How to Judge an NFT Project: Lessons From Overhyped Projects

Why are NFT prices falling? What to avoid when buying NFTs from a crypto project?

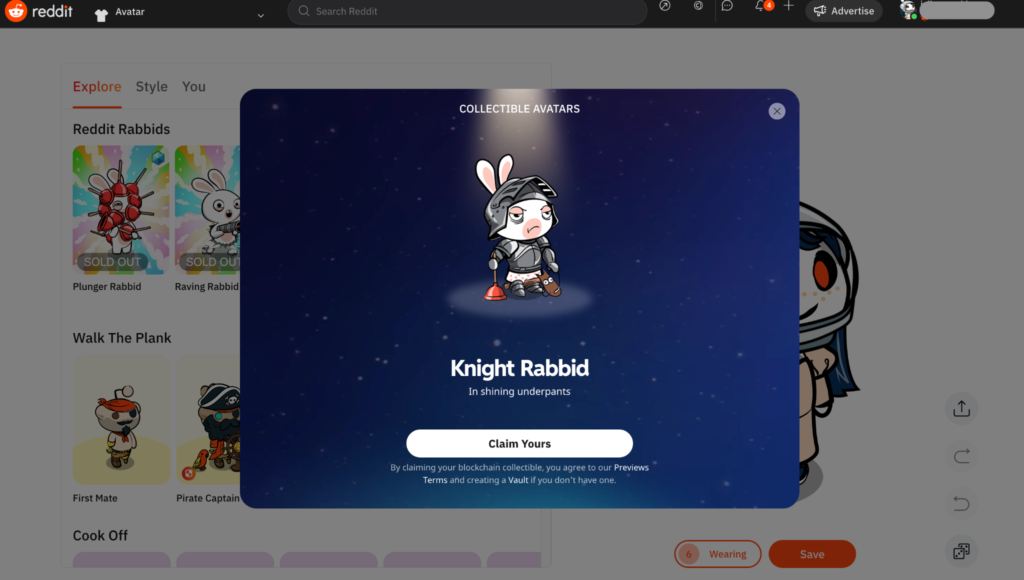

Remember the popular NFT collection called Bored Ape Yacht Club (BAYC)?

This collection became extremely valuable in early 2022, but as of 2023, its popularity has faded, causing prices to drop dramatically.

The lowest price for one of these NFT artworks, also called the ‘floor price’, has fallen from 153.7 ETH (a type of digital currency) to 27.4 ETH.

This ‘floor price’ helps indicate the overall worth of the art collection, so a big drop in the floor price means that the value of individual pieces has also taken a big hit.

One popular example of a BAYC NFT price decrease that has been circulating on social media is a piece owned by Justin Bieber, which was once valued at $1.3 million and is now only fetching offers of around $58,000.

That being said, those who bought these artworks early are still doing okay, as these pieces are still quite valuable compared to other NFTs.

However, this isn’t the only digital asset that’s seen prices skyrocket and then crash in recent years. In fact, it’s pretty much keeping pace with the overall NFT market, which is at its lowest in two years.

However, there are important lessons to be learned from this situation.

Many people, especially those who invested heavily, have paid a steep price to learn these lessons. So if you can learn from their experiences without losing money yourself, it’s wise to do so.

Beware of projects which use extreme marketing

The Bored Apes always had an intense marketing campaign going on.

Such unnatural hype can artificially inflate an asset’s value and make its market more fragile. For digital assets like these, it can result in investors who don’t really understand what they’ve bought into.

It encourages risky speculation over genuine engagement, weakening the market. A stable market should be built on cultural value and real affection for the asset, not just a flashy advertisement.

Additionally, when these NFTs are showcased in mainstream media, it might prompt wealthy individuals to buy many, raising the entry price for new investors and creating potential points of failure.

For instance, when a major Ape owner rapidly sold dozens of NFTs earlier this year, it drove the market to a five-month low.

A healthy digital art market needs a diverse community of engaged, individual owners, not a bunch of speculators ready to sell at the first sign of trouble.

Don’t rely on digital assets to maintain a stable value

Some Bored Ape owners have used their Apes as loan collateral and are now facing losses as values fall.

For example, BendDAO, a loan service, is selling dozens of Apes that were taken as collateral for unpaid loans.

This is just one of many similar services, and these forced sales might even be causing Bored Ape values to spiral downwards.

The notion that NFTs could be used as reliable financial tools this early in their existence is highly doubtful, even though providing such a service might be profitable.

But borrowing against a volatile asset, whether it’s a digital one or not, is a terrible idea.

Now these borrowers are seeing their Apes being sold off at the market’s lowest point instead of potentially waiting for a better time.

