How to Survive the Crypto Winter? 5 Tips From Financial Experts

The crypto winter has already affected most cryptocurrency investors and holders as the prices of digital assets continue to fall. What’s even worst, many projects have been tumbling, and a few have almost disappeared in a matter of hours.

After the huge collapse of UST and the Terra ecosystem, others have been faced with liquidations. After several weeks of difficulty, Three Arrows Capital, a crypto hedge fund based in Singapore, was ordered to liquidate. BlockFi and Voyager Digital, both crypto exchanges, took out large lines of credit in order to survive the crisis. Voyager Digital had also been involved in funding Three Arrows. Their creditor was Sam Bankman-Fried, founder of FTX, who stated that he believes that many crypto exchanges are “secretly insolvent.”

Recently, Voyager Digital’s shares were temporarily halted from trading on Toronto Stock Exchange after they filed for bankruptcy. The shares were also halted in U.S. over-the-counter exchanges.

These problems were caused by Coinbase’s announcement (COIN) that crypto brokerage investors don’t have the same insurance and liability protections as traditional banks or brokerages.

More investors in the crypto space

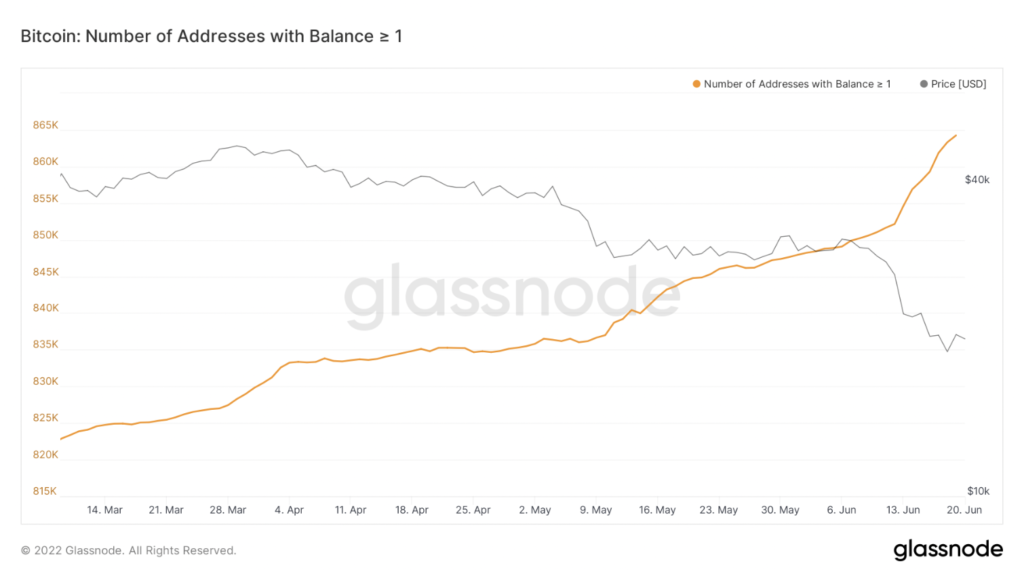

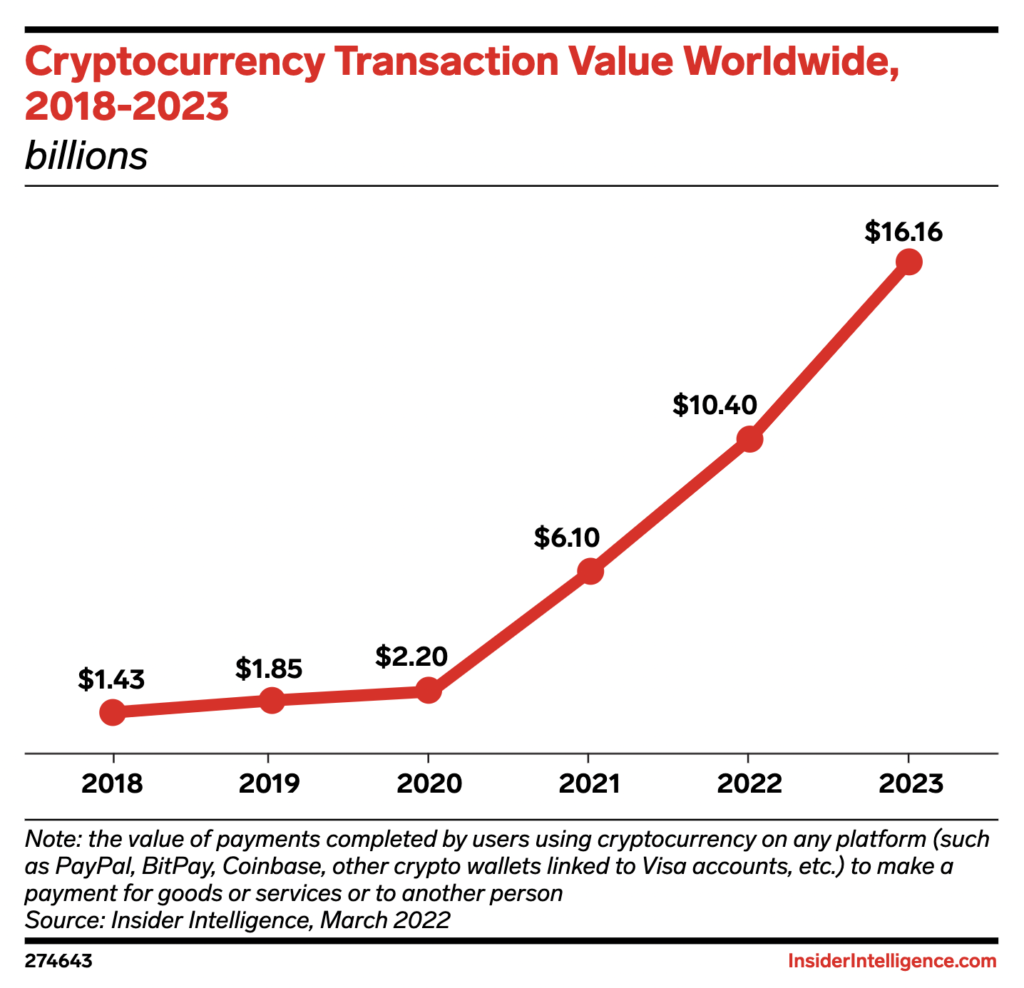

More individuals and institutions want to access crypto, and investment funds are slowly incorporating digital asset management and investing into their practices. However, these trends cannot be reversed, regardless of how asset prices fall.

