by Iulia Vasile | Mar 22, 2023 | News

Recently, the Montana Senate passed a bill that aims to safeguard the interests of crypto miners operating within the state.

The proposed law is currently being reviewed by the Montana House of Representatives and seeks to eliminate discriminatory regulations that could hamper their mining operations, both for individuals and commercial entities.

The bill seeks to exempt digital assets used as payment from taxes, and allow home crypto mining that uses less than 1 megawatt of energy annually, except when it violates existing noise bylaws.

The proposed pro-crypto mining bill in Montana aims to remove any energy rate classification that hinders home crypto mining and digital asset businesses. Lobbyists and crypto companies have been working together for years to establish crypto-friendly laws in the state. Montana has high wind energy potential, but remote wind projects struggle due to the need for long transmission lines. However, the bill can be an early buyer of that power and help to bring customers (Bitcoin miners) to the state. There is a misconception that mining is bad for the grid or the environment is holding back the crypto-mining industry in the United States, despite it being a powerful tool for balancing the grid and cleaning up the environment.

Regulatory policies also fail to consider the positive aspect of this process. One of these would be the grid balancing concept.

Crypto mining is best suited for states with grid-balancing programs. These programs pay participants to lower their power consumption during times of high power prices or low supply. Miners can easily reduce their power consumption at any hour of the day, making them ideal participants in such programs.

What is the Montana pro-crypto bill?

The proposed bill seeks to establish a “right to mine digital assets” in Montana and prevent discriminatory electricity rates for crypto miners. The bill also protects “home” mining and removes local government’s power to use zoning laws to prohibit crypto mining operations.

Additionally, the bill prohibits extra taxes on the use of crypto as a payment method and categorizes digital assets as personal property, similar to stocks and bonds. The Montana Senate passed the bill on Feb. 23 with 37 for and 13 against, and it will now be presented to the House for approval. Finally, the bill will require the signature of Governor Greg Gianforte to become law, who may choose to veto it.

How Montana Could Benefit from Pro-Crypto Mining Bill

Proponents of the bill anticipate that Montana can attract mining companies by updating legislation, which will, directly and indirectly, boost the region’s economy.

Montana State Senator Daniel Zolnikov, the primary advocate of the bill, believes that Montana has a lot to gain by embracing the digital asset industry.

By permitting unrestricted crypto mining operations, Montana can potentially attract more businesses and investments from the cryptocurrency sector, creating jobs in rural communities.

Senator Zolnikov hopes that this move will signal to the larger digital asset industry that Montana welcomes their innovation and new companies into the state.

Sustainability Concerns Surrounding Montana’s Pro-Crypto Mining Bill

Despite optimism about the potential benefits of crypto mining, some are concerned about the impact on small towns and communities.

Colin Read, former mayor of Plattsburgh, New York, and SUNY economics professor, pointed out that mining companies often fail to deliver on their promises of job creation.

Additionally, an influx of crypto mining companies could cause energy and sustainability challenges, as seen in New York, which experienced skyrocketing retail energy rates due to increased demand.

As a result, the New York Public Service Commission introduced steeper energy tariffs for crypto miners to mitigate the issue.

Similar challenges have arisen in Texas, where crypto mining businesses have set up operations, leading to power grid overloading during extreme weather conditions.

In Montana, Missoula County has implemented requirements for crypto mining firms to either consume or generate enough renewable energy to cover 100% of their operations, responding to concerns about power consumption and pollution. These sustainability concerns underscore the importance of balancing the potential economic benefits of pro-crypto mining legislation with sustainable energy practices.

Montana’s weather conditions, including summer heat rising above 100 degrees Fahrenheit (38 Celsius) and sub-zero temperatures in winter, contribute to the state’s high per capita energy consumption rate. Due to environmental concerns surrounding the environmental impact of crypto mining, several American states have implemented laws limiting energy-intensive activities, such as placing caps on energy usage or restricting energy sources.

For instance, New York recently imposed a temporary ban on mining firms using non-renewable energy sources to reduce the state’s carbon footprint. Montana may face similar sustainability challenges if its pro-crypto mining bill is passed.

Senator Zolnikov addressed these concerns, stating that Montana already has an attractive energy mix for digital asset mining and that the bill aims to provide legal certainty for long-term operations. Montana has access to geothermal, wind, solar, and hydro energy sources, including the Missouri River and its tributaries, which are used to generate hydroelectric energy.

Will the pro-crypto bill pass?

