Additionally, the blockchain technologies have several other promising software. Implementations of secure, decentralised systems might assist us in beating organisational issues of security and trust, which have plagued our society. In effect, we could disrupt sectors core to markets, companies and societal constructions, eliminating inefficiency and individual mistakes.

So I ask you: how important is cryptocurrency in this context? If you consider crypto to be valuable, then here’s how to predict crypto price trends. After all, these steps should be followed for a successful cryptocurrency investment strategy. We gathered some of the most known and used methods which can help you predict crypto price trends.

Start with analysing the market

Analysing the market and what kind of analysis to make is the key.

When talking about price analysis, we think about graphs that show how cryptocurrencies have played against fiat currencies, like the $US, over time. At first glance, they seem like meaningless lines moving down and up, but the information tells a story about how recent incidents from the crypto market have influenced costs and what may happen next.

The analysis is essential for traders. It will help them make informed decisions about when it is ideal to purchase, sell or hold crypto. Indeed, the oldest types of price analysis emerged back in the 18th century in Asia, as it had been used to plot fluctuations in the purchase price of rice. There are three kinds of analysis to be made: technical, fundamental and sentimental analysis.

The technical analysis involves discovering statistical tendencies based on historical action, analysing price movements and other indicators that are essential, such as trading volume. These analysts typically have the doctrine that prices follow trends and history repeats itself, and they utilise their information to predict if the cost will go down or up in the long run. Nevertheless, it is like calling the weather, so it might not become true.

Fundamental analysis requires another strategy. Rather than looking where prices are moving, they seem to be looking at what are the things that push the numbers. Like the market or the way the business has been handled, to ascertain an asset’s worth.

Sentimental analysis sees traders effectively take the pulse of important players in the marketplace: journalists, influencers and regular consumers one of them. Here, the philosophy is that data doesn’t always tell the full story. Tendencies such as fear selling or a purchasing spree could be picked up beforehand based on public perceptions.

Predict crypto price trends by reading charts

New to reading charts? Do not worry! It is much easier than you imagine. The graphs can come in a few different forms, but we will discuss the most used chart: the candlestick chart. You can find them in most crypto exchanges, and some even offer the option to change the kind of chart to be shown.

This is a critical step when proceeding with technical analysis. It’s essential to determine how prices have developed over days, weeks or even months. The average price for a period of a 24-hour interval will not tell the entire story.

Candlesticks show the details on how the cost of a crypto asset fluctuated throughout a single trading session and help you make comparisons between more extended periods.

