In the face of volatility, the crypto marketplace continues to attract the interest of investors and traders, as its popularity grows. Mainstream digital currencies like

Bitcoin,

Ethereum, and

Litecoin have seen enormous growth in only a couple of years. Individuals who stocked their account up at the time with Ethereum or Bitcoin have become quite wealthy. So what influences the price of

cryptocurrency?

The price of Bitcoin had blown up in December 2017. 2017 was an unexpected and full of controversies year in the cryptocurrency market. Bitcoin started the year with a price of $1,000 and ended at almost $20,000. Obviously, the increases in demand for Bitcoin resulted in a higher price. When the majority of Bitcoin owners started selling their Bitcoin, for whatever motive, the reverse happened.

It’s understood that the supply-and-demand determines the dynamics of any exchange rate. The price is the result of all of that, but it’s required to recognize the criteria which affect market tendencies in projections for the long term and brief prospects to get a deeper comprehension.

So… What’s driving the demand? What influences the price of cryptocurrency?

What’ important to keep in mind when wondering “What influences the price of cryptocurrency?” is the following:

Cryptocurrencies are decentralized, the current market isn’t. Power over the marketplace is at the control of the elite controlling the larger share of the overall supply.

The marketplace has been gaining recognition and has attracted the interest of a lot of people. Even the cryptocurrencies, for example, Ethereum Bitcoin, Litecoin and Verge, have risen of times in only a couple of years to hundreds and thousands of dollars. The world wide web is filled with stories about lucky individuals who invested in Bitcoin and Ethereum before the majority of the population ever heard of the term “cryptocurrency”. And the vast majority are still confused about digital tokens and cryptocurrency.

Read more on The Beginner’s Guide to Cryptocurrency

There are risks, but people are thinking about buying cryptocurrency every day. It is estimated, that around 50% to 70% of the price of cryptocurrency gets corrected by the market in a couple of days. This is when inexperienced users can endure huge losses. Check out what are the cryptocurrency mistakes newbie investors make and how to avoid them. That’s why it’s important to understand the motion of the prices and comprehend the factors which influence and determine the price of the cryptocurrency.

1. News

The cryptocurrency market volatility is dependent on mass media hype. This could bring attention to a coin on both positive or negative fluctuations. A sudden spike or drop in the price of one or more cryptocurrency can be caused by a social media post of a famous cryptocurrency personality, which can be then massively spread by the media. News has a substantial influence on investors and in the marketplace.

Networking is one great method of manipulating people. News feeds can instil dread and anxiety, but also euphoria. There are many examples, which perfectly illustrate the effects of information over the marketplace. For example, in September 2017, China banned ICOs. The entire marked panicked and the price of Bitcoin dropped from $5000 to $3000.

What influences the price of cryptocurrency? Following the news can help you in short term predictions. But you need to know that news differs from each government. In January 2019, the controversies with the Chinese and Japanese cryptocurrency exchanges led to a meltdown of Bitcoin and altcoins, but NEO was still raising as it was backed by the Chinese news.

It is crucial to adhere to information and the latest trends from the media, but also consider it may be used for manipulation.

The withdrawal of the U.S. from Iran’s atomic agreement is among those present events hitting the headlines. This could have a negative influence on the crypto marketplace, leading to a drop on all established cryptocurrencies.

But what the media reports are only one factor which influences the price of the cryptocurrency, but it matters a lot when the press is reporting huge issues about a cryptocurrency. The media is going to be a fantastic tool when the mass adoption of cryptocurrency will begin.

2. Politics

News warns of economy convulsions. But the business can be severely destabilized by political scenarios.

What influences the price of cryptocurrency? This countries’ leaders along with the laws norms’ impact cryptocurrencies. Regulations, bans and other laws concerning cryptocurrencies affect their prices. The decision of China to ban ICOs in 2017 led to the momentary collapse of Bitcoin. They also put a ban on mining. The mining sector in this nation occupies a huge share in the entire amount of pools. A considerable quantity of funds is focused here, which lead to stagnation and may interrupt the industry equilibrium.

Read more on Cryptocurrency Regulation Around the World

That was not an isolated case. The opinions of other leaders in the field of investments have a similar effect. The world’s biggest investor, Warren Buffett, for instance, has cautioned that Bitcoin holders could confront future consequences and implied that the collapse of their electronic money is right around the corner. Let us remember when Mark Zuckerberg’s prohibited utilizing social networks like Facebook and Instagram as a stage for marketing any products predicated on cryptocurrencies or ICOs.

It is important to see that regulations may translate into adoption and market maturity. Cryptocurrency regulations offer protection and clarity of customers’ resources, meaning that more risk-averse investors, as well as institutional investors, can also get involved.

3. Economy

Demand and supply is the variable that is most crucial. There’s a limited number of coins (from each cryptocurrency) and so if the distribution is set and the demand keeps going up (like it happened with Bitcoin and many others ) then the cost increases. That’s why mass adoption is desired. The more people buy crypto, the higher the price.

What influences the price of cryptocurrency? Economic instability search for alternatives and may have a ripple effect in financial markets, as both shareholders and citizens eliminate faith in fiat money. Other factors which could interrupt the marketplace comprise dependence on emitters, inflation, and currency devaluation. Additionally, the crypto marketplace remains in its infancy period, where volatility can impact adversely on the value and recognition of cryptocurrencies as a way of payment.

Read more on What Can You Buy Using Cryptocurrency?

It’s just as important to be aware that fiat money, in addition to financial businesses, are conservative concerning the financial dimension. In spite of improved technologies and simplified monetary transactions, their strategies remain decentralized and limited. Processing of micro-transactions is non-existent or too complex in platforms.

Advanced technology can simplify procedures but don’t alter the fundamentals. The economics of the cryptocurrency marketplace takes into account these facets.

4. Fear / Public opinion

What people think about a coin is vital. If people feel that coin is going to tank, they will not buy in the coin or even sell it if they possess some coins.

By selling or not purchasing they’re currently causing the purchase price of the coin to tank as they anticipated, but it is happening due to their actions. The identical situation works in reverse as seen lately with Bitcoin where folks understood the cost was going to rise and more and more people started to buy into it (causing the price to rise more). When the cost increased appreciably, it appears people have started to sell, thus locking the cost below 3000.

Lots of purchasing pressure are from those that are only hearing about Bitcoin for the first time Or it can increase due to people that are starting to view it as more than a tool for offenders while it strikes the headlines for more than the closing down of Silk Road or comparable stories of cybercrime about the darknet. Whilst many have continued criticizing Bitcoin, the numbers speak for themselves. Where else could an investor earn 700% in only 11 weeks? Cryptocurrency has made early adopters wealthy. An influx of people looking for gains has been a significant driver of cost this season.

Economy majors/thought leaders, dominate the marketplace with the assistance of FOMO (fear of missed chance ) and FUD (fear, uncertainty and doubt). Fiscal giants’ action falls in the cost rates and functions as a catalyst for the prices’ ups and downs. They form the disposition of this majority, which raises decrease or growth. Improved “punchy” expansion inspires confidence and can induce to get assets in a hurry and unwisely. So… What influences the price of cryptocurrency? A sale can be influenced by uncertainty. The renowned investor and billionaire Warren Buffett, with $90 billion in his own accounts, used to say “Be fearful when others are greedy, and also be greedy when others are fearful”.

Read more on The best cryptocurrency exchanges for beginner

It’s actually very important to behave independently and not follow the crowd, particularly when the sector is highly overbought (should you think about purchasing) or oversold (if selling is contemplated).

5. Technological progress

The last element is innovation that the coin brings to the table. We are talking about coins that bring value, not the cryptocurrency projects which disappear and run off with the cash raises in the ICO or coins which are trying to become the new bitcoin. Steemit will do good with its innovative idea, along with other coins like Golem, Opus, and BAT, which have a particular niche.

The technological part is appealing to those who believe in the coin’s utility and are holding the coin for the long run, not for those individuals who are just using altcoins to earn money trading (since they’d only care about cost whether the coin is really useful).

Read more on How you can earn free cryptocurrency?

But this aspect can’t be ignored when we are talking about the market’s demand. The development of new platforms causes an increasing interest of investors and this has a positive effect on the development of assets.

The resistance of the classic financial institutions also conditions the market increase. Striving for anonymity, liberty, protection and quicker transactions are the goals which lay as a basis for the market’s evolution. This will not online improve users’ life, but also make the companies more productive and transparent. And with new regulatory and legislative processes, the cryptocurrency marketplace will make room for itself in a new economic world. Of course, cryptocurrency, the blockchain technology and digital tokens can be used for so much more than the financial field.

What influences the price of cryptocurrency? We cannot disregard the technological component when it comes to what shapes the market demand. New platforms introduced for example trading through the cellular handsets, often arrive with a brand new wave of interest which may impact the cryptocurrency marketplace. The growing interest of investors will have an influence over the price of a cryptocurrency.

It’s not possible to forecast the end result of transformations. Factors that influence growth and many variables make it difficult to estimate the results. You may expect an advanced breakthrough or a failure in economics and engineering.