Montana’s pro-crypto mining bill aims to attract more cryptocurrency mining businesses to the state, potentially bringing positive transformations. However, the bill’s approval could lead to initial sustainability challenges related to eco-friendly and sustainable energy.

While Montana presently has both renewable and non-renewable energy sources, the state’s response to emerging changes in the wake of the pro-crypto mining legislation will be crucial. Balancing economic benefits with sustainable energy practices will be a delicate balancing act for Montana.

by Iulia Vasile | Mar 17, 2023 | News

Euler Finance fell victim to a flash loan attack that resulted in the loss of more than $195 million in stablecoins and ERC-20 tokens.

On March 13, Euler Finance, a noncustodial lending protocol based on Ethereum, was hit by a flash loan attack. This resulted in the theft of millions of dollars in Dai (DAI), USD Coin (USDC), staked Ether (stETH), and wrapped Bitcoin (wBTC). As per the latest update from on-chain data, the attacker carried out multiple transactions and was able to steal almost $196 million, making it the largest hack of 2023 thus far.

The funds stolen include the following:

- DAI (8,877,507.35)

- wBTC (849.14)

- stETH (73,821.42)

- USDC (34,413,863.42)

- stETH (3,897.50)

- stETH (8,099.30)

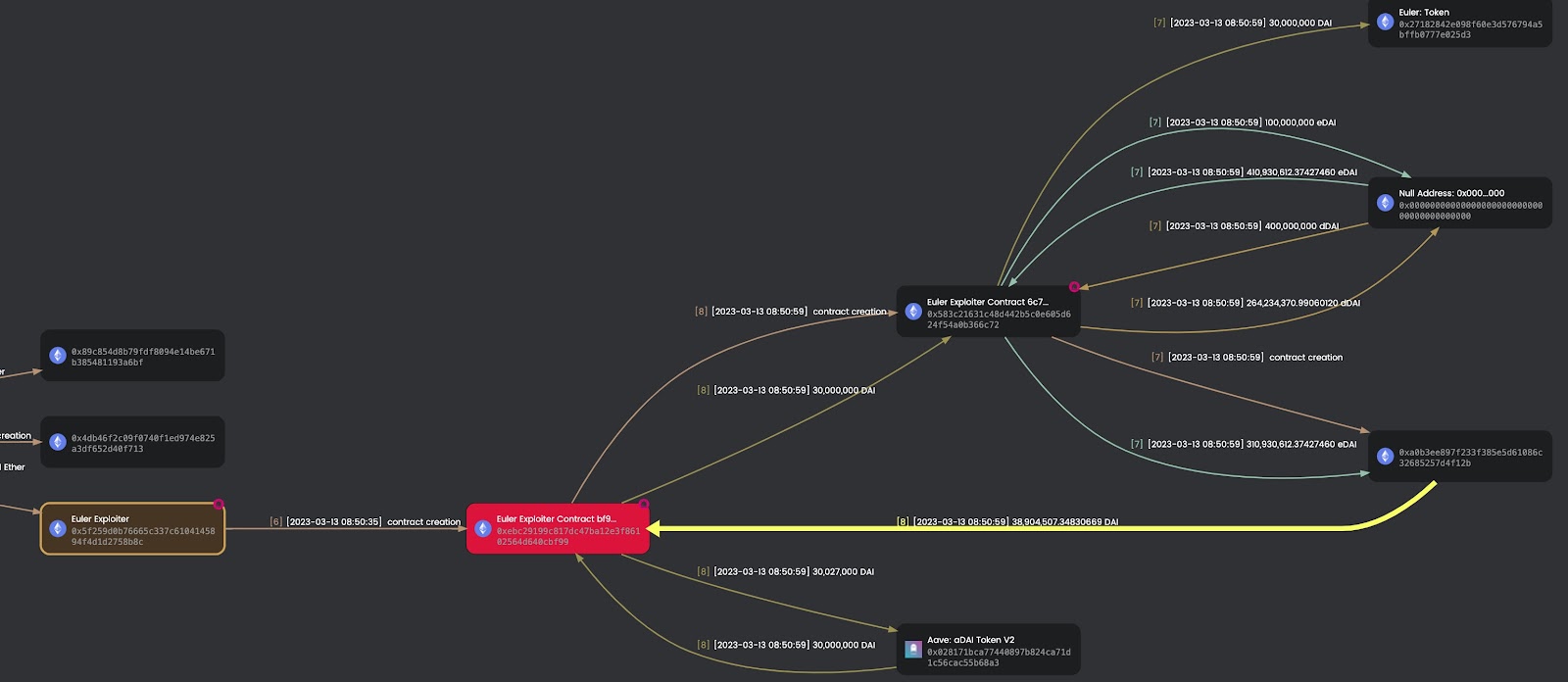

As per findings by the crypto analytic company Meta Seluth, the recent attack appears to be linked to the deflation attack that occurred a month ago. The attacker leveraged a multichain bridge to transfer the funds from BNB Smart Chain (BSC) to Ethereum and executed the attack today.

