Cryptocurrency mistakes newbies should avoid: Lack of expertise, Psychology and other Foolish mistakes newbie cryptocurrency traders make

How to prevent mistakes newbie cryptocurrency traders make?

Errors are brought on by a lack of expertise

We knew that it while preparing the listing. We have checked one more time and we all knew that we’re going the ideal way. A dealer must combine unknown business and he does not know the effects of his activities or their lack. Therefore he makes several activities, occasionally he earns, occasionally he loses after all he knows what he’s done. He’s his own bags of mistakes and for the large aspect of dealers, it’s the exact same.

Generally, nobody learns from the error of different dealers, we chose to publish this listing. Perhaps you have enough discipline to not get rid of money as the most aspect of dealers Well, nobody learns from the expertise of many others, we chose to publish this listing. Perhaps you have enough discipline to not lose your cash as other dealers do.

To tell the truth, typical mistakes rely not just on experience. They’re associated with a deficiency of knowledge and abilities which are useful especially for cryptocurrency trading world. We are going to examine the principal illusions of dealers, that make traders lose part of the funds.

In addition, you are going to discover 3 dumb mistakes, they appear to be evident, but they hurt sensible and decent people over and over again. They believe that”that won’t happen to me” These errors are part of the emotional world, but they do not deserve another category.

We’ll classify all errors according to their standards:

- Lack of experience

- Psychology

- Foolish cryptocurrency mistakes newbies traders make

The overview:

Should you catch on quite quickly, you will observe this long read begins from the origin of problems. this is a comprehensive guide and explanation of every error cryptocurrency traders and newbie make:

- The 20% principle – the most suitable proportion of inexpensive resources in your portfolio using reduced capitalization. It should not be over 50%.

- If you have discovered a”sexy” cryptocurrency from networking stations, likely you have missed a chance to buy it.

- It is important not only select unique coins to your own portfolio but also put money into various kinds of the marketplace.

- If you would like to trade as a casino, then you must invest all your money in a deposit or on your initial wager. If your plan is to create money from trading, then you should not comply with this information.

- Should you see coin cost visiting the moon, then you must check a trading volume, averting pump & dump strategy.

- It is a major mistake to market money if it begins falling. Additionally, you should not hold it indefinitely. Assess your trading forecast and do not follow it if it is not working.

- Exchange support isn’t a bank, so your capital are under danger.

- Examine your errors. If you have reserved your reduction, find a way how to prevent it next time.

- Trading with No strategy. It is like driving to nowhere: you will quit driving when gas is finally over.

- Do not follow your plan – it is like shifting the destination whilst driving with no map and with no clue how to read a topographical map.

- Risk management – amounts that determine your entrance and exit rules along with your dimensions of Stop Loss. Without them, you see the tea leaves trade or combine the collective mind. Join our discussion and inform us if you adhere to this information (incidentally, this is poor information ).

- All preceding rules will not help you in the event that you don’t know what the current program shows you. But if you’re able to just browse the graphs, with no principles you’ve got a fantastic danger to get rid of money.

- You ought to look closely at the small things, this information can allow you to conserve your own funds.

- We’ve got terrible news for you in the event that you run out of cash or hope to earn a lot of money in stocks.

- In case your dynamics includes a developing loss and it resembles a loss and it is encouraged by reduction signs, there’s a fantastic possibility

- that this can be a reduction. You ought to take it and try to not revenge. The marketplace acts like a living organism, however, it is not worth of revenging or fighting it if you have failed.

- News effect on price moves. It’ll be too late in the event you choose to put in the trade with a broad group of different dealers.

- You need to stop theft and supply safety to your own funds.

- Advisors earn money on innocent novices, not on successful guidance.

- You need to make an effort and make money rather than looking for a button. In cases like this, you will have the ability to forecast your own result.

- You need to use just reliable robots.

- Insufficient comprehension of Stock Exchange motion

- The most essential ability of every dealer is your ability to browse the market. The charts move continuously, at the cryptocurrency business, even in brief periods anything could happen.