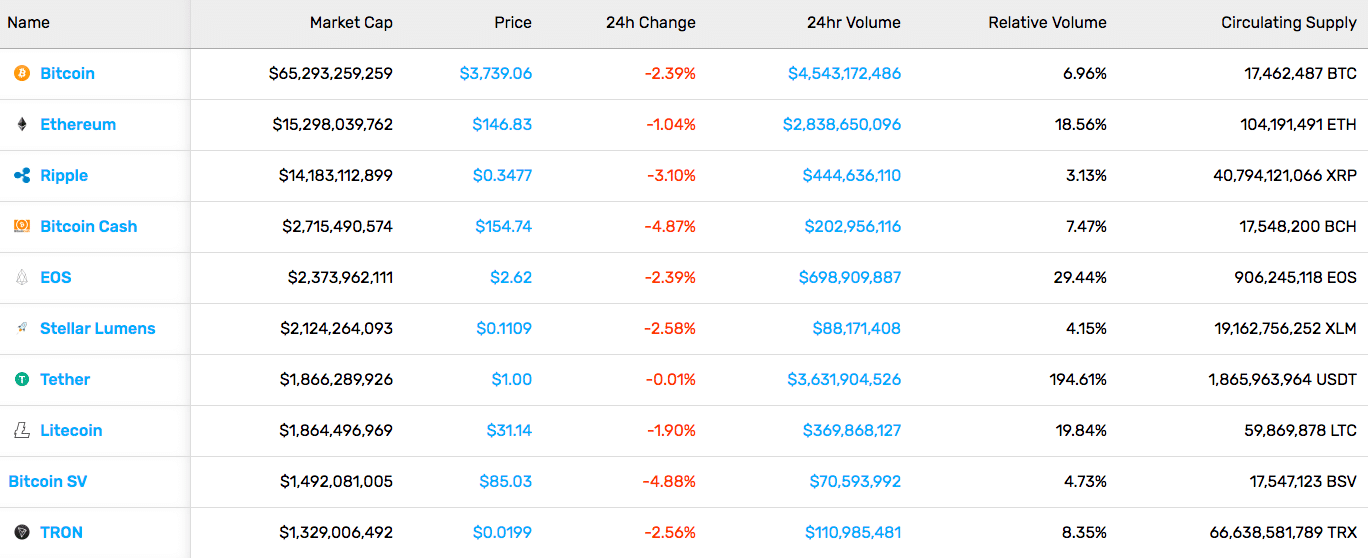

The second week of January left us with a drop in the crypto market, with a $123.2B market cap, a 4.5% drop on the week. Most of the top cryptocurrencies saw red during this week as well, with the exception of

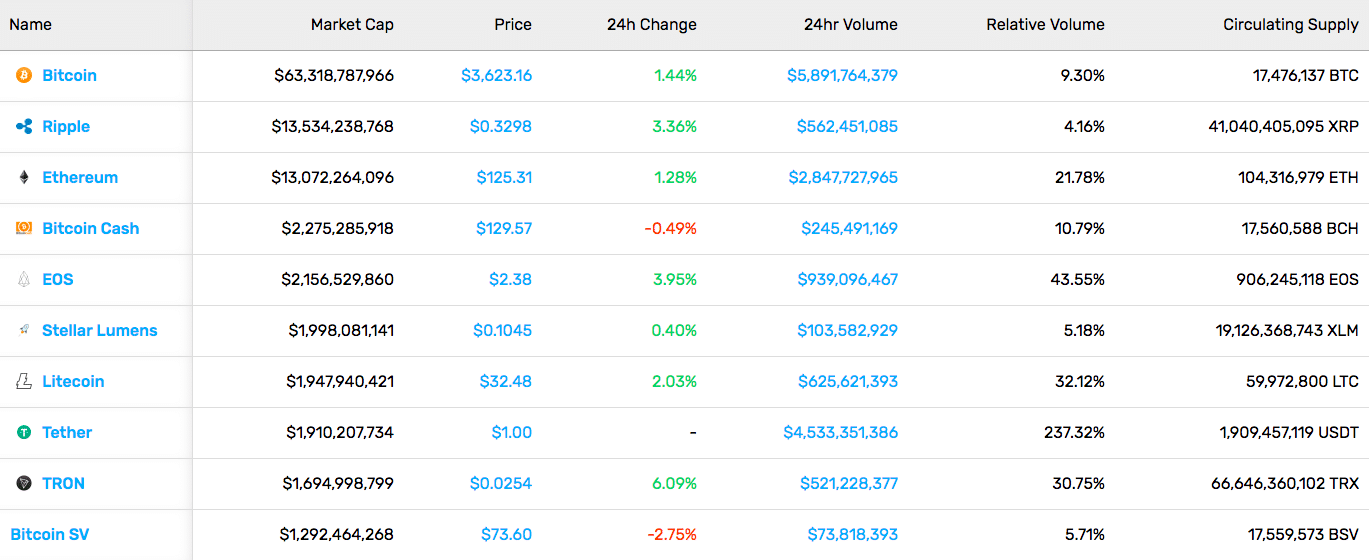

The second week of January left us with a drop in the crypto market, with a $123.2B market cap, a 4.5% drop on the week. Most of the top cryptocurrencies saw red during this week as well, with the exception of  A rather uneventful week was the third week of the year. The total market cap was at around $122B. Most individual cryptocurrencies stayed within single-digit gains and losses. A few exceptions were Augur (56.85%), Chainlink (20.45%), and TenX (78.94%).

A rather uneventful week was the third week of the year. The total market cap was at around $122B. Most individual cryptocurrencies stayed within single-digit gains and losses. A few exceptions were Augur (56.85%), Chainlink (20.45%), and TenX (78.94%).