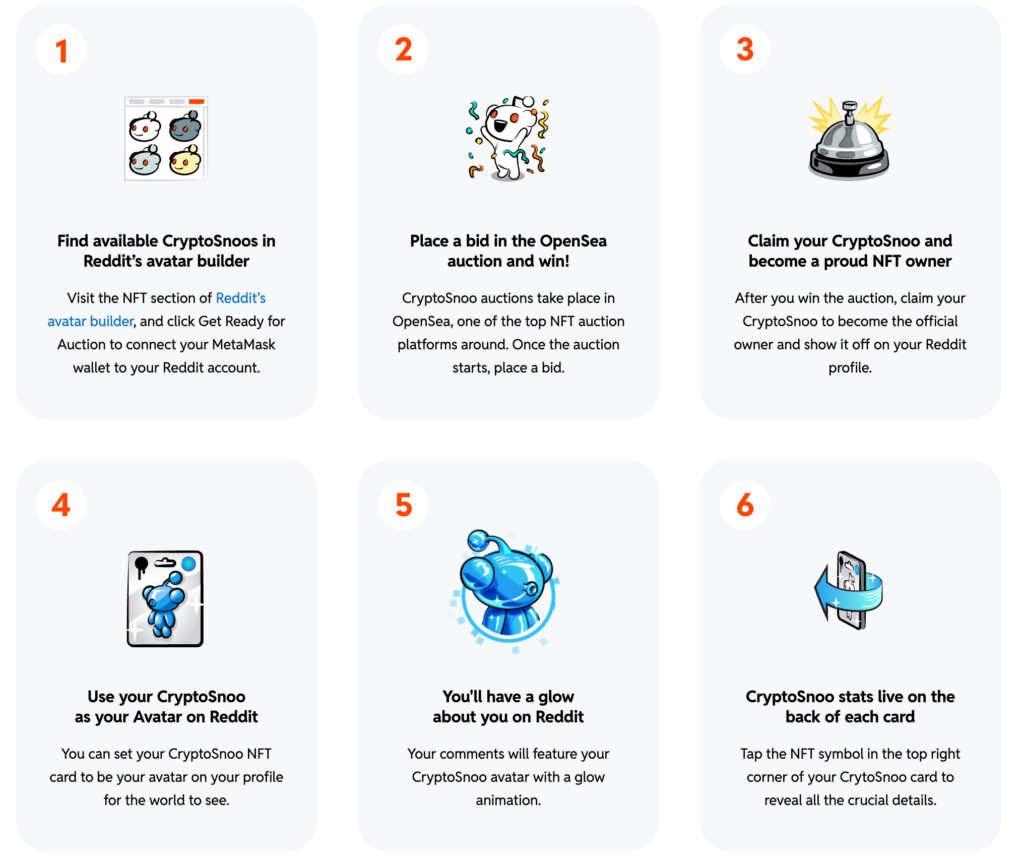

Joining late can be costly

Those suffering the most right now are the latecomers who bought Apes NFTs at peak prices.

Some have suffered larger losses than even Justin Bieber, and it’s unlikely they’ll recover their investments.

The issue with this is that investors, especially new crypto investors, will find it challenging to identify when a market is overpriced.

However, there are a few red flags to watch out for. Be wary if you see heavy marketing (such as an Ape being promoted on late-night TV shows). Such hype could be driving up the asset’s price beyond its real value.

A cautious approach is to realize that if others are already making huge profits, it’s probably too late for you to benefit from that surge, regardless of the asset. You might end up being the one left holding the bag.

This is especially true for community-driven NFTs.

If everyone around you is buying into a rising asset expecting future profits, they’re probably all doing the same thing.

A bubble in NFTs can actually harm the organic growth of its community.

Of course, another aspect is also the utility of that said digital asset. While some projects have a blockchain game, such as Footballcoin, which gives true utility to their NFTs, most do now.

Most projects will use words such as “unique” or “innovative” to describe their assets but will spend little time explaining the mechanics of the project. These are other red flags that you should consider when judging an NFT project.

Don’t mix arrogance with digital assets

Remember the exclusive BAYC yacht parties?

Some of the negative feelings towards Apes stem from typical behavior seen during a booming crypto market, such as over-the-top parties.

However, Ape owners also seem to have earned a reputation for being unusually arrogant and self-centered. To many people, an Ape picture is like a rude tweet mocking those who don’t understand why a digital monkey image could be worth half a million dollars.

While this behavior might have been a reaction to widespread ridicule towards the Apes, it was a strategic blunder (similar to what we see with Bitcoin). Now, the lack of goodwill towards Apes, whether within the crypto community or in general, is resulting in less financial support for these assets.

This is because the community of owners plays a vital role in the value of NFTs like these. For instance, the communities of other NFT collections, like Wassies and Miladies, have done a much better job at maintaining their value compared to Apes over the past year, although they started from a lower price point.

This may not be a lesson you’d learn in a traditional market, but it’s an important one. Most of us are now paying more attention to the Apes’ downfall partly because of how the owners behaved when things were going well.