Everybody knows that among Bitcoin’s most important resource is its borderless character and it may be utilized as a cross-border payment alternative. On the other hand, the decentralized character of Bitcoin has hamstrung its widespread adoption marginally, and many businesses have thus seen a market in the standard industry.

To begin with, there was Ripple, among just three blockchain-first businesses that were recently appointed from the Forbes Blockchain 50 listing, which has created its mandate to associate with big and institutionalised financial banks and institutions.

Some think this has happened. JP Morgan Chase this season also declared its blockchain-based cross-border payment alternative experimentation, the JPM Coin.

IBM has a substantial stake in the burgeoning blockchain marketplace with Hyperledger Fabric the most-used from the Forbes Blockchain 50 record, accounting for 26.

So, the race is really to supply a cross-border blockchain payment option, but are such enterprise businesses overlooking the mark somewhat, and even overlooking their key market altogether? Many companies and companies may see the significance of utilizing IBM’s solution, although the guy in the road, who are fed up with the standard financial system, may be more prone to use decentralised alternatives like Bitcoin.

However, where’s the viable, simple to use, user-friendly alternative which produces cryptocurrencies and their cross border possible available for everybody?

Ripple wishes to function as go-to for banks, JPM coin has been born of a lender, as well as the World Wire alternative has software predominantly for fiscal and business associations.

None of those solutions is made for the different side of this marketplace; the customers and the people who wish to have the ability to profit on the effectivity and worth of sending cash across boundaries throughout the blockchain.

Nowadays, many here will state Bitcoin, along with other cryptocurrencies, fill this market; they’re resources for your people and planned to aid people who wish to operate out the standard financial regime. However, it also has to be recalled that cryptocurrency adoption is nowhere close wide enough to attain critical mass.

On the flip side, there’s the decentralised cryptocurrency world which nonetheless has a gigantic ‘Wild West’ standing, this leaves a huge marketplace stranded in the centre.

“The biggest barrier for something like World Wire to get off the ground is the traditional banking system and its resistance to innovation,” explains Elizabeth White of The White Company, a company hoping to give cryptocurrency solutions which appeal to both customers and companies.

“Large intentional banks have been using systems like SWIFT for decades and have whole ‘wire departments’ dedicated to processing transactions. While blockchain would significantly modernize, automate, secure and speed up the whole process, it would require retraining and reworking a bank’s entire operations to implement,” White stated.

“IBM is using World Wire to compete with SWIFT for international bank transfers. While the system has a lot of potential and has a real chance of supplanting SWIFT; Individuals or companies cannot use World Wire, so they would still have to go through the regular banking process to send international payments.”

“For many banks, moving to XRP, JPM Coin, or World Wire is just not worth it because their customers are not yet demanding the speed and low cost of blockchain transactions, and in fact banks are making a lot of revenue on wire fees and the like.”

“There is also some apprehension amongst many banking professionals about using ‘blockchain’ because sadly there are quite a few that still don’t understand the technology and may even associate blockchain with money laundering, completely missing the significant anti-fraud prevention advantages of distributed ledger.”

A hybrid payment method

The growth of the cryptocurrency area was required thanks to its tumultuous and tumultuous past. It started as this bewitching online cash that could interrupt every business possible and captured the imagination of swaths of individuals, but in addition, it opened the doors for fraudsters, scammers, and speculators.

The backlash was a far more controlled, controlled and quantified approach to 2019. It has opened the other door for its business companies and major associations to join, but these polarised sides have left a major gap open from the centre.

White, along with the White Company, consider they’re on the ideal path to achieve this abandoned over target market since they’re providing stability and safety of important financial institutions because of supplying things like insurance by a leading UK Bank Lloyds, in addition to using a blockchain, Stellar is endorsed by IBM.

However they also feel the offering of a simple to use and user-friendly end, using a coin that is stable, and chances to exchange different cryptos, will help lure even more customers.

“Our payments platform, for example, is built on Stellar, which is a dedicated payments protocol supported by IBM, Deloitte, Stripe and others, and is focused on optimizing speed and efficiency of payments,” adds White.

When it’s to be considered at across a spectrum – based decentralised cryptocurrencies on one end, venture cross-border blockchain options on another – a middle ground has to be constructed and established. Users would like to have the safety of financial and banking institutions, with no bureaucracy and heritage connected with that.