1. Lack of experience

Cryptocurrency mistakes newbies should avoid: Purchasing cheap cryptocurrency

It isn’t worth investing in a cryptocurrency only’cause it’s cheap. There are still individuals who reside in 2010 when the market consisted of the few of cryptocurrencies.

These people today think that cheap altcoins are undervalued: after their price goes to the moon.

This doesn’t indicate that weakly capitalized coins aren’t worth purchasing. Risky and lucrative assets must be included in your portfolio, so they could bring fantastic gains. Their percentage should not be more than 20%. If you begin trading, you need to supply your portfolio with assets that are strong, and their commission must be not less than 50%.

If cheap is what you are looking for, there isn’t anything cheaper than earning free cryptocurrency.

Cryptocurrency mistakes newbies should avoid: Purchase a cryptocurrency following its growth

You shouldn’t invest money on”sexy” tokens. Ordinarily, it’s too late to purchase it if everybody discusses this”sexy” token since the cost soar is accompanied by its own crash.

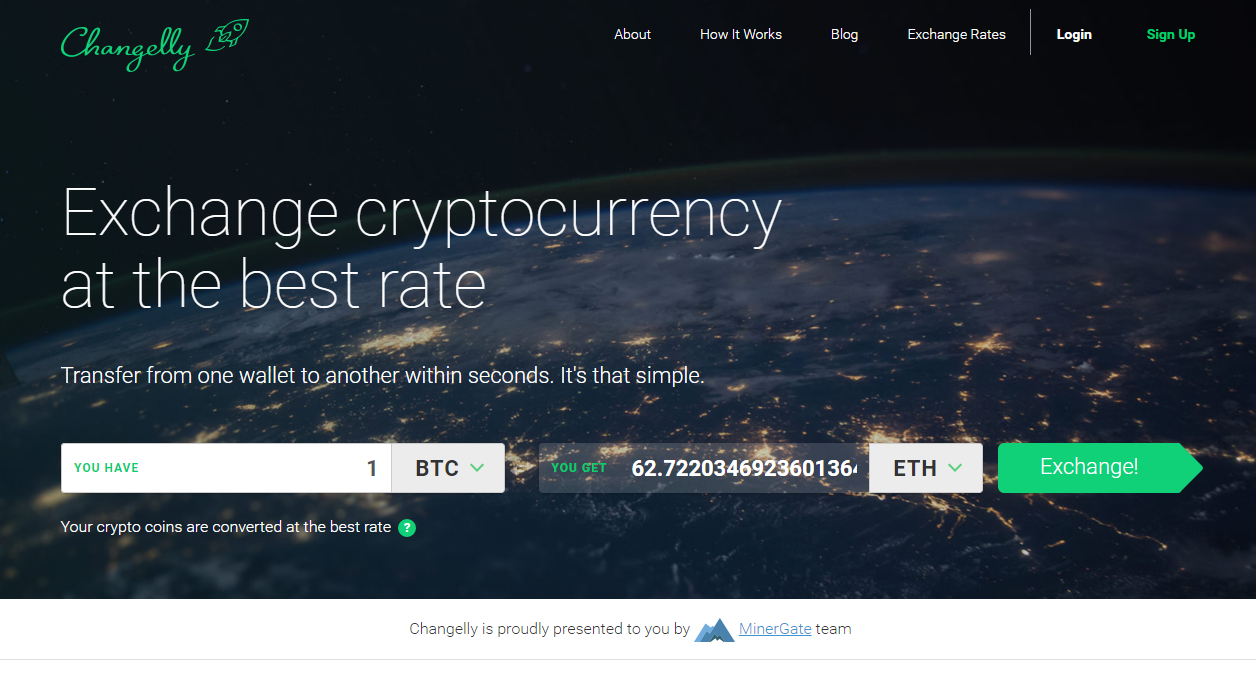

Cryptocurrency mistakes newbies should avoid: To not diversify your funds based on Advertise leadership

Maybe you’ve learned about diversification and believe it is an investment in various coins. Nonetheless, it’s usually regarded as insecure to spend only in 1 way of the marketplace. That is why cryptocurrency investors opt to invest in trading, mining, ICO, and startups in precisely the exact same time, also disperse this portfolio properly.

Why is this essential? Cryptocurrency marketplace lives by its own legislation, its own lively can differ: a sharp increase, lingering fall, sore level – and you can’t predict it. It’s essential for each and every dealer to rely on the gain from different trades in the event of a failure at once in several kinds of investment.

In cases like this, you should not forget about balancing and creating your portfolio. It is vital to produce a record of the very promising coins and pick the sum of every coin on your own funds. You have to look at your portfolio frequently and delete or add resources.

You should not spend money on “hot” tokens. Usually, it’s too late to buy it if everyone discusses this “hot” token because the price soar is accompanied by its crash. Some investors had bought highs Ripple (XRP) and Tron (TRX) in 2017, and they regretted a few weeks later, in 2018.

Cryptocurrency mistakes newbies should avoid: Invest all your funds on your first deposit or trade

Generally, newbies attempt to make from scratch as far as you can. Maybe not all them think how to generate their own strategy or how to not lose their deposit.

Attempting to make all of the cash from the cryptocurrency marketplace, they frequently overlook the vital components in trading – capital and money direction.

It contributes to serious mistakes – shifting all of the available capital to their own trading accounts.

Don’t make your initial deposit from your entire amount, particularly in the event that you don’t have a trading program or your statistics.

Cryptocurrency mistakes newbies should avoid: Be a victim of a pump and dump scam

If you have discovered unknown coin, which cost went to the moon, then you ought to stop dreaming, since this might be part of the pump and dump scheme.

At exactly the exact same time, you should not dismiss it you need to assess its trading volume on CoinMarketCap. Its 24h trading quantity significantly less than $1mln – that could possibly be a “pump and dump” scam.

Cryptocurrency mistakes newbies should avoid: Sell your cryptocurrency if the price is going down

This is a current market, babe, this may occur: a coin cost that you have, suddenly, starts to fall. About persistence, we will talk about a little later.

Let us talk about the 1st one about promoting your coin when it functions to collapse. You will see the error.

You need to alter your position before you choose to market falling cryptocurrency. Let us say that you have invested in this coin since you thought in its own prospects.

1) Have you ceased thinking in the long-term outlook of the cryptocurrency?

2) Have you shifted your goal?

3) Have you noticed any information, which affected its cost?

We believe that you have known everything: if all of your answers are”no”, you need to wait to get a much better time.

Such trades accumulate a massive reduction, which is extremely tricky to pay with gains.

Generally, volatility is fine. Cryptocurrencies – are claims, their costs go not just up and down, but they constantly fluctuate. Additionally, the majority of the time that their rates are from the sideways motion — they fall and grow roughly in precisely the exact same selection. Consequently, if the cost has dropped contrary to your expectations, then it’s fairly possible this is only one more fluctuation prior to expansion.

It is important to start a trade after assessing the cryptocurrency price chart and the most recent news. If that which shows you that you ought to start a trade, maybe it’s well worth waiting until the close of the drawdown.

Cryptocurrency mistakes newbies should avoid: Choose only one cryptocurrency

If a coin does not satisfy your expectations, then you can face together with the next common error – hold money at any price.

Yep, you should not sell it instantly, additionally, you should not rush and opt for an opposite manner.

Persistence, particularly in the event that you confront failures and problems with any money, is a potent technique. Generally, this is a helpful attribute of personality, which generally provides an edge, but not necessarily.

In a couple of days, you will observe an inclination to permanent losses. You should not persist – only promote the coin, create a few changes on your plan, have a look at your situation and fix your ineffective strategy.

It is very important to understand:

Prevent your own personal rules and beliefs should you see they aren’t functioning.

