Litecoin is peer-to-peer online money that permits instant, near-zero price payments to anybody on earth. Litecoin is an open source, an international payment system that’s totally decentralized with no central government.

Litecoin was an early Bitcoin spinoff. In specialized details, Litecoin is almost equal to Bitcoin.

Read more about What’s Bitcoin?

Litecoin premiered via an open-source client on GitHub on October 7, 2011 by Charlie Lee, a Google employee and former Engineering Director at Coinbase. The Litecoin network went live on October 13, 2011.

It was a branch of this Bitcoin Core customer, differing primarily with a diminished block production time (2.5 minutes), a greater maximum amount of coins, another hashing algorithm (scrypt, rather than SHA-256), along with a slightly modified GUI.

During the month of November 2013, the aggregate value of Litecoin experienced massive growth which included a 100% leap within 24 hours.

Litecoin reached a $1 billion market capitalization in November 2013.

In May 2017, Litecoin became the first of their best 5 (coinmarketcap.com) cryptocurrencies to adopt Segregated Witness. Later in May of the identical year, the initial Lightning Network transaction was finished through Litecoin, moving 0.00000001 LTC from Zürich to San Francisco in under one second.

According to litecoin.org, Litecoin works like this:

Mathematics secures the network and empowers individuals to control their own finances. Litecoin features faster transaction confirmation times and improved storage efficiency than the leading math-based currency.

With substantial industry support, trade volume and liquidity, Litecoin is a proven medium of commerce complementary to Bitcoin.

How does Litecoin work? Mining Litecoin and Proof-of-Work

Among the most technical and fundamental differences between the two is that their mining process. Proof-of-work is really simple to comprehend.

The miners use their computational capacity to solve exceptionally tough cryptographic puzzles. The mystery solving should be extremely difficult, if it’s straightforward then miners will maintain mining cubes and drain from the whole bitcoin supply.

But while the mystery solving part is tough, checking to determine whether the solution of this mystery is right or not need to be easy.

And that, in summary, is proof-of-work.

- Solving the puzzles and getting a solution should be tough.

- Checking to see whether the answer is right or not need to be difficult.

Bitcoin and Litecoin go about that somewhat differently.

What are the differences between Litecoin and Bitcoin?

Litecoin differs in certain ways from Bitcoin.

The developers claim that this permits Litecoin to have quicker transaction verification.

Litecoin utilizes scrypt in its own proof-of-work algorithm, a more sequential memory-hard function necessitating asymptotically more memory compared to an algorithm that’s not memory-hard.

Because of Litecoin’s usage of this scrypt algorithm, both FPGA and ASIC devices created for mining Litecoin are somewhat more complex to make and more costly to create than they’re for Bitcoin, which utilizes SHA-256.

Bitcoin employs the SHA-256 hashing algorithm because of its mining functions. Before long, miners found they could radically increase their mining energy by joining together and forming mining pools through parallel processing.

Read more about What are mining and the blockchain tech?

In parallel, the application instructions are broken up among multiple chips. As a result, the running time of the program reduces greatly and that’s essentially what the mining pools do.

Mining Litecoin

The SHA 256 puzzles expect a great deal of processing power, which gave rise to technical”application-specific integrated circuits aka ASICs. The sole reason these ASICs functioned was bitcoin exploration.

These mining pools could essentially have a whole powerplant of ASICs made particularly for bitcoin mining.

- The thought was that any ordinary Joe could sit on his notebook and donate to the system by turning into a miner. But, with the growth of these ASIC plants, the average Joes have no opportunity to compete with the large businesses.

- Mining can be a very wasteful procedure. The quantity of power wastage that occurs via mining is tremendous.

And that is why Litecoin employs the Scrypt algorithm.

What’s Scrypt?

Scrypt was initially called”s-crypt” but it’s announced as”script”. Therefore, parallelizing the calculations isn’t feasible.

Suppose we have two procedures A and B.

With Bitcoin, it’ll be possible for the ASICs to perform A and B together in precisely the exact same time by parallelizing them.

If you attempt to parallelize them, then the more memory required becomes far too much too handle.