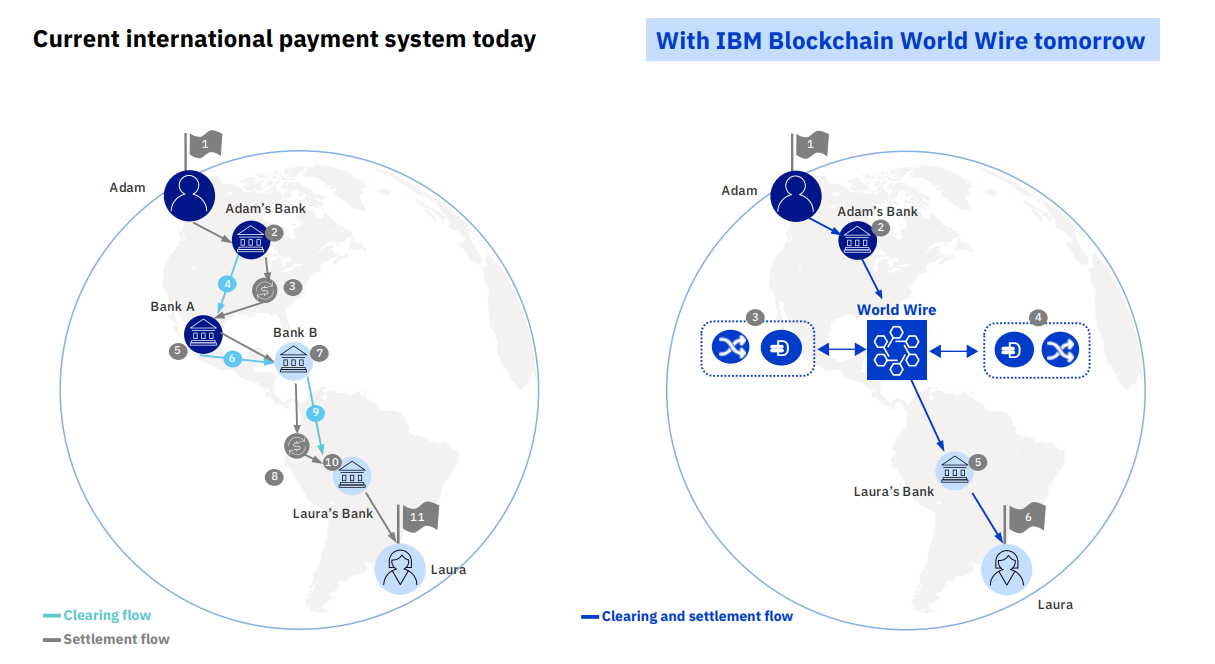

What’s IBM World Wire?

72 countries, 47 currencies, 44 banking endpoints and more than 1081 unique currency trading pairs. IBM Blockchain World Wire is here.

In March 2019, IBM announced the launching of World Wire, a worldwide payments system, which is using the Stellar network.

The great news is that this system can be used by any financial system in the world, and it’s not limited to banks. By using the speed and flexibility of Stellar, World Wire intends to replace the heritage correspondent banking system using easy point-to-point transactions. At the moment of the launch, World Wire was handling 47 currencies in 72 nations, and it is just likely to rise from that point.

World Wire promises to unlock the planet’s financial potential making money more fluid, wider markets.

BUT…

Since IBM launched World Wire, a global payments alternative which uses Stellar, some have been disappointed because it is not exactly a blockchain infrastructure. Basically, if the trades aren’t placed in”Blocks”, then it isn’t a Blockchain. And they’re not.

IBM has created a worldwide online banking protocol which sits between two transacting banks. It is faster but not as quickly as Blockchain (when we factor in resolutions). In global settlements, there are 3 Important variables:

Messaging . The sender and the recipient are notified of the transaction status.

Clearing . All intermediary activities that contribute to the settlement.

Settlement. The funds are in the receiver’s account.

While PayPal incorporates the preceding three functions into one port, IBM’s World Wire goes a step further and incorporates them completely rather than only via the frontend.

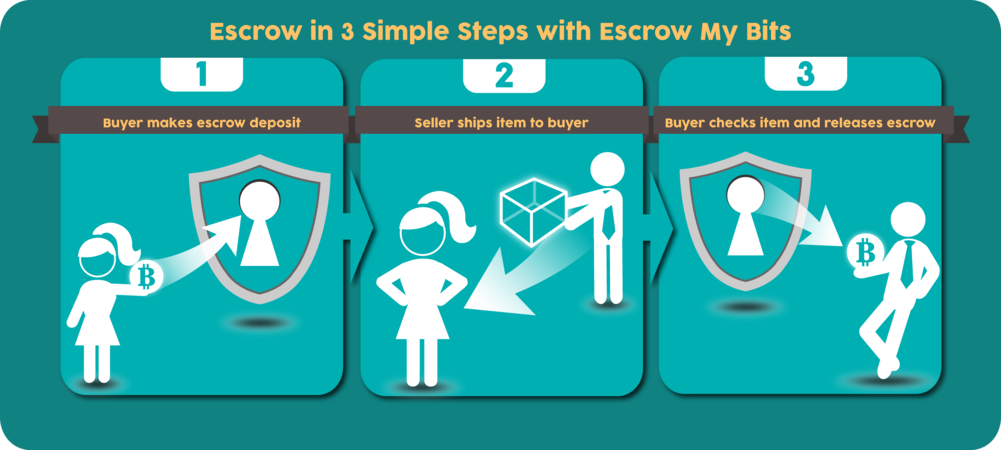

Considering that the IBM World Wire essentially assimilate everything into information pieces and sets them onto a uniform ledger, it’s confronted with the most frequently encountered issue of cryptography: Asset Transport without inflating the strength worth. Consider it like this. If I wish to send you a car within the Blockchain, I would be able to only move the ownership rights, but not the asset itself.