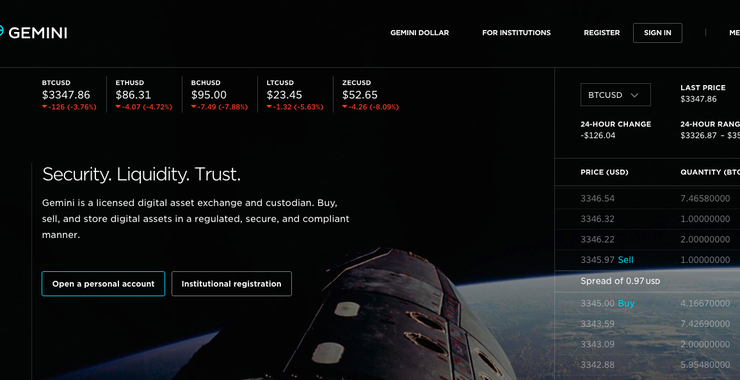

Cryptocurrency mistakes newbies should avoid: Store your funds on the exchange

It’s dangerous to store all of your funds within a market. We’ve got numbers of instances once the trades were closed with no reason and blocked users balances indefinitely — their customers lost their capital. Accounts with low-security level could be hacked.

The trades aren’t exactly the same as banks, so they’re aimed to not save capital. You need to store your cash in more secure and more suitable cold wallets.

You should regularly draw your money if you do not intend to use this amount throughout the transaction.

Qualification

A range of mistakes that are connected with a lack of particular skills. That is why they are sometimes utilized as a guideline for selecting which path to research further.

This block comprises the following errors:

- Avoid assessing unprofitable trades

- Trading with No strategy

- Launched in a trade That Doesn’t suit your plan

- Know nothing regarding risk management

- Do not know stock market motion

- Prevent assessing unprofitable trades

Cryptocurrency mistakes newbies should avoid: Avoid analyzing unprofitable trades

It’ll be nearly possible to lower your unprofitable transactions to zero. You ought to consider trading for a company and plan your own losses.

All traders confront with losses. A number of them believe this is a reduction, then come to the conclusion they weren’t fortunate enough. That can be a mistake.

Without assessing what’s occurred, it’s hard to comprehend what do you want to modify firstly, so as to prevent losses that are new.

You need to examine your failures and examine them, so as to define your errors.

If it’s a challenge for you to examine it on your own, you can combine our trading discussion, there we assist beginners.

Cryptocurrency mistakes newbies should avoid: No strategy crypto trading

Everybody knows about the volatility of this cryptocurrency marketplace — the origin of (endless pleasure ) gains and (infinite pain) risks.

Cryptocurrency market has created an illusion of”I shall quickly input and cope with everything through the procedure.”

Regrettably, without a transparent trading program, you get a fantastic opportunity to lose your money, since you need to make decisions based on instinct and feelings, you need to consider different people- everything that contributes trading from company to betting. A few indicators that you know are not likely to help since they reveal nothing about the dangers and quantity of trades.

Additionally, emotional stress will make you feel drowsy fast.

Cryptocurrency mistakes newbies should avoid: Engage in a trade that does not match your strategy

People who remain at trading, earlier or later, with a different number of losses, realize that they want their own approach.

After a few losing trades, traders see it is crucial to adhere to the plan rigorously.

Thus, follow your strategy, averting joining the transaction that doesn’t agree with your plan, even though it appears appealing and transparent.

If you have noticed that you ought to alter your priority, then you need to change it, but you need to also prepare a plan. Don’t attempt and reevaluate your trading procedure if you aren’t prepared to risk.

What proportion of your funds would you hazard in each individual trade? When can you use Stop the Loss?

The dilemma is that the world is merciless to people who don’t maintain a journal of trades and don’t put limitations on losses.

It is not important if you use conservative or aggressive risk management.

Without it, the problem will later be fairly miserable for you.

Generally, don’t test your luck and compute your own risks.

Cryptocurrency mistakes newbies should avoid: Lack of understanding of stock market movement

The program is composed of corrections and instincts.

Impulse is a lively upward or downward motion that’s more powerful than the preceding maximum or minimum. Correction is a motion of the chart in a particular impulse. Correction is more than an urge.

To be able to specify price movements of a coin, then you need to inspect the graph at several periods: 1 hour, 4 hours daily.

With no abilities, traders have a fantastic opportunity to purchase the highs and market them with a reduction.