While financial advisors have very different opinions on the topic of digital assets, they all seem to agree that they don’t need to like crypto to be able to offer it to their clients. Crypto is trading more like a technology stock because institutions are increasingly involved in it. They buy and sell according to the volatility. However, investors who wish to reap the benefits of crypto’s growth must be able to endure the swings. They will miss the growth if they wait for crypto to become a safe investment.

Since we are all experiencing the crypto winter and the effects of a highly volatile asset have been shifting financial trends, it might be a good idea to stop and carefully consider every trade. Here’s a list of methods that financial advisors recommend applying when you find yourself in utter panic and fear.

1. Don’t panic

Don’t forget that we’re talking about highly risky digital assets that present much greater volatility than any other financial assets. The global economy was expected to enter a new recession as a decade passed from the last one. For this reason, many analysts were expecting a “crypto winter.”

Investors should be well-diversified and prudently positioned to weather any downturn in crypto asset values. If you have the cash and a healthy appetite for risk, you might consider buying more crypto at lower prices.

2. Be aware of the risks

We are used to hearing financial advisors comfortably talking about risk in equities and real estate. But we must talk about cryptocurrencies and digital assets in the same way. There is a low risk involved whenever you decide to invest in volatile assets, and cryptocurrencies are top of the list. Another risk of crypto that all investors should be aware of is the custody of the assets.

