On the other hand, the efficacy of the policy has remained contentious as a lot of individuals feel that policy makers should encourage liberty and transparency by enabling the public to interfere and adjust the platform for people attention.

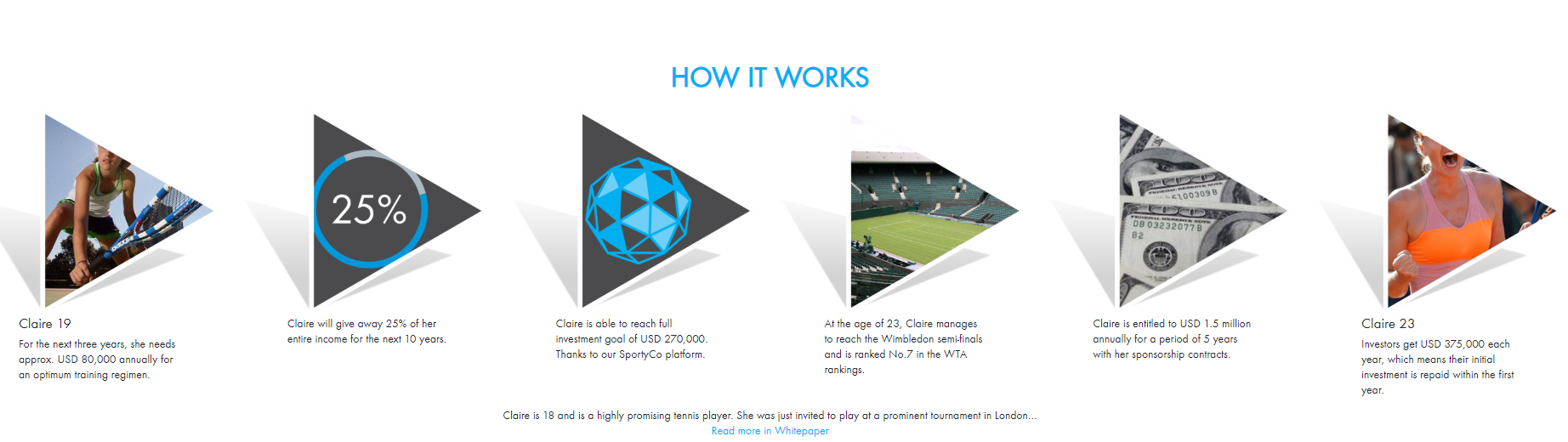

Digital fund technology, such as blockchain, have enabled a sort of crescive entrepreneurship which seeks opportunities in connection with financially excluded individuals.

Blockchain entrepreneurship can create semi-formal financial services which bring financial ambitions closer to individuals.

Blockchain is an advanced new technology with the capability to disrupt existing economic and business versions.

Some countries appear poised to get a quicker adoption of blockchain, although a frame is required to evaluate how the technology could be deployed and which programs and use cases are very likely to be viewed in the not too distant future.

While the possibilities that blockchain promises are very good, the technology remains in an early phase of growth and will have to overcome potential downsides (regulatory, technical, and organizational), until it becomes mainstream.

In this context of uncertainty, firms in emerging markets may afford to wait till the result is evident nor introduce their current business models to excessively insecure whole-scale blockchain initiatives. Rather, they need to adopt an experimental strategy which lets them build choices and therefore learn in the process, educate their plans, and boost their value propositions.

Blockchain’s full capacity is hard to forecast at this early stage in its evolution.

However while the majority of the focus surrounding blockchain has occurred in complex markets, its best potential for critical effect may lie in emerging market economies.

But given the relatively substantial prices of this proof of concept, it’s very likely that most adoptions of blockchain will happen when:

- value-added software will be built on top of current blockchains like bitcoin;

- personal or semi-private blockchains targeting procedure efficiencies in financial solutions; or

- extensive margin software allowing new marketplaces.

