Solana is showing signs of potentially surpassing Ethereum in terms of consumer decentralized applications (DApps), as noted by Solana Foundation’s former head of growth. Despite current market challenges, Solana’s unique features could lead to increased developer activity and user adoption.

Matty Taylor, co-founder of Colosseum and previously part of the Solana Foundation, shared that he believes the Solana blockchain is going to become more popular than Ethereum, especially for regular users.

He said that Solana has been doing better than Ethereum in attracting user-friendly apps that fit with the modern web, thanks to its ability to handle transactions quickly and efficiently.

Currently, according to DappRadar, Ethereum has about 4,520 decentralized applications (Dapps), which is considerably more than the ones on Solana (240).

But even so, Solana has kept its nickname over the years, as it is often mentioned as a potential “Ethereum-killer.” This is because Solana can process transactions faster and more efficiently than Ethereum.

The collapse of FTX and the subsequent market downturn were major challenges for Solana, but according to Matty Taylor, these events actually brought more developers to the platform, even as the value of Solana’s SOL token dropped.

Taylor pointed out that every major blockchain network, including Bitcoin with its Mt Gox incident and the 2020 market downturn, has faced tough times. He believes that Solana has emerged from these challenges stronger and with a growing number of developers.

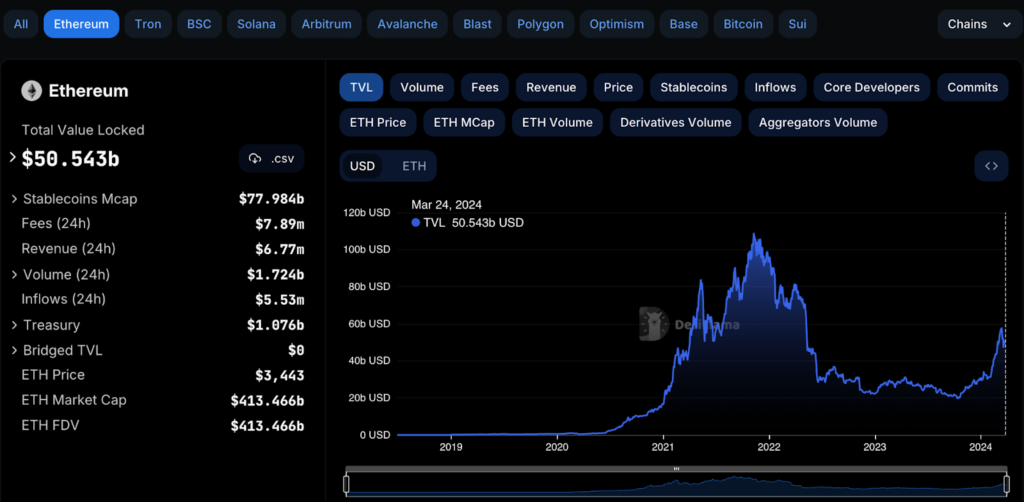

Despite these advancements, Ethereum still leads significantly in the crypto space.

As of March 2024, according to DefiLlama data, the total value locked (TVL) on Ethereum is $50.5 billion, more than 11 times Solana’s TVL of $4.34 billion.

Source: DefiLlama

Source: DefiLlama

Additionally, Solana faced technical issues when its blockchain stopped producing blocks for over five hours on February 6, forcing a network restart by its validators. This was not the first time; Solana has experienced several notable disruptions since January 2022.

Matty Taylor explained that while network problems are usually bad for any system, blockchains trying to expand their capabilities will naturally face some challenges. He mentioned that it’s better for these issues to occur now rather than later, especially before large, critical funds like pensions begin to rely on blockchain technology. He admitted that while it’s not ideal, these challenges are part of the innovation process.

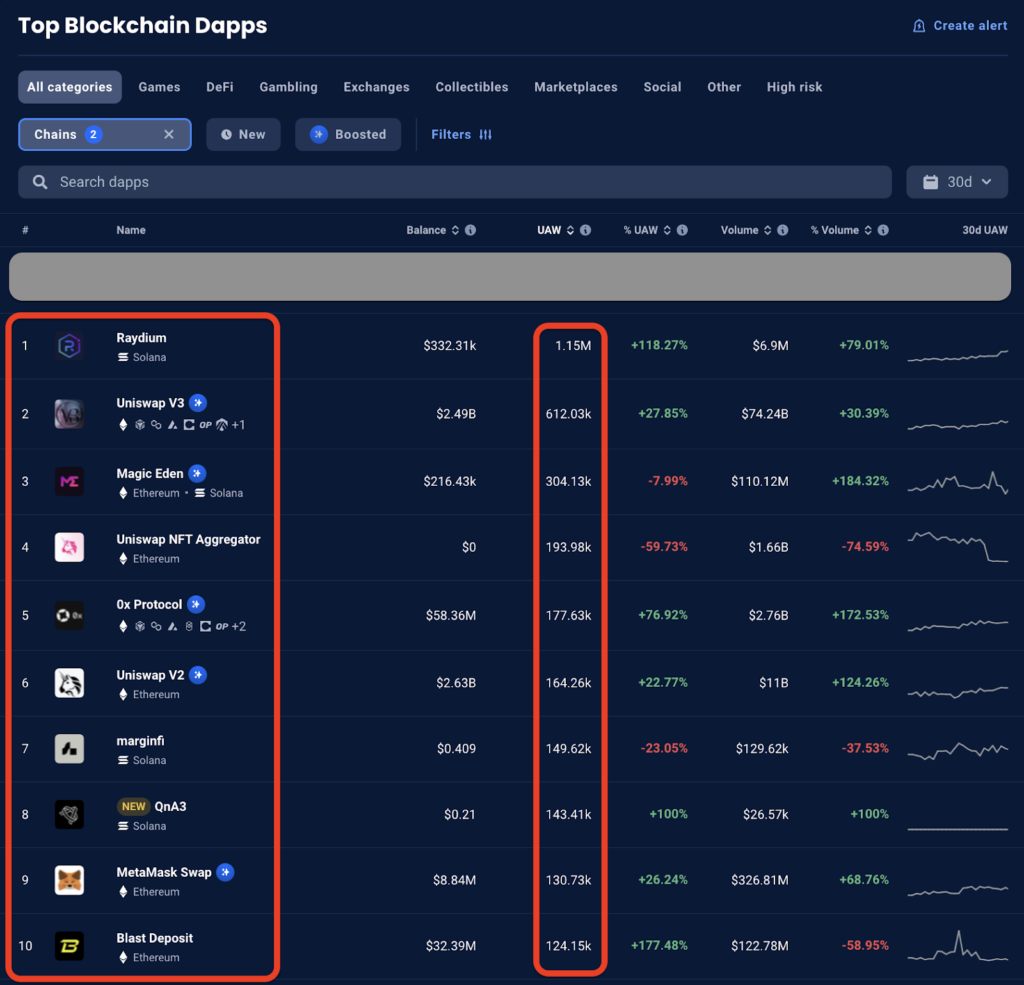

Ethereum vs Solana dApps

There is no doubt that Solana is becoming a serious competitor to the already established Ethereum blockchain.

According to DappRadar, the top 10 Dapps are divided between Ethereum and Solana. Three of these are native to Solana, six are Ethereum-based, and one (Magic Eden NFT marketplace) supports both blockchains.

However, it’s worth pointing out that the UAW (Unique Active Wallets) interacting with these apps seems to be increasing on the Solana-based Dapps.

Raydium, the Solana-based DEX, has taken the lead with over 1.15 million unique addresses in the last 30 days. This is almost double that of the most popular DEX in the crypto space, Uniswap. However, the top from DappRadar counts Uniswap V3, V2 and the NFT aggregator as separate Dapps, but there’s no way of knowing if those aren’t the same addresses on both Uniswap V3 and V2.

According to CoinMarketCap, Solana (SOL) registered a price surge of over 78% during the last month, reaching a trading price of about $185 at the end of March 2024.