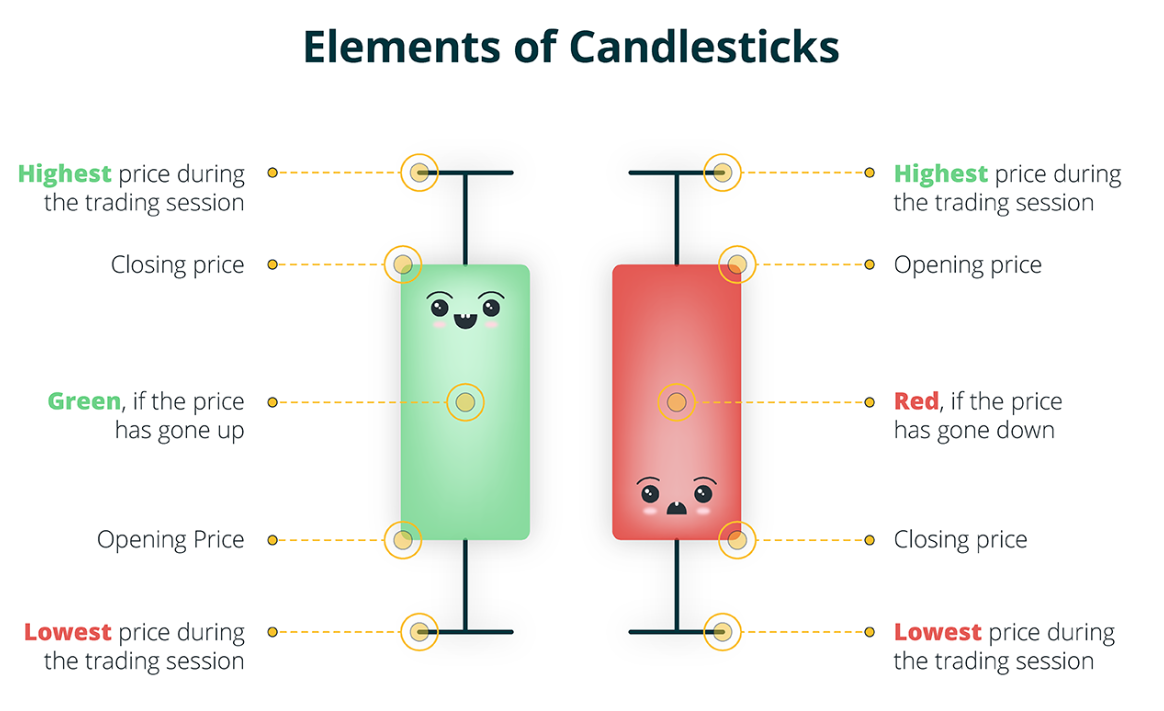

There are a few things to remember about the way the candlesticks are constructed, that will tell you everything you need to know.

When costs have gone up over the course of one day, the chart will show a green candlestick. The thin line in the bottom indicates the lowest cost that has been listed for its crypto-asset throughout the trading session. The thin line on top shows the maximum price for which it was traded.

Let’s take a look at the rectangle. The base of it indicates the price for which the cryptocurrency or asset was trading when the market opened, and the top of the rectangle means the price upon closure.

When prices have a downward trend, the candlesticks turn red. The principle for studying the graph is the same, but what is inverted. The thin line on top indicates the maximum price, and the one on the bottom shows the lowest one. The trading session exemplified by the thick red line, from top to base, illustrates where costs stood as soon as the markets closed and opened.

It is a gorgeous invention that has been tried and tested for centuries. Because the crypto world could be so volatile, hourly candlestick graphs are common to find.

Know what action to take based on the charts

Traders look for familiar candlestick graphs.

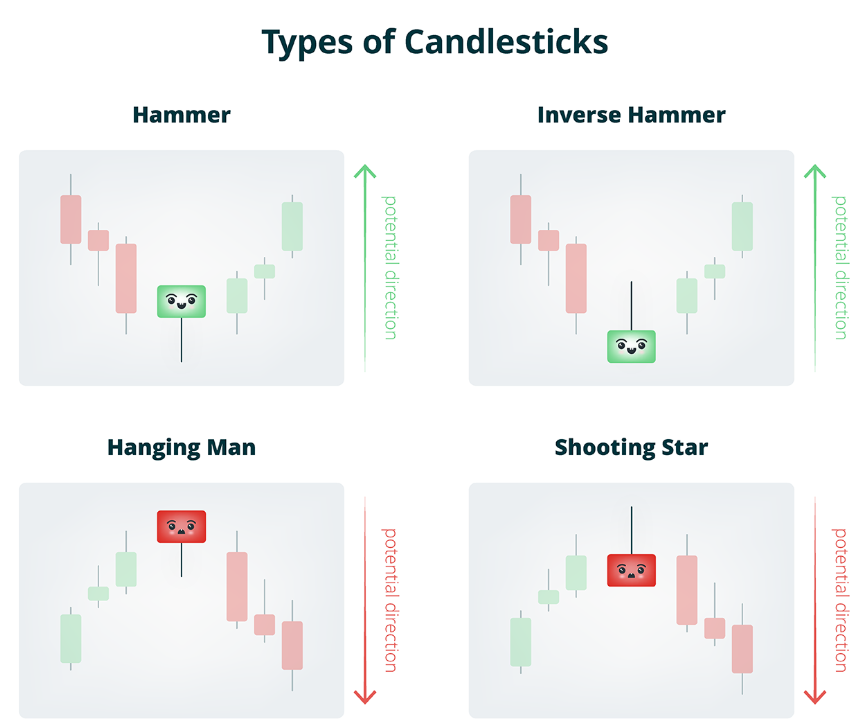

Here are a few recognisable types of candlesticks.

Hammer candlestick generally offers a very long line in the base, which suggests that costs have dropped steeply before recovering to close higher. Ordinarily, this may imply crypto resources were being marketed widely throughout the trading session, but buyers exerted sufficient pressure to assist costs to rise again.

This routine may also be inverted.

Shooting star candlesticks look very like inverted hammers but happen in a different situation. These are generally seen after cost advances and indicate an asset might be about to set off on a downward tendency.