This DeFi attack on Euler Finance is one of the most significant hacks of 2023 thus far.

Movement of funds from Euler Finance. Source: Meta Seluth

Movement of funds from Euler Finance. Source: Meta Seluth

ZachXBT, another well-known on-chain investigator, confirmed the correlation and stated that the attack’s fund movement and approach bear striking similarities to those of bad actors who recently targeted a BSC-based protocol.

In the previous attack, the attackers deposited the funds into Tornado Cash, a cryptocurrency mixer. Presently, the illicitly obtained funds are residing in the following hacker-controlled addresses:

- 0xebc29199c817dc47ba12e3f86102564d640cbf99 (Contract) – 8,877,507.34 DAI

- 0xb2698c2d99ad2c302a95a8db26b08d17a77cedd4 – 8,080.97 ETH

- 0xb66cd966670d962c227b3eaba30a872dbfb995db – 88,752.69 ETH & 34,186,225.91 DAI

Euler Finance has acknowledged the exploitation and reported that they are working closely with security experts and law enforcement agencies to address the matter.

According to Slowmist, a blockchain security firm that conducted an in-depth analysis of the attack, the attacker utilized flash loans to deposit funds and then proceeded to trigger liquidation by leveraging them twice. After donating the funds to the reserved address, the exploiter performed a self-liquidation to obtain any remaining assets.

The exploit’s success can be attributed to two key factors. Firstly, the funds were donated to the reserved address without undergoing a liquidity check, resulting in a soft liquidation. Secondly, the soft liquidation logic was activated by high leverage, allowing the liquidator to acquire most of the collateral funds from the liquidated user’s account by only transferring a portion of the liabilities to themselves.

The entire process occurred within a single transaction (one per pool) using flash loans obtained from AAVE.

It seems that one of the smart contracts in Euler has a glitch where it fails to verify the health factor during the execution of the donateToReservers() function. As a result, the attacker could liquidate their position from the protocol, repay the flash loan, and generate a substantial profit.

In a funding round last year, Euler Finance secured $32 million in investments from notable entities such as FTX, Coinbase, Jump, Jane Street, and Uniswap. Euler Finance garnered significant attention for its liquid staking derivatives (LSDs) offerings, which enable stakers to unlock liquidity for staked cryptocurrencies like Ether and potentially increase their returns. LSDs are a relatively new type of token, and they now account for up to 20% of the total value locked in decentralized finance protocols.

Euler Finance tries to retrieve the stolen funds

Shortly after the announcement of a $1 million bounty, the illicitly obtained funds were transferred to the cryptocurrency mixer Tornado Cash.

Euler Finance issued a demand for the hacker to return 90% of the stolen funds within a 24-hour period to potentially avoid facing legal consequences.

by Iulia Vasile | Mar 10, 2023 | News

Silvergate Capital Corporation has revealed that it will close its operations due to “recent industry and regulatory developments”. The company confirmed that the liquidation of Silvergate Bank would involve the complete repayment of all customer deposits.

This decision follows the withdrawal of support by various crypto companies, including Coinbase, Paxos, Gemini, BitStamp, and Galaxy Digital, following an investigation into Silvergate’s alleged participation in the collapse of FTX. The bank also announced the closure of its exchange network on March 3, stating that the decision was based on risk considerations.

Silvergate had established itself as a significant banking partner for several crypto companies. However, apprehensions about its financial stability arose when it announced a two-week delay in filing its annual 10-K report, which typically offers a summary of the company’s financial position.

The departure of Silvergate has left the potential impact on other crypto companies that have funds held by the bank or have exposure to it uncertain. The bank stated that the transfer volume of customer fiat deposits had decreased by approximately $50 billion in Q3 of 2022 compared to the corresponding period in 2021.

Debate over Silvergate’s downfall and the future of crypto banking

The collapse of Silvergate bank sparked a debate over who was responsible for the chain of events that led to its downfall. After the bank’s voluntary liquidation announcement, numerous reactions from lawmakers, crypto analysts, executives of crypto firms, and commentators appeared on social media.