This sharp increase, together with its latest tech developments, played a pivotal role in last month’s TVL increase for its top protocols. Here’s a screenshot from DefiLlama of the top protocols on Solana, sorted by their TVL (total value locked).

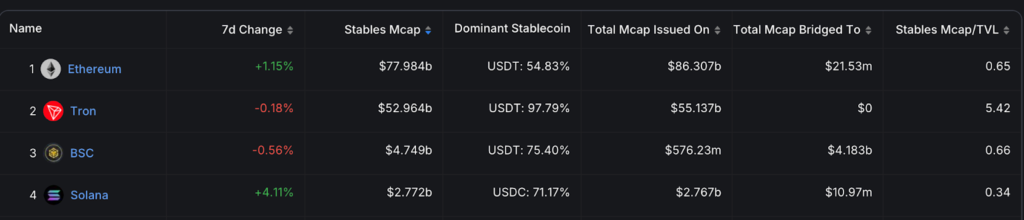

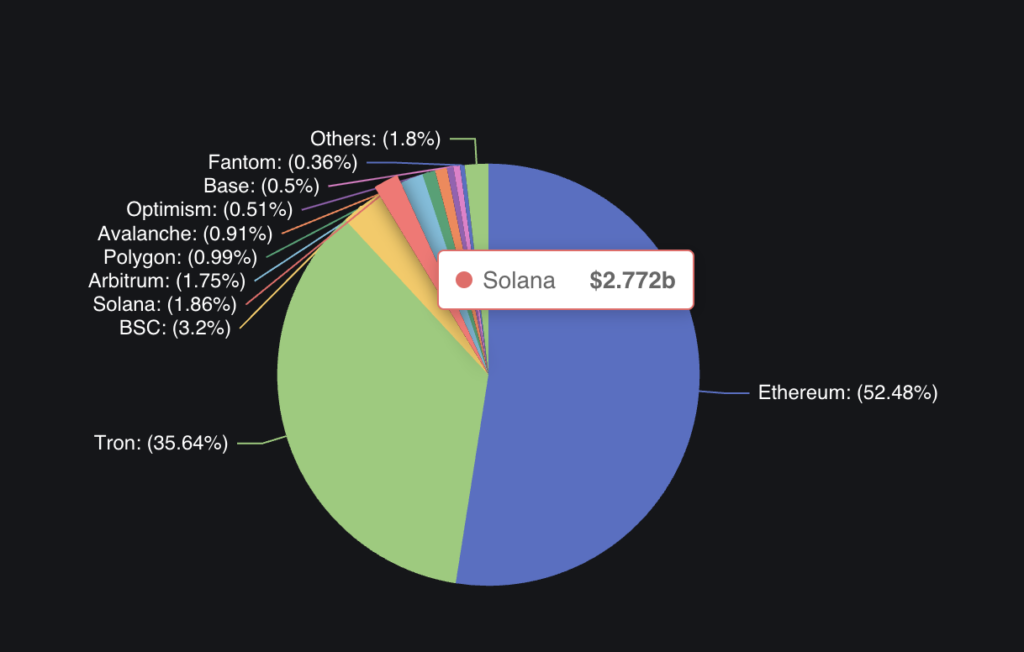

Stablecoin dominance

Stablecoins are another way to measure how relevant a blockchain really is. Investors and day traders will often use stables, such as USDT and USDC to safeguard their trading profits from the market’s volatility.

While Ethereum still maintains its sovereignty, being responsible for over 52% of all stablecoin transactions, Solana ranks as the 4th blockchain for stablecoin trading, with a 1.86% dominance of the total market share.

Source: DefiLlama, Total Stablecoins Market Cap Dominance

Here is a breakdown for each of the top blockchains for trading stables.

Solana is gradually growing in volume and market capitalization, experiencing more than a 4% increase over the last week. It appears that Solana is steadily outpacing Ethereum. If this trend continues, it will not be a matter of if but rather a question of when.