The coexistence of private and public blockchains is ensured, based on the sort of services and the character of the business where they’re applied. A persuasive business case for blockchain can be drawn up in now failed or under-served markets, even in which there’s a less competitive market structure and higher confirmation expenses.

Use cases which are relatively straightforward to design and execute, and which can be combined with tested technological alternatives for example cryptocurrencies, will probably find premature adoption (by way of instance, including a digital money payment choice for pockets and cross-border obligations ). Intra-organizational projects meant to reduce organizational sophistication and reconcile numerous databases could be an additional possibility.

Financial services companies are expanding that sort of cooperation to reputable counter-parties to reduce prices through personal blockchain.

Really tumultuous blockchain solutions that leave from existing company practices transmit high potential for future expansion, but their increased complexity and demand for stakeholder cooperation (like elaborate fiscal instruments and intelligent contracts) will probably delay their adoption.

Building with this theory, emerging markets seem poised to get a faster adoption of blockchain engineering, since they fulfil lots of the states listed previously, such as high verification expenses, underserved population, and oftentimes have a comparative absence of classic incumbents with substantial market power to impede new entrants.

In financial services, the present infrastructure is shallow in virtually all low-income nations, a lot of which have suffered from derisking at the aftermath of the fiscal crisis. Luckily, this handicap may hasten the adoption of blockchain, because of lack of infrastructure also means fewer organizational immunity to the new technologies and reduced transition costs for transferring from a legacy to another system. Thus, regulators and present financial institutions in emerging markets have less incentive to protect against the blockchain revolution, even as it doesn’t hugely disrupt present market conditions.

International trade and payments finance are cases of businesses experiencing a flurry of initiatives out of marketplace front-runners and new entrants alike. Both have high trade and confirmation costs that blockchain can decrease by enhancing the speed, transparency, and procedure. Emerging market countries have big population segments which remain under-served concerning banking and financial solutions as a result of the high cost of customer acquisition for conventional financial institutions.

Moreover, the extensive usage of cellular-based solutions, especially in Africa and Asia, provides a simple route to get a blockchain-based platform to expand its services.

In lower-income nations, cellular penetration is extremely large, at 83% one of the 16-to-65 age range.

If blockchain succeeds to offer proof of concept for a workable business model in payments for both cellular banks and other financial players, it might progress the longstanding developmental objective of financial improvement. Serving previously unprofitable clients and small and midsize businesses can generate around $380 billion in extra earnings.

So blockchain can provide emerging markets a chance to leapfrog conventional technologies, as occurred with cellular technology in several emerging market areas, especially Sub-Saharan Africa.

Financial services

From the financial services industry blockchain initiatives fall under two major categories. The first is process efficiency rationale, which happens in countries with recognized financial marketplace leaders (average in OECD nations ). And the next is fresh market development rationale, where new market players aim the inefficiencies of current business models to provide value in emerging markets. These may be start-up companies originating from complex or out of emerging market economies, or big non-financial players who see an opportunity in enlarging the value chain of present support. Global obligations, or remittances, and electronic wallets are all examples.

These initiatives often prosper in markets with a blend of comparative volatility due to political or currency risk, a lack of a solid standard banking system, big under-served consumer segments, an electronic or cellular finance population, and explicit service or tolerance by authorities.

Within this business, blockchain initiatives are normally open networks, backed by a cryptocurrency (generally Bitcoin) and are generally local. China is a notable player within this classification, together with businesses which have a lively presence in both sections (start-ups and big established players), together with regional policy throughout Asia and venture capital investors that have international aspirations beyond emerging markets.

The positive impact of blockchain in emerging markets may be not just scientific, but also institutional.

From a government and social standpoint, blockchain’s characteristics of transparency may also function to bridge the ‘trust deficit’ and place pressure on authorities to improve services to taxpayers, forcing them to become accountable and getting rid of the demand for decades of systemic improvement.

