Zimbabwe Launches Gold-Backed Digital Currency Amid Economic Struggles

Zimbabwe’s central bank is launching a digital currency backed by gold.

They plan to start selling these digital coins to investors on May 8th, 2023. Individual buyers can get them for at least $10, while companies and other groups need to spend a minimum of $5,000.

The Reserve Bank of Zimbabwe announced that people can buy these gold-backed digital coins with U.S. dollars or local currency.

However, if using local currency, the price will be 20% higher than the average market rate. Investors can join in and buy these coins starting May 8th, but the opportunity will end two days later.

The “willing-buyer willing-seller interbank mid-rate” is a middle point between the rates banks are ready to buy and sell different currencies to one another.

It depends on factors like how much of a currency is available and how much people want it. This rate helps set prices for many financial deals, and banks and other financial institutions often use it as a reference.

On April 28th, the Reserve Bank of Zimbabwe shared their plans to create a digital currency supported by gold, which can be used as official money in the country.

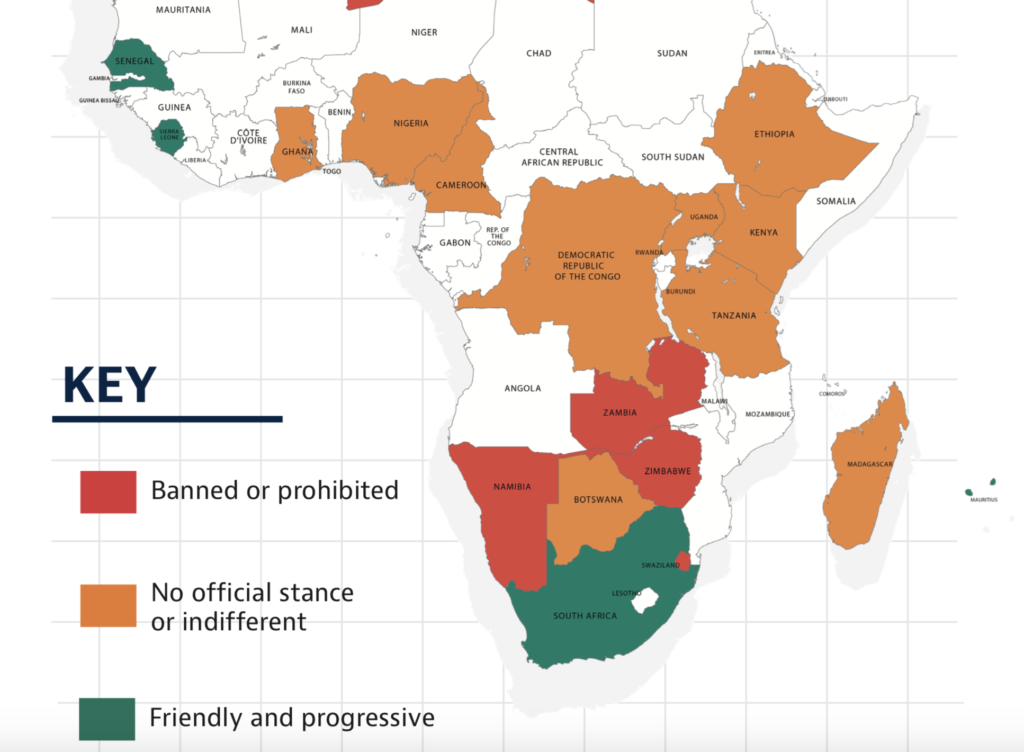

Zimbabwe has faced issues with unstable currency and high inflation for over a decade. After a period of extreme inflation, the country started using the U.S. dollar in 2009. Nigeria was the first African country to introduce its own digital currency, called the eNaira, in 2021.

Zimbabwe and hyperinflation

This new digital currency is part of Zimbabwe’s efforts to strengthen its local currency. Zimbabwe has been trying hard to overcome the effects of hyperinflation over the past decade.

In 2009, Zimbabwe replaced its valueless local currency with the U.S. dollar. However, their economy has faced difficulties due to a significant shortage of U.S. dollars in the country.

In early 2019, Zimbabwe’s central bank revealed plans to reintroduce the Zimbabwe dollar as legal tender, after using the US dollar and seven other global currencies for a decade. The reason for this change was that extreme hyperinflation had severely weakened the local currency.

However, many people ignored this, the black market flourished, and the local currency devalued quickly. The government then allowed the use of the U.S. dollar again.

Due to the previous severe inflation, many people now prefer to find scarce U.S. dollars on the illegal market for their savings or daily transactions. Confidence in the Zimbabwe dollar is so low that numerous retailers and even some government institutions don’t accept it.

On the official market, the exchange rate is slightly above 1,000 Zimbabwe dollars to the U.S. dollar. But on the thriving illegal street market, it’s about double that amount in local currency.

Zimbabwe has tried unusual ideas to prevent its currency from losing value.

In 2022, they returned to using the U.S. dollar to manage rising prices.

In July 2022, Zimbabwe introduced gold coins as legal tender to stabilize the local currency and preserve its value. However, many people found them too expensive to purchase everyday items like bread.

In March 2023, the Monetary Policy Committee approved a plan to support Zimbabwe’s local currency.

This came eight months after the country introduced gold coins as a way to maintain the currency’s value. This plan seemed to have worked. In January 2023, according to the Committee’s monthly report, the price of gold increased by 5.7% (from US$1,795.97 to US$1,898.95 per ounce). While the price in February has slightly retreated (by 2.3%), the Committee decided to go through with its plan.

According to the bank’s statement, the pricing of the gold-backed tokens in Zimbabwe will be based on international gold prices set by the London Bullion Market Association.