Small Investors Can Now Own 1 Full BTC

Small-time investors have the opportunity to realize their dreams of owning at minimum 1 Bitcoin, with BTC trading in the $20,000 area for the first time since 2020.

Bitcoin trading in the $20k range

Investors around the world have been chasing one of the total 21 million BTC since the early days of Bitcoin (BTC). This massive hysteria has been caused by the phenomenal interest in the cryptocurrency and the widespread acceptance of the internet in the last few years.

After hitting another all-time high in November 2021, when bitcoin’s price reached almost $69,000, the leading cryptocurrency has been declining in value ever since. In May 2022, the bear market has been confirmed, and it involves not only the cryptocurrency market, but the most important financial markets. The crypto market is now more tied to the stock market than ever, as more institutional investors have joined in 2021.

While many online celebrities have been raising concerns and painting a gloomy future for bitcoin, some see it as an opportunity to become a bitcoin owner.

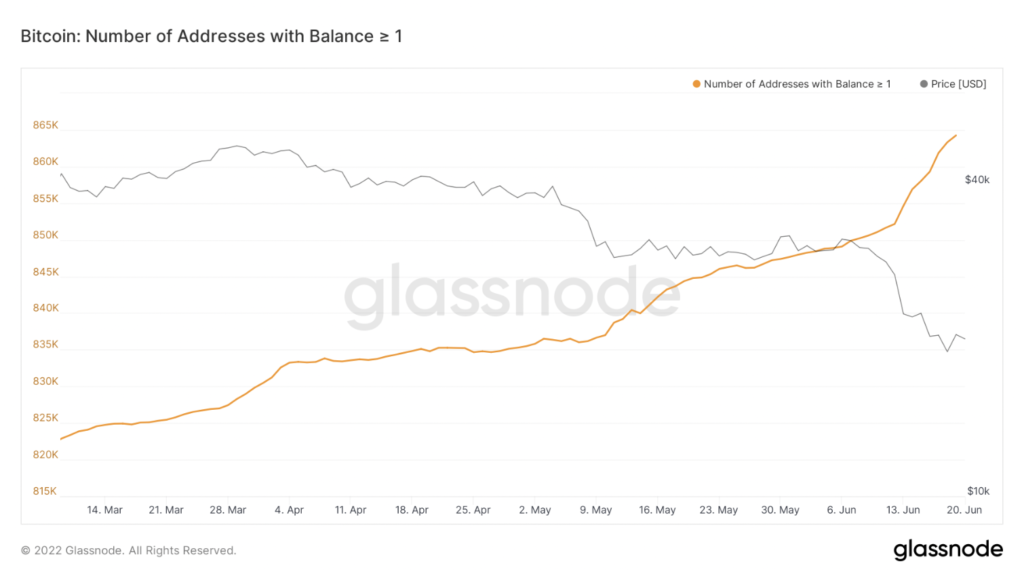

BTC trading in the $20,000 area for the first time since 2020 gives small-time investors the opportunity to realize their goal of owning a minimum of 1 BTC. According to Glassnode, there has been a significant increase in the total number of Bitcoin addresses containing 1 BTC or more. These have increased by over 13,000 in June.

The total number of addresses that hold 1 BTC has seen an immediate decrease in the days ahead, but the Reddit crypto community continues to welcome new crypto investors who have worked hard to become wholecoiners.

New investors become wholecoiners

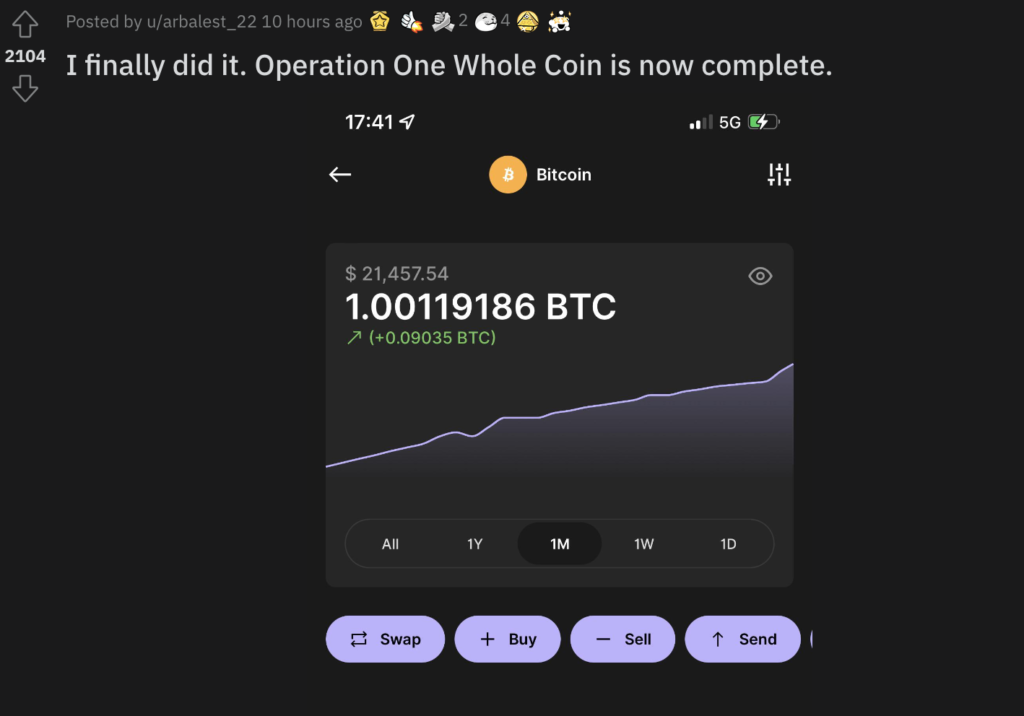

Some Reddit users even share their stories about how they saved enough to accumulate 1BTC and share screenshots of their achievements.

This Reddit user, arbalest_22 said that he spent approximately $35,000 to accumulate 1 BTC. He continues to support the Bitcoin ecosystem by pledging to procure Satoshis and sats until his total of 2 BTC. The ultimate goal of this user, and those who contributed to the discussion is to have tax-free income.

Other users say that they were able to become wholesalers by using the dollar-cost-average strategy. This dollar-cost-averaging (DCA) requires investors to regularly buy smaller amounts of BTC over a longer time.

According to Glassnode data, the total number of Bitcoin wallet addresses that hold more than 1 BTC increased is around 800,000.

Although falling BTC prices can be seen as an opportunity for investment, Google search trends highlight the tendency of other investors to speculate about its future.

Is it time to buy the Bitcoin dip?

After weeks of unrelenting selloffs, the Google search results show that cryptocurrency markets are experiencing peak anxiety.

After the comments of the United States Federal Reserve on the inflation outlook, nerves were high in crypto markets. The sell-off began at the beginning of June 2022.

Bitcoin lost the $20,000 psychologically significant mark. It also crosses another negative milestone, as it kept falling below the previous halving cycle’s highest for the first time ever in its history.

BTC/USD suffered 37% losses in the first two weeks, making June 2022 the worst month for Bitcoin.

The pair has traded almost 60% lower year-to-date. This is 70% less than the record high of $69,000 set in November last year.

According to cryptocurrency analysts, Bitcoin needs a higher volume and volatility to match volume levels from previous bear market bottoms, at the 200 MA (200-week moving average), a key lifelong support line.

The US stock market seems to recover and the S&P had its second-best week of 2022, which indicates a modest relief across risk assets. Everyone is looking at Bitcoin’s 200-week MA, which is the major indicator that gives the average price of Bitcoin over the last 200 weeks, hoping to surpass this support lever soon.