For instance, in 2016 Dubai Government launched an International Blockchain Council to aid authorities and business on how to best leverage the technologies to enhance services to taxpayers.

Recent developments

Recent advancements though it’s still too early for definitive decisions, 2016 found a tendency concerning the stream of investments and capital in the blockchain business, based on information supplied by research company CB Insights.

There were indications that the industry is moving past hype and also toward an inflexion point, using a unifying interest from big corporations and venture capitalists to more complicated financial applications, in addition to international diversification:

• Investment in the industry remained flat in comparison with 2015 (at $550 million) but nevertheless important (it stood at $5 million in 2012), together with funding concentrated into fewer prices, signifying maybe an end to the investment bubble.

• Financial services remained the busiest company shareholders, with important banks linking.

• While the United States still dominated the industry using a 54% yield market share, its comparative percentage decreased as Asia’s share increased threefold to 23%; Asia appeared as a worldwide venture capital investor at important prices.

Blockchain revolution

Distributed ledgers technologies is evolving quickly, driven by inner forces directed at correcting some of their technology’s limitations, with easy-to-use options like Ethereum and other disruptive technologies which are forming the Industrial Revolution.

The blend of those forces that are innovative, such as cognitive computing, robotics, the Internet of Things, along with innovative analytics, will unite to produce perfect conditions for changing the present financial infrastructure.

Smart contracts

With the dawn of Ethereum, the “smart contract” concept has been introduced, embodying a second-generation blockchain platform dissociating the electronic representation of resources on the series from electronic currencies like Bitcoin.

Along with the rate and efficacy achieved through dispersed ledger technologies, smart contracts offer the capacity to perform more complicated and complex tasks among parties.

Unlike conventional contracts, smart contracts have been inserted in code and will get information and take action based on predefined rules. They may be utilized in a lot of situations, for example, transfer of land names, settlement of financial derivatives, and royalty payments for musicians. The largest impact is likely to be a composite of smart contracts and the Internet of Things.

Internet of Things (IoT)

Internet of Things platforms have a tendency to get a centralized model where a broker or heartbeat controls interactions between apparatus, an arrangement which may be costly and impractical.

It hence provides a transactional capability for both person-to-person and machine-to-machine trades in an increasingly connected world of numerous, enabled devices like sensors and smart devices.

This unique capability among smart devices may facilitate the development of new business models. For example, devices might also be utilized as miners, making cryptocurrency benefits for the blockchain confirmation procedure.

By devoting computing cycles through idle time to procuring an electronic ledger, a mobile phone program, by way of instance, could be partly subsidized via its mining processor.

A blockchain-enabled Internet of Things could be applied to several situations, from business to government, agriculture, energy, health, science, and education, and the arts.

It clarifies blockchain as “the frame for easing trade processing and processing among interacting apparatus. …Devices are permitted to execute digital contracts letting them be self-maintaining, self-servicing devices”.

They include collections of contracts written on the Ethereum blockchain, which collectively specify the corporate governance of this company without resorting to some classic vertical managerial arrangement.

Taken together, intelligent contracts amount to a collection of bylaws and other founding documents that determine how a company’s constituency– for example anybody around the globe who owns DAO tokens bought with ethers–votes on conclusions, devoting funds as well as in theory, produce a wide-range of potential yields.

Decisions are made via collective voting.

Blockchain technology blurs the lines between the marketplace and the company because it generates a more efficient approach to handle the high transaction costs of financial coordination.

The development of network-centred models predicated on blockchain technology may challenge the preeminence of present electronic platform giants and supply the underlying framework for a shared market and reconfigured economic action.

Possible setbacks

Is the network scalable?

The consensus established character of blockchain validation mechanics requires significant computational capability and may delay transaction rate as the requirement for information storage increases.

This poses a severe technical barrier to the scalability of this blockchain system and also to attain economies of scale.

Is it stable?