Some lawmakers in the United States have seized the opportunity to comment on the crypto industry, characterizing it as a “risky, volatile sector” that poses a risk to the broader financial system.

Senator Elizabeth Warren has referred to Silvergate’s collapse as “disappointing but predictable,” urging regulators to take action against the risks associated with crypto.

Senator Sherrod Brown expressed his apprehension about banks that engage with cryptocurrencies. In his opinion, they pose a potential risk to the financial system.

The senator emphasized the need for robust safeguards to protect the financial system from the dangers associated with crypto. The senator’s comments have drawn criticism from some members of the community who argue that the issue was not caused by crypto but instead by fractional-reserve banking. They point out that Silvergate held considerably more in-demand deposits than cash reserves, which they believe was the primary factor behind the bank’s troubles.

Some companies have taken the opportunity to reaffirm their dissociation from the bank. Binance CEO Changpeng Zhao said on Twitter that the crypto exchange does not have any assets stored with Silvergate. Likewise, Coinbase issued a similar statement.

On the other hand, Nic Carter, the co-founder of Castle Island Ventures and Coin Metrics, a crypto intelligence firm, opined that the government was responsible for “accelerating the collapse” of Silvergate. Similarly, Ram Ahluwalia, the CEO of Lumida, a financial services company, shared a similar perspective, asserting that a letter from a senator had eroded public confidence in Silvergate, resulting in a bank run. He argued that the bank was denied due process.

Previously, Carter mentioned the existence of “Operation Choke Point 2.0.” He claimed that the U.S. government is utilizing the banking sector to orchestrate “a sophisticated and extensive crackdown on the crypto industry.”

However, some individuals think that the downfall of Silvergate might not necessarily have an adverse impact on the crypto industry. Instead, they believe that combined with proposed tax law changes, it could intensify the departure of crypto firms from the United States.

In the wake of Silvergate’s liquidation, there has been a growing concern about where crypto firms will turn to for their banking needs.

Coinbase, which previously accepted payments through Silvergate, announced on March 3 that it would be facilitating cash transactions for institutional clients using its other banking partner, Signature Bank.

However, Signature Bank had disclosed in December its intentions to lower its exposure to the crypto sector by decreasing deposits from clients holding digital assets.

In a bid to further diminish its crypto exposure, Signature imposed a minimum transaction limit of $100,000 on transactions processed through the SWIFT payment system on behalf of Binance.

The market is down

Given the liquidation of Silvergate Bank, the cryptocurrency market has experienced a decline. The other factors involved in this downfall include the lawsuit against KuCoin exchange, and comments from the United States Federal Reserve chair Jerome Powell that have worried investors.

Bitcoin is giving signs of a bearish future, and the crypto Twitter community talks of a potential bottom at $12,000. Ether has also experienced a decline.

The expectation of interest rate hikes and a softening economy weighs on risk assets, and Powell’s comments regarding a possible uptick in inflation have added to investor concerns.

The recent enforcement actions against Paxos and Binance and the SEC crackdown on centralized staking have also prevented the development of sustainable bullish momentum across the market.

The uncertainty regarding crypto regulation has led to market volatility, and the liquidation of Silvergate Bank is expected to make regulators keep an even closer eye on the sector.

Banks are already implementing robust anti-money laundering measures in preparation for further crypto regulation. While the crypto market had a strong start to 2023, investors’ appetite for risk is likely to remain muted until there is more transparency regarding the roadmap for crypto industry regulation and signs that U.S. inflation has peaked.

by Iulia Vasile | Feb 28, 2023 | News

Ajay Kumar Choudhary, the executive director of the Reserve Bank of India (RBI), has revealed that the recently launched digital rupee, India’s in-house central bank digital currency (CBDC), is undergoing offline functionality testing.

Apart from evaluating its offline capability, the Reserve Bank of India (RBI) is assessing the potential of CBDCs for cross-border transactions and their integration with legacy systems of other nations.

The wholesale segment pilot was launched by the RBI on November 1, 2022, with 50,000 users and 5,000 merchants onboarded for real-world testing. As of the end of February 2023, around $134 million and 800,000 transactions have been completed via wholesale CBDCs.

In addition to offline functionality, the RBI is also exploring the CBDC’s potential for cross-border transactions and its linkage with the legacy systems of other countries. Choudhary stated that the RBI is eagerly anticipating the participation of private sectors and fintechs in CBDC, especially on offline and cross-border transactions.