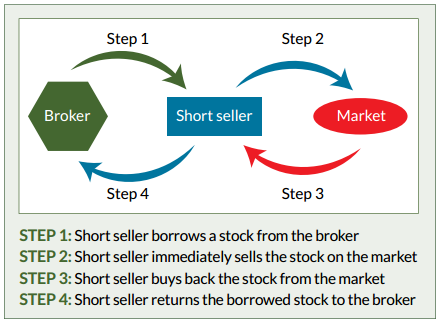

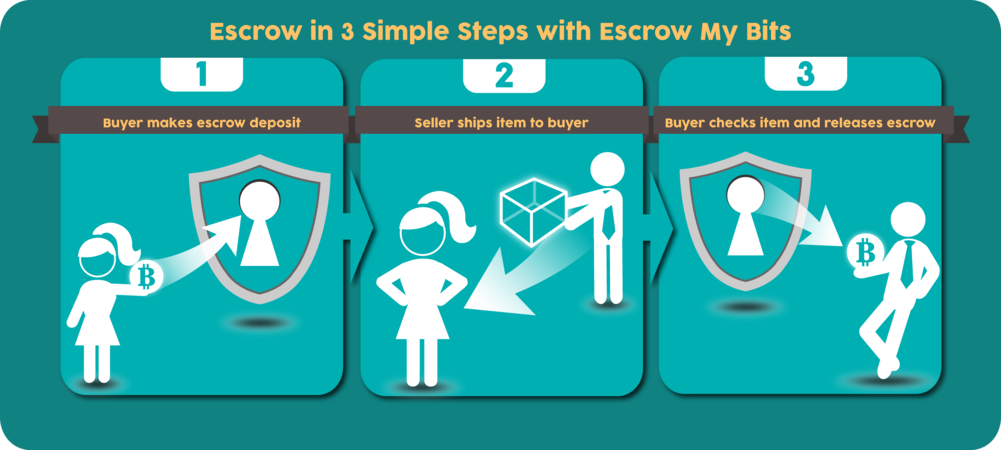

(credit: Escrowmybits)

This is the point where the crypto-tokens come in the picture. I am now able to send the car into an escrow at the same time you move a sum of cash (or even cryptocurrency) into the escrow. We need to trust that the escrow will ease the exchange, not run off with both, your cash and my painting.

Thus, you and I get substituted with our individual banks and as all of us know, they’re wiser than everyone.

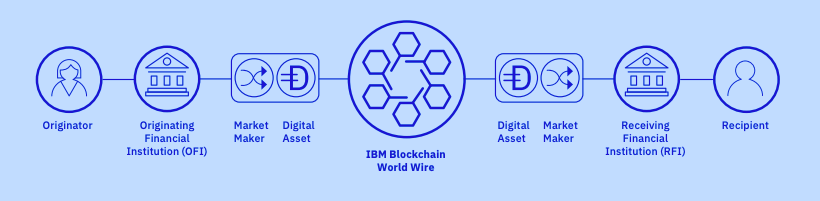

How does IBM World Wire work?

IBM World Wire need tp create a stablecoin for each transfer to take place. Why? Because the purchase price of the car varies in real-time, as does the cost of the money the receiver pays when the 2 individuals have decided to make the trade. That’s why IBM World Wire enables both banking associations to come up with a stablecoin on the Stellar protocol and use it an exchange currency.

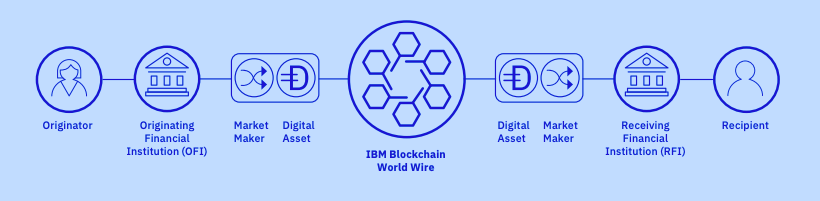

Credit: IBM

Let’s take the example of sending money from one country to another. If X from the UK wants to send money to Y in the US, the two corresponding banks have to create a settlement, or better said, a stablecoin for them to trade.

This means that X from the UK, or his bank, has to purchase that stablecoin created for this transaction, using the local currency, the pound, and then the bank in the US buy US dollars using that stablecoin. the entire operation is set to take place in minutes.

This alternative to the old transactional methods focuses on the rate of transport and the simplicity of producing resources (cryptocurrencies generated on Stellar are called resources ). If, however, IBM can attract the Central Banks into the dining table, the World Wire could address an important issue that the banks from all over the world face every day.

A route to the future

It’s fairly pleasant that blockchain tokens, digital resources, cryptocurrencies, or anything type of tag lands on these, are the long run.

There will however have to be a middle-out expansion which will help lure the majority of users to this brand new and largely misunderstood area. If the businesses are searching for themselves along with other large businesses, along with the cryptocurrencies are used by people in the know, then humanity is still waiting for the groundbreaking moment when your smartphone will bring this to the masses.