2. Psychology

List of errors connected with mental eligibility of the dealer, which may be solved together with introspection and self-control. Robots cope better compared to individuals with this listing.

- Inattention

- Emotions

- High expectations

- Fighting against loss and neglecting stop reduction

- Forget assessing breaking news and dismiss facts

Cryptocurrency mistakes newbies should avoid: Inattention

The cryptocurrency marketplace is truly volatile, and it’s fairly tricky to keep an eye on everything. This issue could be partially solved by robots, also by way of training.

At times it’s possible to purchase cryptocurrency at a rather large price. This will lessen the price, so the cost will probably be unprofitable.

It is vital to create your own trading plan and determine the intricacies of this inventory, you need to calculate and make conclusions quickly. Incidentally, robots deal with it better than individuals.

Stress, euphoria, expect, irritation are harmful. They bring reductions to a dealer or even cause the reduction of their deposit, they don’t allow to have a sober look at the circumstance.

Cryptocurrency mistakes newbies should avoid: Emotions

Emotions take over investors and they raise their losses, don’t take profits in time, and start intentionally poor traders.

If you believe you get started earning large amounts from the very first days, you’re confused. In reality, success doesn’t come instantly and depends upon your expertise obtained by perseverance and self-confidence.

People who get to the finish, get an outcome. On occasion, the very first income from cryptocurrency trading comes after dropping a few deposits, but the outcome is always well worth it.

Cryptocurrency mistakes newbies should avoid: High expectations

If you believe that you start earning big amounts from the very first days, you’re confused. In fact, success does not come immediately and depends upon your experience obtained by perseverance and self-confidence.

Those who go to the finish, get an outcome. Sometimes the first income from cryptocurrency trading comes after dropping several deposits, but the result is always well worth it.

Cryptocurrency mistakes newbies should avoid: Struggling against loss and failing stop reduction

The brutal fact is that trading losses won’t regain. But it’s hard for novices to set up with losses, and frequently they begin to behave responsibly: attempting to maintain the position until the previous satoshi or perhaps double the loudness of the trade. The longer they behave weirdly, the higher are their losses, they could lose their deposit.

The reason for the error can be found in the certainty of dealers. They think that investment must”return” the cash to them. Regrettably, they convince the industry rarely.

Don’t take altcoins as a distinct region of the marketplace or product.

Cryptocurrency mistakes newbies should avoid: Forget researching news and dismiss the truth

The price of cryptos is dependent upon the news. Dealers forget about it, particularly if they use technical evaluation whilst trading. It is important to utilize basic analysis in cryptocurrency trading and unite it using specialized evaluation.

This error isn’t common. Some dealers forget about it, but they could understand the value of monitoring the information. Well, every event from the cryptocurrency business can bring sharp price changes or alter the trend management.

The frequency of monitoring is dependent upon your trading plan. It’s thought that you are able to develop your abilities in 21 days. Set a reminder and find time for studying daily. As an alternative, you may subscribe to this newsletter.

3. Foolish cryptocurrency mistakes newbies traders make

They have been dedicated by adults, normally smart men and women. We’re Certain That You Aren’t capable of doing, however, we recommend checking them:

- Careless attitude toward safety

- After others guidance and Purchase signs

- Seeking to locate”a cash button”

- Utilizing unreliable trading bots

- Careless attitude toward safety

Dealers consider safety if it is too late to take care of it. Before enrollment on the market platform, you need to check whether it employs the best applications to encrypt personal information, such as SSL certificates. It’s also wise to be certain transactions with SMS and email verification are protected. Additionally, email ought to be safeguarded also.

Cryptocurrency mistakes newbies should avoid: Following others guidance and buy signals

You ought to be aware that IT-celebrities can place advertisements, even John McAfee confessed paid advertising, moreover, you should not overlook that advisers are not accountable for their own words.

It is trendy to buy signs on forums, and other programs before the market turn against you. You must remember the “easy money” signifies something else.

Successful traders utilize advertisements rarely and select unique methods of boosting their approaches. By way of instance, through trust administration. Should you purchase access to signs group, you get a fantastic opportunity to combine a bogus group and shed your own funds.

