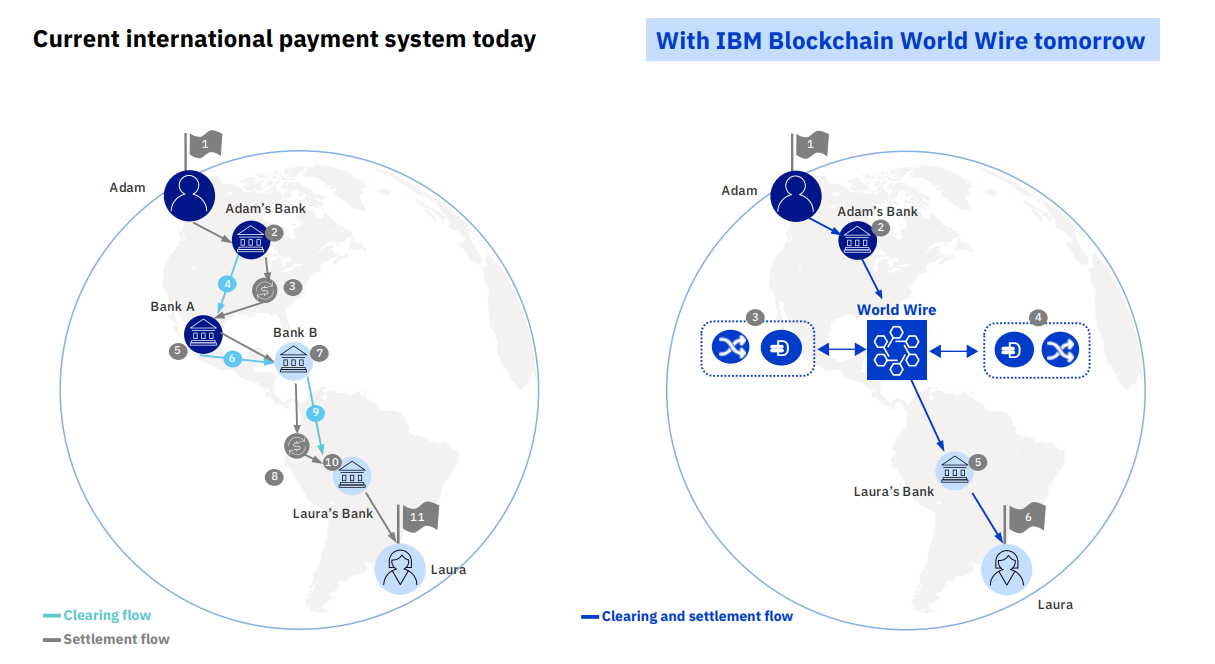

Ripple made the final payment to purchase MoneyGram at a cost of $4.10 per share, which is over a dollar per share of the stock’s recent price of approximately $3.00. The action first started in June 2019.

Ripple owns just under 10% of MoneyGram’s outstanding common stock.

MoneyGram plans to utilize this funding inflow to support its operations, specifically since it expands its usage of Ripple’s On-Demand Liquidity product, the renamed xRapid payment system which uses the XRP cryptocurrency.

Since June, MoneyGram has started using XRP to run trades in Europe, Australia and the Philippines, and now transacts approximately 10% of its own Mexican peso foreign exchange trading volume.

In an announcement, MoneyGram chairman and CEO Alex Holmes said that the venture was “transformative,” noting that the corporation could settle trades “in seconds.”

South Korea Takes Legal Step to Stamp Out Unregistered Crypto Exchanges

South Korea passed a legal amendment to oblige assets exchanges to register with the Financial Services Commission (FSC).

This change was made to align fight money laundering, and it asks crypto exchanges to have so-called actual name virtual bank account – sub-accounts for consumers inside a market’s main account – to avoid falling foul of the laws.

The opposition lawmakers had voiced worries that exchanges without real-name digital balances would be made to shut, bringing additional contraction of the national cryptocurrency market.

In 2018, the FSC outlawed anonymous digital balances with the consequence that just four exchanges were abandoned with real-name digital balances through contracts with local banks: Bithumb, Upbit, Korbit, and Coinone.

Ukraine Plans to Tax Crypto Gains at Low 5% Rate

Ukraine’s parliament received a cryptocurrency tax draft bill.

Written by 13 members of the parliament, the bill defines crypto-assets as a “special type of valuable property in the digital form, created, accounted for and disposed of electronically,”, for example, cryptocurrencies, tokens and other forms are not defined in the draft.

“We are confident that the adoption of this [draft] law will create conditions for the launch of the virtual assets market in line with the legislation of Ukraine, taking into account the balance of interests of entities engaged in transactions with virtual assets and the state, which will get additional tax revenue from such transactions,” said the ministry.

If the bill passes parliament, the earnings from trading assets will be calculated as the difference between the buy price and the price received in the sale. Profits should be declared as “other” form of earnings, while reductions might not be balanced to decrease the whole financial result before taxation, the record states.

Crypto income will generally be taxed at the normal speed, which will be 18% in Ukraine. However, in better information for dealers, there is a first 5% rate on private income from the selling of crypto assets to get a five-year period after approval of the invoice (assuming it moves).

Revenue of crypto assets wouldn’t be responsible for value-added tax (VAT).

Tokenized assets would observe another tax program, being described as electronic assets certifying possession or non-property rights. In such cases, tokens are taxed in precisely the exact same manner as the products or services financing them.

Michael Chobanian, creator of this Ukraine-based crypto trade Kuna and president of this Blockchain Association of Ukraine, stated he considers the law would operate, however, there are additional challenges confronting the business which have to be dealt with.

“If the National Bank of Ukraine doesn’t allow banks to open accounts for crypto businesses in Ukraine nothing for the industry will really change,” Chobanian said.

The ministry lately declared a partnership with all the Binance cryptocurrency market for help developing regulations for crypto from the nation.

Coinbase has added support for 5 new crypto options to its Visa debit card

Coinbase declared that holders of Coinbase Card are now able to spend XRP, basic attention token (BAT), augur (REP), 0x (ZRX) and stellar (XLM). These add to the already available options: bitcoin (BTC), ether (ETH), bitcoin cash (BCH) and litecoin (LTC).

Coinbase clients in Bulgaria, Croatia, Denmark, Hungary, Iceland, Liechtenstein, Norway, Poland, Romania and Sweden have also been given access to Coinbase Card.

Zeeshan Feroz, CEO in Coinbase UK, said in a statement:

“By more than doubling the number of assets our customers can spend on Coinbase Card, as well as introducing the card to 10 new countries, Coinbase continues to help drive crypto’s role as a utility, and not just an investment.”

The Coinbase Card has been introduced back in April to function both the U.K. and EU states. Coinbase issues it “immediately” and converts cryptocurrency into fiat money when clients make a trade using the debit card.

According to the company, the card may be used anywhere that accepts Visa. There are charges for ATM transactions over the value of $200 – 1% domestically and 2% international, and fees for some trades.

Coinbase also supplies an iOS and Android program which allows users to create Visa obligations on their cellular devices. The Coinbase Card is issued by Paysafe Financial Services Limited, a company approved by U.K. regulator, the Financial Conduct Authority.