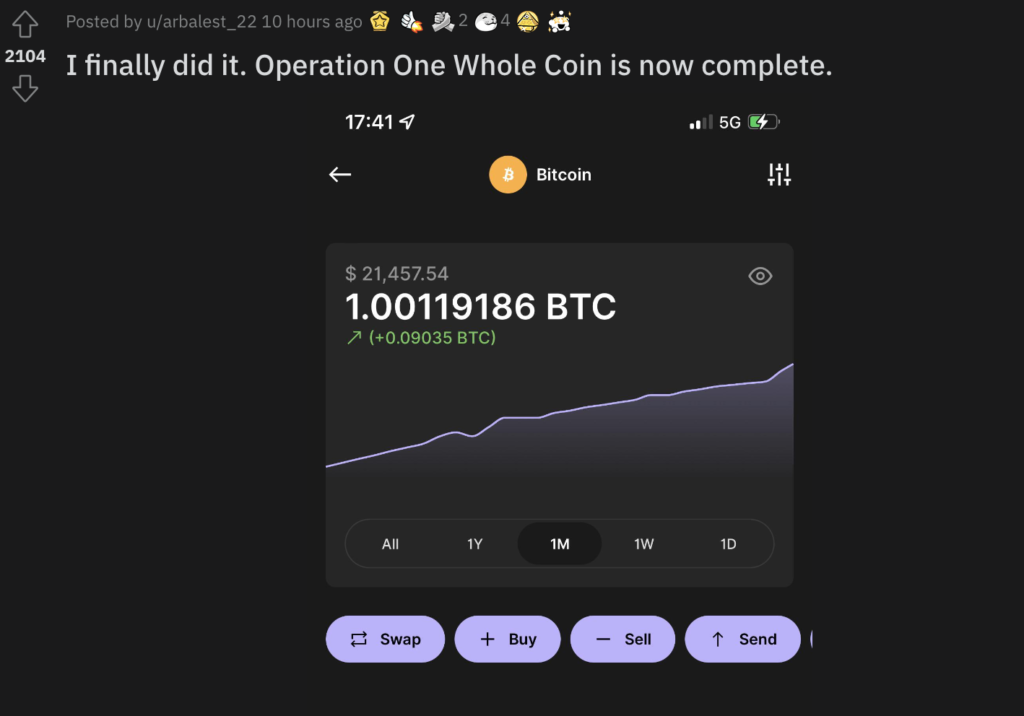

Some platforms allow you to buy it with a simple account, and they also offer custody of it. But in this case, you are not really the owner of the digital assets, as they are not exactly in your wallet. If the platform goes down, your assets go down with it. If you want to invest long-term in crypto, consider learning more about self-custody crypto wallets and transferring your digital assets to such a wallet. There are many options available out there, from browser wallets to hardware wallets.

3. Know your risk tolerance

Some people have a higher risk tolerance than others. That’s why some investors are more interested in crypto in the first palace, while others prefer to stay away from volatile assets.

All financial advisors suggest that you should invest according to what you’re willing to lose. If you find that your risk tolerance is small, then consider diversifying your investments. Yes, the most direct way to invest in a crypto is by buying the assets directly from an exchange and then holding it in your crypto wallet. But there are other ways that might leave you with less exposure to the market.

You might want to consider crypto ETFs (Exchange-Traded Funds), crypto trusts, hedge funds, and even invest indirectly in crypto by choosing mining and blockchain stocks.

4. Wait for the dust to settle (or don’t)

Investors who are more comfortable taking on risks may choose to follow Warren Buffett’s advice to “buy when the blood is in the streets.” However, you will need to conduct further research to learn how to allocate your funds and what assets to choose. However, during a “crypto winter,” nobody can tell you when prices have hit bottom or if they can further drop. That’s a risk you’ll have to accept or wait until the trend changes to start investing.

5. Wait for the “crypto spring”

Again, nobody can tell you when the trend will change. However, there is a lot of innovation happing in the crypto space, even in this “crypto winter.” Following projects that build useful services during a bear market is always a good idea. The future is reserved for those who create utility and value.

The metaverse is still being built. NFTs are still a very valuable idea, and those projects (e.g., FootballCoin) that bring utility will survive the bear market. The rails for institutional participation in crypto and digital assets remain under construction despite the downturn.

Smart money expects a “crypto spring.” Investors who practice patience will reap the benefits of a possible future rebound in the crypto space.