Cryptocurrency mistakes newbies should avoid: Seeking to locate “a cash button”

The simple fact that countless dealers couldn’t locate it, obviously, doesn’t imply anything. Well, there’s absolutely no button.

We won’t dissuade you in the event that you choose to find it. You need to understand that this button will be hidden so much if it actually exists. It is much easier to make money than attempting to locate a cash button and we encourage this thought.

Cryptocurrency mistakes newbies should avoid: Using unreliable trading robots

The marketplace offers a significant array of robots, advisers and sign bots, free of charge or not free of charge.

Generally, these are scam programs geared toward parasitize the innocent beginners.

- You should not purchase robots when you have not analyzed it and can not rely upon it.

- Prevent projects that haven’t any community. Remarks can be imitation, community – certainly not.

- Developers frequently offer their bots at no cost, but you may utilize in on the market that has a lousy reputation.

You know yourself better than anybody else, so that means that you can forecast your potential mistakes and you understand where situations you need to pay extra attention.

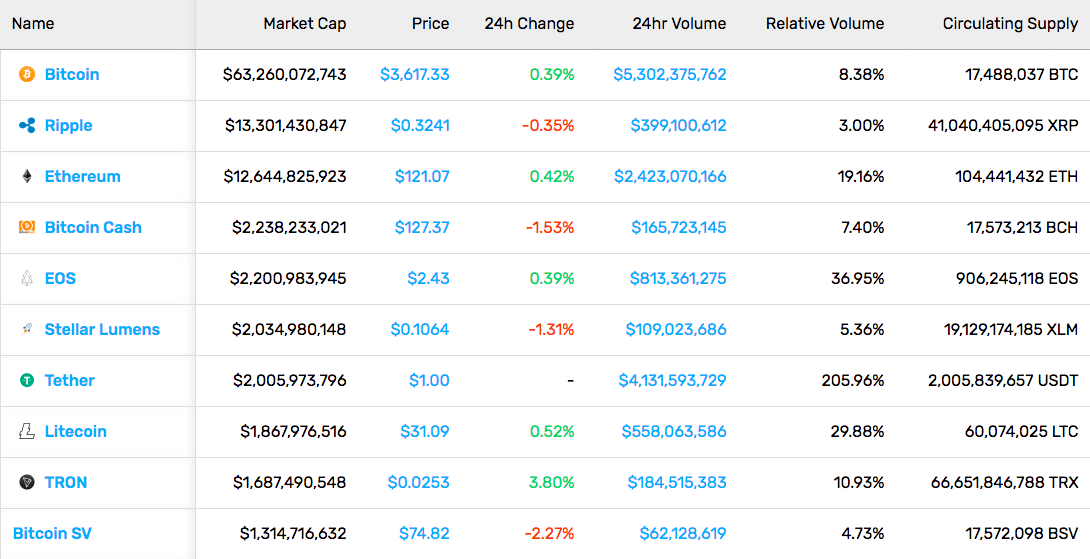

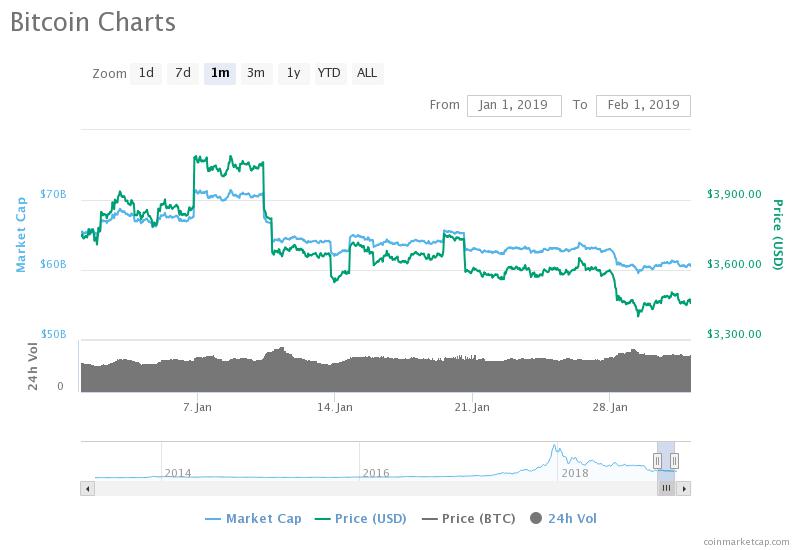

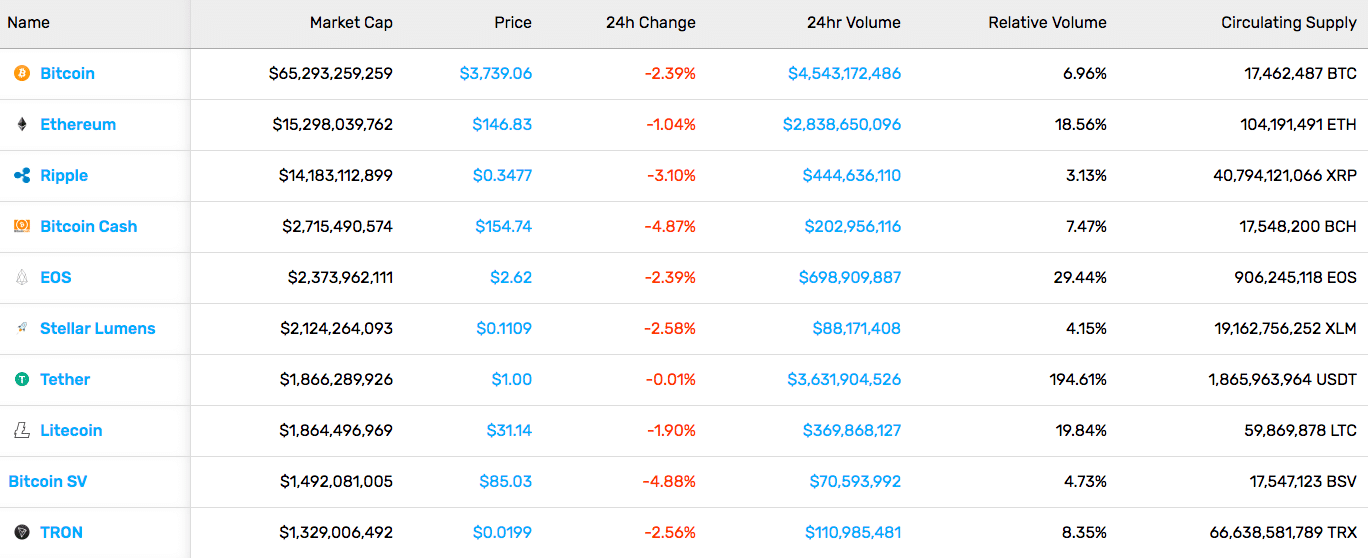

The second week of January left us with a drop in the crypto market, with a $123.2B market cap, a 4.5% drop on the week. Most of the top cryptocurrencies saw red during this week as well, with the exception of

