How To Find A New Coin Crypto Investments Worth Your Attention

In the rapidly evolving world of cryptocurrency, the emergence of new coin crypto and digital tokens is reshaping the landscape.

Asset tokenization and digital tokenization are becoming increasingly prominent, offering new opportunities for investment and innovation.

Particularly, the rise of non-fungible tokens (NFTs) has introduced a unique dimension to digital assets, challenging traditional notions of ownership and value.

As new digital coins and tokenized assets enter the market, understanding the nuances of NFTs and the meaning behind fungibility in these contexts is crucial.

For enthusiasts and developers, creating your own crypto coin or token offers an exciting frontier, with numerous platforms facilitating the launch of new crypto tokens.

Amidst this, the list of new crypto coins continues to grow, each offering distinct features and potential.

From security tokens in crypto to the latest NFT trends, staying informed about new crypto coin releases and the evolving definitions within this digital token board is essential for both seasoned investors and newcomers.

Since the crypto sphere is made out of all kinds of coins and tokens, let’s quickly review all the different kinds you may encounter.

Types of crypto coins:

- Bitcoin (BTC): The first and most well-known cryptocurrency, used primarily as a digital form of money and a store of value.

- Ethereum (ETH): Known for its smart contract functionality, it allows developers to build decentralized applications (dApps) on its blockchain.

- Altcoins: A collective term for all cryptocurrencies other than Bitcoin, often with different features and use cases.

- Stablecoins: Cryptocurrencies pegged to a stable asset, like the US dollar, to minimize price volatility (e.g., USDT, USDC).

- Utility Tokens: Used within a specific ecosystem to access services or pay for network fees (e.g., Binance Coin, Chainlink).

- Security Tokens: Digital tokens that represent ownership in real-world assets and are subject to regulatory oversight.

- Privacy Coins: Designed to provide secure and anonymous transactions (e.g., Monero, Zcash).

- Central Bank Digital Currencies (CBDCs): Digital currencies issued and regulated by a country’s central bank.

- Non-Fungible Tokens (NFTs): Unique digital tokens that represent ownership of specific items, often used for digital art and collectibles. How to judge an NFT?

- Governance Tokens: Provide holders with voting rights in decentralized organizations or protocols (e.g., MakerDAO’s MKR).

- DeFi Tokens: Associated with decentralized finance projects, these tokens often facilitate financial services without traditional intermediaries.

- Exchange Tokens: Issued by cryptocurrency exchanges, often offering benefits like trading fee discounts or participation in exchange decisions.

- Tokenized Assets: Digital tokens representing a share in a real-world asset, like real estate or art.

- Layer 1 Tokens: Native tokens of foundational blockchain networks (e.g., Ethereum, Solana) that provide the infrastructure for other tokens and applications.

- Layer 2 Tokens: Operate on top of an existing blockchain to improve scalability and efficiency (e.g., Polygon).

- Meme Coins: Often created as a joke or with no serious purpose, gaining popularity through social media and community support (e.g., Dogecoin).

- Yield Farming Tokens: Associated with yield farming practices in DeFi, where users earn rewards for lending their assets.

- Liquidity Pool Tokens: Issued to liquidity providers in decentralized exchanges as a proof-of-stake (PoS) and for earning transaction fees.

- Play-to-Earn Tokens: Used in blockchain-based games, rewarding players for participating and achieving certain milestones (e.g., FootballCoin’s XFC or Axie Infinity’s AXS).

- Fan Tokens: Offer fans a stake in the decision-making of sports teams or clubs, often providing voting rights and exclusive rewards.

Researching new coins

When assessing new crypto coins or digital tokens, it’s crucial to understand the problem the coin aims to solve.

Each new crypto coin today (from asset tokenization to NFT crypto currency) is designed with a specific purpose in mind.

For instance, a new coin in crypto might focus on improving transaction speed or offering enhanced privacy compared to existing cryptocurrencies like Bitcoin.

Understanding the underlying technology and innovation is equally important. Whether it’s a new digital coin leveraging blockchain advancements or a crypto security token offering new ways of asset representation, the technology behind a coin determines its potential and sustainability. This includes innovations in digital tokenization, such as the creation of new token crypto types or the use of CBDC tokens by central banks.

Analyze the development team

The credibility and expertise of the team behind a new crypto coin are critical factors in determining its potential success. When researching new crypto tokens or digital tokens, it’s essential to examine the backgrounds of the team members.

Look for their previous experiences in the crypto and tech industries, and consider their track record in creating or managing similar projects.

A strong team with a history of success in developing crypto currency tokens or digital tokenization projects can be a promising sign.