The 2016 cyber-attacks on Distributed Autonomous Organizations, caused by a Vulnerability of smart contracts, highlights Cybersecurity for concern for blockchain and suggests The technology hasn’t yet reached its maturity.

Can separate blockchains operate together?

To be able to profit from a distributed system, the institution of industry-wide cooperation and common criteria for interoperability is crucial.

On the other hand, the technology remains in its pilot stage and a particular length of prototyping will be essential before business standards emerge, implying that industry-wide criteria aren’t likely in the long run. In the financial services industry, consortia initiatives are now underway to give space for communicating among stakeholders, for example, Fabric by Hyperledger and R3 Corda.

Is the information private?

Several ambiguities and worries remain unresolved regarding information security in the context of blockchain programs, such as a selection of applicable law and authority, right-to-be forgotten inapplicability, along with the availability of information to all parties.

How fast would it be regulated?

The present regulatory framework hasn’t managed to keep up with the fast pace of electronic innovation. Unclear or aggressive regulations and a lack of government recognition of electronic assets can dissuade the on-boarding of almost any new technologies, such as blockchain.

For dispersed ledgers technologies to be approved from the financial services sector, it is going to have to comply with present Know Your Customer/Anti Money Laundering regulations.

Some nations, such as the United Kingdom, China, and Singapore, have obtained a hands-on strategy to comprehending the new regulatory requirements, devoting particular task forces to advise the authorities on its own strategy or forming public-private partnerships, but others have embraced an arm-length strategy, anticipating developments from the business.

What’s it likely to cost?

Another important challenge is that the potentially substantial costs, both organizational and financial, connected to the execution of blockchain engineering, even to get a pilot stage. Companies will need to consider the potential but uncertain benefits that may come in the adoption of blockchain from the current and actual costs of analyzing use cases.

These prices include problems of integration with legacy systems in addition to the restricted a pool of qualified human capital required to deliver a blockchain job to fruition. Businesses in the financial industry are forming consortia with an opinion to have mutable prices so the blockchain infrastructure can function as an interoperable sector utility, nevertheless, issues of alignment and conflicts of interest among the several players stay.

These roadblocks, although not insurmountable, imply that blockchain probably is not going to have a direct disruptive effect across sectors.

Adoption is very likely to be slow over the next five to ten decades, and also prevalent on-boarding will be essential to achieve full economies of scale and leverage the complete network impacts.

The financial services industry is the very first to mobilize at a concerted fashion, since they’re investing and are embracing an attempt, find out, and adapt the strategy.

How can blockchain impact emerging markets? – Conclusion

On the path to blockchain execution, two major risks shouldn’t be underestimated.

First is the regulatory and legislative environment and how it could influence distributed ledger technology in the authorities in question, such as compliance and information privacy.

Second is a company’s capability for change and also the talent pool available for handling the change from the culture and operations of this business.

The decision-making procedure should arise in the organization’s value proposition and its own strategic vision and leadership, moving into an investigation of the way blockchain is impacting that distance and how it might provide improvements in the organization’s value proposition, or perhaps create new markets to the business enterprise.

Based upon the intricacy of the procedure and the amount of confidence required by participants and compliance demands, companies will decide what blockchain instruments to set up (alternative or personal, open or open networks) and if they’re better served by creating the project in cooperation with outside partners.

This procedure should result in the range of a couple of pilots to leave fast wins, to learn by the encounter, and also to give informed feedback about the best way best to adjust longer-term attempts. No matter their choice and level of participation, companies need to seriously think about the far-reaching consequences of blockchain by conducting their own research to ascertain how it could affect their marketplace and future value proposal, then plan accordingly.

In doing this, companies need to strike a balance between creating internal competencies and experimentation, while efficiently managing potential dangers and prices. To hedge against exposure to threat, they might desire to pursue partnerships with business peers and start-ups into mutualize prices of infrastructure construction..