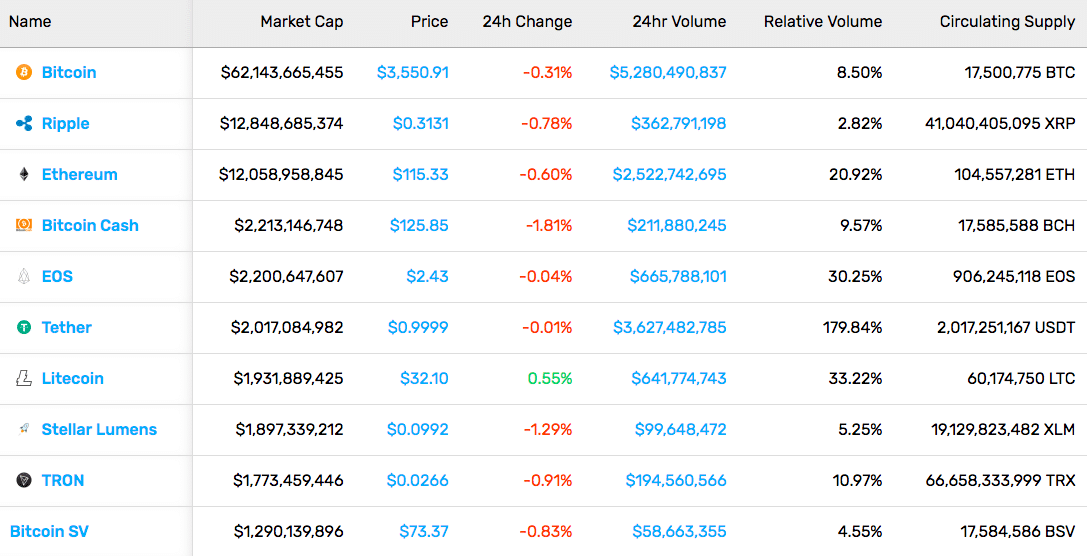

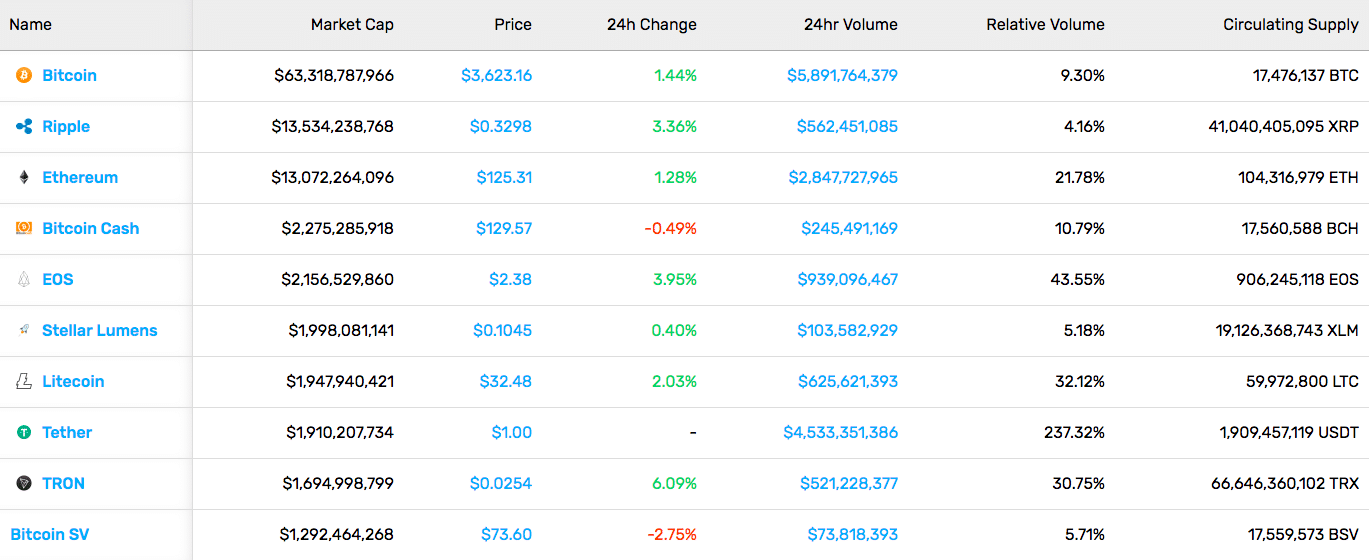

The second week of January left us with a drop in the crypto market, with a $123.2B market cap, a 4.5% drop on the week. Most of the top cryptocurrencies saw red during this week as well, with the exception of  A rather uneventful week was the third week of the year. The total market cap was at around $122B. Most individual cryptocurrencies stayed within single-digit gains and losses. A few exceptions were Augur (56.85%), Chainlink (20.45%), and TenX (78.94%).

A rather uneventful week was the third week of the year. The total market cap was at around $122B. Most individual cryptocurrencies stayed within single-digit gains and losses. A few exceptions were Augur (56.85%), Chainlink (20.45%), and TenX (78.94%).