Scrypt is known as a”memory difficult problem” because the primary limiting factor is not the raw processing power but also the memory. This is especially the reason parallelization becomes a problem. Running 5 memory difficult procedures in parallel demands 5 times as much memory.

Regular individuals are able to compete by purchasing easy daily memory cards rather than super-specialized ASICs.

Pound-for-pound, memory is far more expensive to create compared to SHA-256 hashing processors.

Scrypt was intentionally designed to create certain that mining is available and democratized as you can. This could, unfortunately, imply that the passing of the fantasy of democratized exploration.

Litecoin Transaction Rate

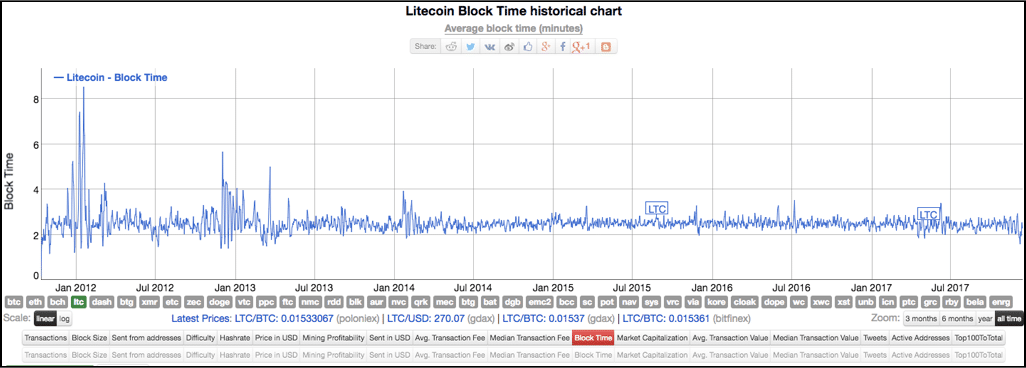

This chart shows the block production time for Litecoin:

This feature is very helpful for retailers who need to perform many mini-transactions every day. Using Litecoin, they could get two confirmations in 5 mins while only 1 affirmation in Bitcoin will require a minimum of 10 mins.

Another significant benefit of the faster block production time is that the variance in miner rewards. Considering that the time between cubes is really modest, an increasing number of miners get the chance to mine cubes and make the mining benefits. This signifies is that the mining benefits should be well-distributed from Litecoin and, by extension, it must be decentralized.

The disadvantages of a quicker transaction rate

Formation of cubes

Mining, in every way, is a contest between miners. You’ve got a lot of miners and pools urgently attempting to mine another block which will be added to the series. There have been cases when more than 1 miner managed to think of a blockchain that might be inserted the series.

In situations such as these, the system determines which block is to be inserted next. Another block then proceeds to turn into an orphan i.e. a totally legitimate cube that will not have any transactions inside.

In Litecoin, because the downtime between the cubes is indeed low, the opportunity of miners mining orphaned cubes increases exponentially.

The strain around the blockchain

Litecoin was created particularly for transaction volume, but that puts immense strain and clogs the blockchain.

Litecoin solved this difficulty into the fantastic scope by introducing Segwit. Considering that Litecoin implemented Segwit, the load in their series has considerably diminished.

Litecoin Atomic Swaps

Atomic swap permits a cross-chain swap of coins without the necessity of a third party. Eg. If Alice had 1 bitcoin and she desired 100 litecoins in return, then she’d normally have to visit a market and pay certain fees to have it done.

Together with the execution of Atomic Swaps, assume Alice has 1 BTC and Bob has 100 LTC, they can swap their coins with one another, without moving to via a market and paying for any unnecessary trade fees.

Atomic swaps operate by using Hashed timelock contracts.

In reality, the Lightning Protocol is the execution of this HTLC.

Thus, what’s an HTLC? Until now we’ve seen stations that use “timelocks”. An HTLC “goes” by introducing”Hashlocks” and all the timelocks.

The HTLC allows opening of payment stations where capital can get moved between parties before a deadline. These obligations become acknowledged via the entry of cryptographic proofs.

On September 20th 2017, Decred and Litecoin were able to finish a cross nuclear swap using a wise contract conducting on SCRIPT.