Hanging man candlesticks are also helpful for analysing when markets may begin weakening. These candlesticks appear when the prices have been going up for a while. The long thin line suggests that selling pressure of this trading session has come to an end.

When studying candlestick graphs, it’s vital to find a short-term perspective in addition to a long-term view. Also, don’t forget to take the necessary measures to safeguard yourself in the event of market volatility. This is generally achieved with a stop-loss or stop-limit, which entails mechanically selling an asset once it reaches a predetermined low or high stage. Also, remember that volatility is not all bad. Profits can be made even when crypto markets are going down.

Use the most popular technical analysis techniques to predict crypto price trends

The internet is full of articles and analysists trying to discover how to predict crypto price trends and to forecast where the market is going.

Here are two methods used by these analysts.

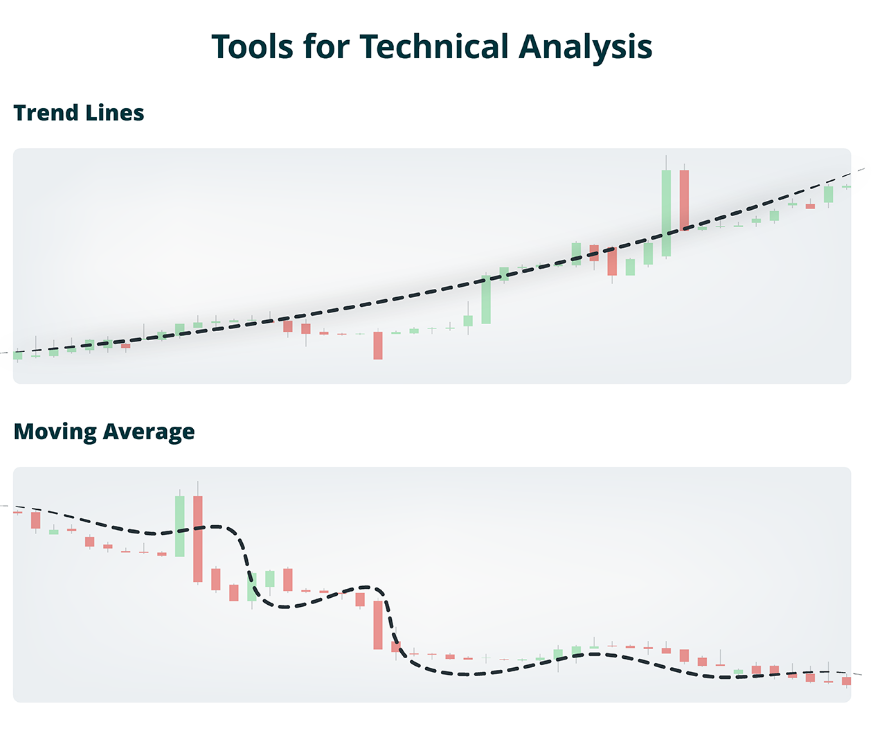

1. Trend lines

This method is trying to take out the anomalies and extreme outliers from the trend of one cryptocurrency’s price, in order to detect if there is an upward trend, or downward, if the prices are lowering on subsequent days.

This, together with assessing the form of candlestick graphs (mentioned above), can help show if there is or not a trend that will likely last or that will end soon, allowing traders to make considered decisions about which the short-term strategy they should adopt.

2. Moving average

This similar approach entails monitoring the price of a crypto asset over a definite time. You can set your period: a week, a month or even longer.

By comparing moving averages within a shorter time period with a longer period of time, you can discover new trends and significant levels of growth and decline that a long-term statistical observation would not clearly reflect.

Even though this technical analysis is the most frequent kind of investigation in the crypto world, it is essential to consider other different variables too.

Always keep in mind that technical evaluation will not tell you the fundamental aspects which are impacting the marketplace and causing prices to head down or up.

Relying on just one kind of analysis is not enough.

Hacking attacks, regulatory rulings, news reports, business agreements and new product launches can help you to stay ahead. This information can also give a hint on where the candlesticks will fall before it does so.

Of course, there are other methods, if you are not the kind of person to stare at charts all day. But please keep in mind that these are just crypto price trends and predictions and that nothing is for sure.

To get the broader picture, it is necessary to stay connected with what happens in the crypto world on a daily basis.

Check out these other resources for a successful start with crypto investments: