Cryptocurrencies are among the most exciting topics of discussion across the world. The hype which crypto area has managed to make is only unprecedented and has generated massive interest from the masses. And this is why more and more millennials are inclined to get into crypto trading.

Trading cryptocurrencies is an art, like carving a painting or stone which masterpiece. It requires certain levels of knowledge, monitoring, ability, and a great deal of patience.

Before investing the time and other tools in almost any artwork, one should decide as to what things to expect and what not to expect from it. So let us figure out exactly that.

What to expect from Crypto Trading?

It is going to take a great deal of time to comprehend the marketplace.

Cryptocurrencies are different from common equity or forex trading. Without having heard the fundamentals of crypto area, it’ll be rather tricky to comprehend market trends, which will be vital for success. Therefore, learning these principles will take a while.

Overnight victory is a rarity in the crypto world, unlike the popular perception. There are various rags-to-riches stories available on the marketplace, of individuals who bought Bitcoin and became super wealthy inside a couple of months. Justin Sun, the creator of TRON, is just one such example.

Stories of failure, even although popular, are more in number.

Just look for the 2018 bearish tendency, and you’ll realise exactly what this means. As it’s based on a technology, which not even the average investors know ultimately, many wind up estimating it entirely wrong, for this one should examine the market tendencies regularly, which may be an intimidating job initially.

Cryptocurrencies won’t turn your money in billions, not fast anyway.

A myth revolves round crypto trading, based on which purchasing Bitcoins will make you wealthy.

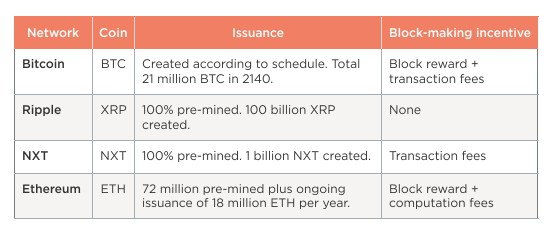

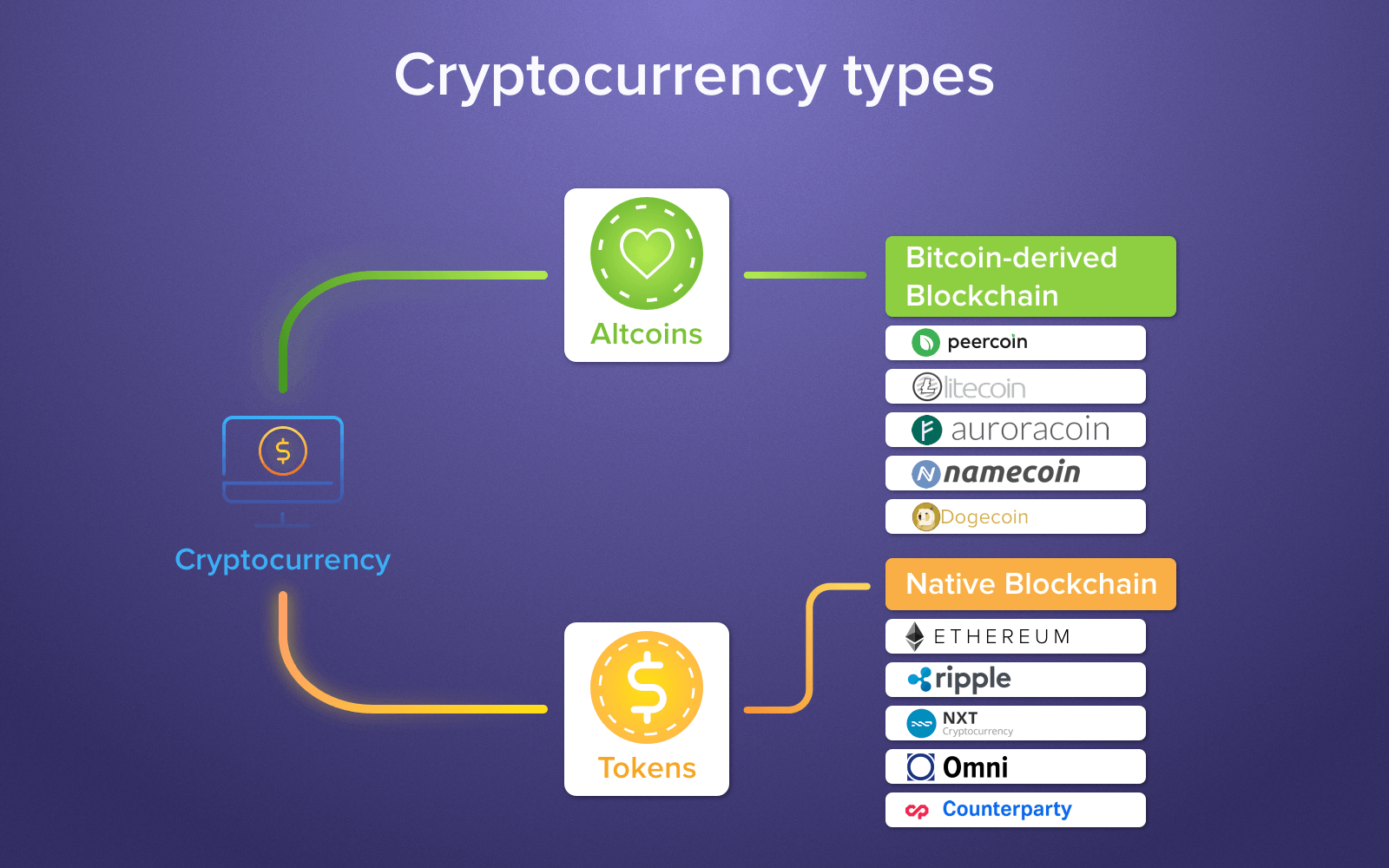

Bitcoin isn’t the only useful cryptocurrency.

According to a survey conducted earlier this season in Europe, over 70% of the respondents didn’t know a lot about cryptocurrencies, although nearly all of them had learned about Bitcoin. Authentic, Bitcoin is the most significant and most appreciated digital token, but it isn’t the only one.

In the past couple of decades, many altcoins have surfaced powerful, which are steady, rewarding, and much more usable than Bitcoins.

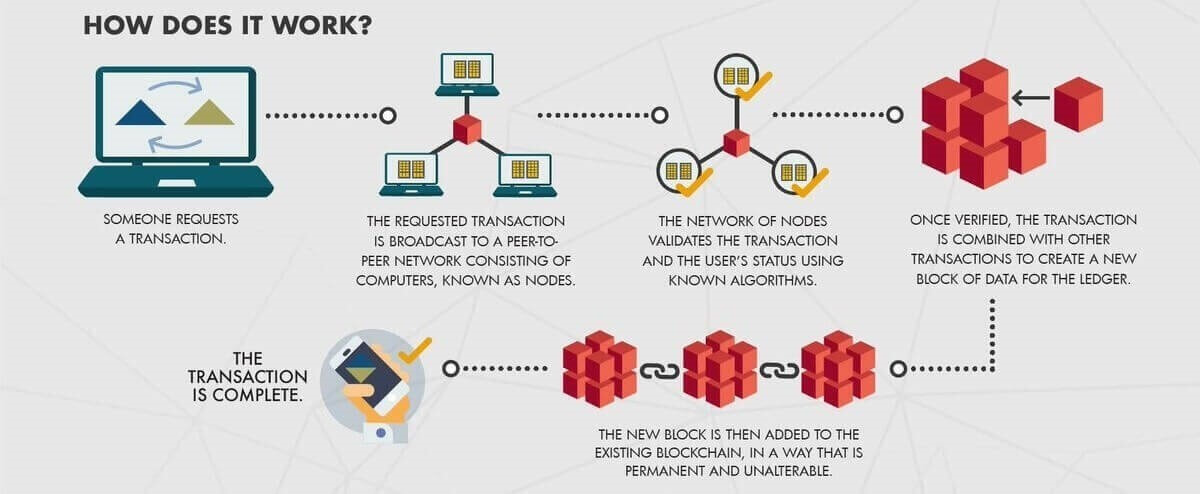

Though many people today feel that the crypto world is impeccable and can’t be hacked, the truth is, sadly, somewhat different. There were hacks on cryptocurrency exchanges and other programs, which have resulted in losses running in countless millions. Though the inherent blockchain technology is very stable, cyber attacks have been levied, and this also begs investors to become extra careful in their electronic resources.

Bitcoin was the very first cryptocurrency, established back in 2009. It’s now the world’s most significant and most appreciated digital token and continues to be a fantastic achievement, to say the very least.

Bitcoin and its success prompted the beginning of many cryptocurrencies within the last ten years, and as listed in August 2018, there are far over 1,600 cryptocurrencies busy, and the number keeps rising daily. This makes life very hard for someone who wishes to place his very first measure in the crypto world, so many choices create confusion, particularly for people that aren’t conscious of the industry thoroughly.

But precisely like conventional investment instruments like forex and equity, cryptocurrencies have a group of factors that decide the destiny of the distinct token. Assessing these factors carefully can enable an investor to decide on the ideal coin with realistic expectations.

Here are a few ways to improve and succeed with your Crypto Trading strategies right now.

Research the history of the coin

Additionally, check the significant events taken place at the ecosystem of the cryptocurrency since the beginning. Research and Read about the cost and equilibrium of this token in the previous six to twelve weeks. A fantastic digital token is one that has been less secure and has been rising steadily, with a minimal indication of intense volatility.

Get involved with the Community Activities

Every electronic currency has a community over social media platforms such as Twitter, YouTube, BitcoinTalk etc. Usually, community tendencies play a considerable part in determining the destiny of any electronic advantage. See what folks are saying about it, and search for individuals with whom you can talk about and comprehend the token much better. Take into consideration the size of the community. The larger, the better.

Research the development team

This is one of the most important sections of picking a cryptocurrency for your investment.

A more powerful team means they are better equipped to combat any strange or undesirable actions which may harm the shareholders. A lot of time, ex-employees of a present token go to make a fresh one.

For example, the co-founder of Ethereum created Cardano. In the same way, Ethereum Classic came into existence because of some differences between the managing of Ethereum (ETH). Teams need to have expertise, knowledge, and abilities to conduct a cryptocurrency ecosystem.

Examine the adoption instances of this electronic token

Cryptocurrencies came into being together with the only real motto of providing an alternative to conventional cash. But, extensive scale speculations had made mass adoption very catchy, as costs of Bitcoins ran to tens of thousands of dollars.

It has pushed market growth tremendously. See the way the coin that you would like to spend in fares in this respect, as the more significant coin is sure to have a greater need in the long term.

The demand for investment occurs primarily because of two reasons, either you have to plan for a future cost, or you do not need your savings to sit idle. In both scenarios, there’s a function and a necessity, based on which an individual makes investment choices.

Purchasing crypto is somewhat similar. One additional case might be that an individual wants to go through the blockchain and cryptocurrency businesses. Therefore, before making an investment one wants to evaluate her or his goals and objectives, where he or she’d have the ability to determine investment strategies.

How choose which cryptocurrency matches your requirements?

There are many cryptocurrencies on the current market, each having an exceptional fashion and behaviour patterns. Some could be helpful for short-term objectives, and others might benefit in the long term. This is another aspect to be careful about if you want to improve your crypto trading strategies.

As an example, if you would like to invest for your retirement, or your kid’s schooling and marriage, you have to put money into cryptocurrencies using a steady character, which also develops over some time. Thus, investing in recognised and most reliable digital translators such as Bitcoin and Ethereum are going to be of fantastic use.

But in case you’ve got a short-term objective, state you want funds for business growth in six to twelve months, then you have to invest in emerging tokens since they’d yield greater rewards. However, such tokens involve danger, since they’re only emerging after all.

Invest less than your overall capacity

Cryptocurrencies, when compared with conventional tools like bonds or equity, are far more volatile, which could either be beneficial or catastrophic. Remember what happened with the price of Bitcoin, which was around $1000 at the beginning of 2017, and which peaked in December to $20000. Regrettably, the market dropped during the next year, and Bitcoin came to about $3,440 in January 2019.

To prevent such scenario bankrupt you, don’t invest all your savings to cryptocurrencies, particularly not in the first stage. Additionally, start looking for stable tokens to buy at the beginning.

If you are investing for a particular purpose, buy tokens with high acceptance

Cryptocurrencies are presently being accepted throughout the world as legitimate payments. In case you’ve got a company, that engages in overseas exchange, you can purchase cryptocurrencies to bypass cross-border fees. While deciding upon a coin, an individual has to think about the liquidity and acceptance of this token.

Furthermore, if you wish to cover fees for higher education from overseas nations, you can buy cryptocurrencies recorded on the global crypto wallet, that would permit you to transfer money with fewer fees. Additionally, moving money in cryptocurrencies would enable saving on currency conversion prices.

Invest in smaller currencies if you only want to explore the crypto world

If you would like to improve your crypto trading strategies investments but aren’t sure about cryptocurrencies, you may attempt to get the gist of this marketplace by purchasing little worth. Stellar (XLM), Ripple (XRP), or FootballCoin (XFC) are excellent options for exploring the crypto space.

As always, crypto investment requires research. Do not take this information as investing advice. Check out our other resources if you want to learn more about how to earn free cryptocurrency, how to predict crypto trends or where to start if you want to invest in crypto.