Pay attention to their transparency and communication.

Teams that are open about their goals, progress, and challenges, particularly those involved in making their own crypto coin or dealing with complex concepts like fungible meaning in NFT, tend to inspire more confidence.

Also, check if the team has been involved in any controversies or disputes in the past, as this might affect the future of the token.

Lastly, consider the team’s vision and long-term commitment.

Are they dedicated to the project’s future, or do they have a history of abandoning projects?

A committed team is more likely to navigate the challenges of launching and sustaining a new coin in crypto, ensuring longevity and stability.

Where can you find all this info? Look on the project’s website. Search for the “About Us” or “About Team” section. Also, check the project’s social media profiles, the profiles of the developers and any other info about each individual involved in that project. The more info you can find online about them, the better.

Market analysis and trends

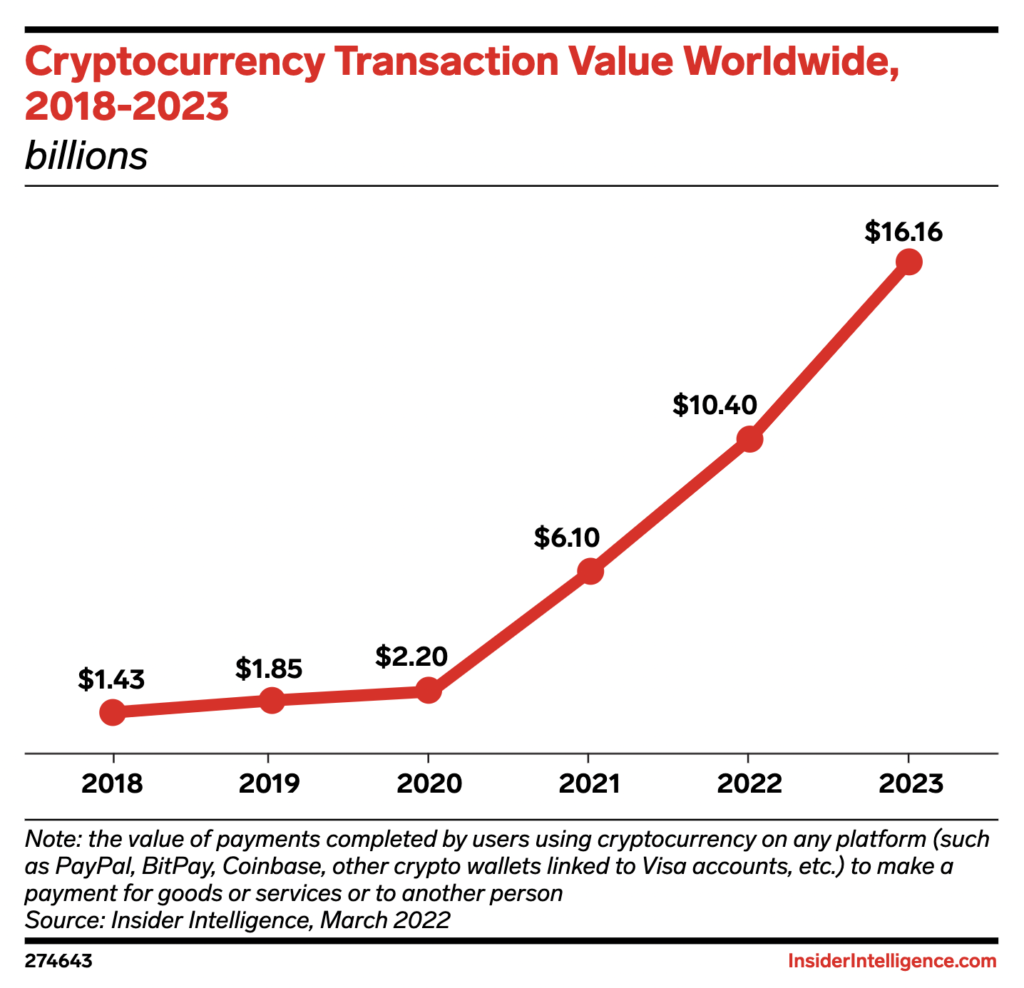

Staying abreast of market trends is crucial in the dynamic world of cryptocurrency.

For new crypto coins, including recent entries like non-fungible tokens (NFTs) or security tokens, market sentiment and trends can greatly impact their value and potential for success.

It’s important to monitor overall market movements, regulatory changes, technological advancements, and investor behavior, as these factors can significantly influence the acceptance and growth of new digital tokens.

Look for patterns and trends in the market, such as increased interest in a certain type of coin, like CBDC tokens or tokenized assets.

This can signal where the market is heading and which new coin crypto might gain traction. Also, stay updated with news and developments in the blockchain and financial sectors, as they often hint at future trends.

Identifying signs of potential growth or risk

Identifying potential growth indicators for new crypto coins involves analyzing factors like trading volume, market capitalization, and community engagement.

A high trading volume and growing market cap can indicate strong investor interest and potential for growth.

Community strength, especially for new crypto coins to be released or those recently listed, is another positive sign. A vibrant, active community often suggests good market acceptance and long-term viability.

Conversely, be wary of red flags that might signal risk. These include limited or fake trading volumes (often seen in new crypto coin pump-and-dump schemes), lack of transparency from the development team, and negative sentiment in community discussions or forums.

Additionally, keep an eye out for any legal or regulatory issues that might affect new crypto tokens, as these can lead to significant volatility or even the demise of a coin.

Where can you check market analysis and trends for new crypto coins?

Here’s a list of crypto platforms that provide a range of tools and resources for tracking and analyzing market trends, helping you stay informed about the ever-evolving world of cryptocurrencies.

- CoinMarketCap: Offers comprehensive data on cryptocurrencies, including price charts, market cap, trading volume, and historical data.

- CoinGecko: Provides a broad overview of the cryptocurrency market, including price tracking, volume, market cap, and community growth.

- CryptoCompare: Features detailed analyses and live price information for various cryptocurrencies, along with reviews and community ratings.

- TradingView: Known for its advanced charting tools, TradingView is ideal for technical analysis and trend identification in the crypto market.

- Messari: Offers in-depth research, analytics, and news updates on the crypto market, focusing on new and existing coins.

- Blockchain Explorers (like Etherscan for Ethereum): Useful for tracking transactions, wallet addresses, and new tokens on specific blockchains.

- Reddit & Cryptocurrency Forums: Subreddits like r/CryptoCurrency and other forums can be great for community sentiment analysis and trend spotting.

- Binance Research: Provides institutional-grade analysis, in-depth insights, and comprehensive reports on new cryptocurrencies.

- Glassnode: Offers blockchain data and intelligence, including insights into on-chain metrics and market indicators.

- Twitter & Crypto Influencers: Following reputable crypto analysts and influencers on Twitter can provide real-time insights and trends.

- Santiment: A platform for analyzing sentiment, network health, and other metrics for understanding crypto market trends.

- Crypto News Websites (like CoinDesk, Cointelegraph): Regularly publish articles, analyses, and news updates on the crypto market.

- LunarCRUSH: Specializes in social media analytics for cryptocurrencies, offering insights based on social engagement and sentiment.

Legal and regulatory considerations

Navigating the legal and regulatory landscape is crucial for anyone interested in new cryptocurrencies.

Understanding the legal framework means being aware of how different countries and jurisdictions regulate or view cryptocurrencies, including new crypto coins. Regulations can vary widely, from full support to complete bans.

The impact of these regulations on new coin investments is significant.

Regulatory changes can affect the legality, value, and stability of cryptocurrencies.

For investors, this means staying informed about current and upcoming regulations in their region and globally, as these can influence investment decisions and the potential risks and returns associated with new digital tokens.

Community and ecosystem

In the world of new crypto coins, the community plays a pivotal role.

A strong and active community can drive the success of new digital tokens, whether it’s a new coin crypto, an NFT non-fungible token, or a security token in crypto. Community support often translates to higher engagement, better trust, and increased visibility.

Assessing the strength and activity of a coin’s community involves looking at its presence on social media, forums, and discussion platforms.

For most crypto projects, the most used social platforms are X (formerly known as Twitter), Reddit, Discord, and Telegram. Most projects list their socials directly on their website’s homepage.

A vibrant community with active discussions, positive sentiment, and collaborative development indicates a healthy ecosystem for new crypto coins to be released or those already in the market. This can be a strong sign of the coin’s potential growth and sustainability.

Strategies for long-term success

For achieving long-term success with new coin crypto investments, adopting strategic approaches is essential.

This involves careful selection of new digital coins, focusing on those with solid fundamentals, like robust technology or strong community support.

Diversifying your portfolio with a mix of different types of digital tokens, including NFTs and security tokens, can also help mitigate risks.

Staying informed is key.

Regularly update yourself on market trends, technological advancements, and regulatory changes.

This knowledge allows you to adapt your investment strategies to new crypto coins and market dynamics, ensuring you are well-positioned to capitalize on opportunities and minimize potential losses.

Remember, the crypto market is fast-paced and ever-evolving, so flexibility and continuous learning are vital for long-term success.