Furthermore, the banks’ executive stated that the CBDC would soon become the medium of exchange. That’s why it needs all features of physical currency, including its anonymity.

The launch of CBDC is India’s motivation for improving regional financial inclusion and leading the digital economy. CBDC would also eventually replace cryptocurrencies, as per Choudhary’s statement on behalf of the RBI.

India’s CBDC for remittances

India’s national payment network, the Unified Payments Interface (UPI), has expanded its services to Singapore as of February 21, 2023.

The integration of UPI with PayNow enables citizens of both countries to transfer funds across borders with great speed.

The facility was launched by Shaktikanta Das, Governor of the Reserve Bank of India, and Ravi Menon, Managing Director of the Monetary Authority of Singapore, through token transactions using the UPI-PayNow linkage.

This integration of UPI with PayNow will allow users from India and Singapore to transfer money across borders with great speed. Users can send or receive money from India using only a UPI-id, cellphone number, or virtual payment address for money held in bank accounts or e-wallets. UPI’s instant real-time payment system allows for immediate cash transfer between the two bank accounts via a mobile interface.

Initially, four major Indian banks, namely State Bank of India, Indian Overseas Bank, Indian Bank, and ICICI Bank, will support outgoing remittances. Incoming remittances will be facilitated by Axis Bank and DBS Bank India. Users in the region will have access to the service through Singapore’s DBS Bank and Liquid Group.

ICICI Bank is one of the participants in India’s central bank digital currency (CBDC) program.

According to Sathvik Vishwanath, CEO of Indian crypto exchange Unocoin, this integration of UPI with PayNow is a valuable addition to India’s payment rails. As close to 30% of Singapore’s population consists of expatriates, and they send money to India once a month or quarter, this integration eliminates friction, reducing the processing time and costs.

While India’s digital payment infrastructure has expanded significantly over the last few years due to COVID-19, the government remains skeptical about cryptocurrencies. The government imposed a 30% tax on crypto gains, forcing major players to relocate from the country. However, the government is eager to utilize blockchain technology for its CBDC program and intends to use existing infrastructure to scale the CBDC program.

But India is in no hurry to push out CBDC

Despite joining the CBDC race a few months ago, the Indian government is in no hurry to rush its central bank digital currency (CBDC) pilot. As per a report by The Economic Times on Feb. 8, India’s digital rupee pilot, launched by the Reserve Bank of India (RBI), has attracted 50,000 users and 5,000 merchants.

At a press conference, RBI Deputy Governor Rabi Sankar announced the first public milestones of India’s digital currency and emphasized the government’s plan to proceed with CBDC testing in the smoothest way possible. Sankar stated that the RBI doesn’t want to push CBDC developments without having a full understanding of its potential impact.

Furthermore, Sankar noted that the RBI has set targets in terms of users and merchants and plans to go slowly with the CBDC testing. He stated that they want the process to happen gradually and slowly and that they are in no hurry to make something happen so quickly.

The latest announcement is in line with data from an official digital rupee application, which indicates that the pilot has reached its capacity for users. As per the data from the digital rupee app by the ICICI Bank, India’s CBDC program is full at present, suggesting that more users will be able to join the trial at a later date.

India’s CBDC development came after countries like China aggressively rolled out digital currency in April 2020. However, despite significant efforts to promote the use of CBDCs, some former central bank officials claimed that the digital yuan’s usage has been low.

by Iulia Vasile | Feb 20, 2023 | News

The CEO of Kraken, Jesse Powell, has accused U.S. regulators of enabling “bad actors” in the cryptocurrency industry to grow to an enormous size at the expense of legitimate players.

In a recent tweet, Jesse Powell, present a personal idea about the true intentions of the regulators:

Jesse Powell has claimed that regulators, including the Securities and Exchange Commission (SEC), are allowing crypto companies to operate without enforcement actions as a distraction from their real targets.

Many of the respondents agree and offer personal perspectives on why the regulators are more interested in pursuing their secret politics than in offering a safe investment environment for individuals.

Powell argues that this could lead to the destruction of the industry by allowing bad actors to dominate the market, while legitimate players are forced to compete for dwindling resources. According to Powell, regulators will simply jail violators later after the damage has already been done.

Jesse Powell, the CEO of Kraken, has claimed that U.S. regulators are favoring “bad guys” over “good guys” in the cryptocurrency industry and that the legitimate players are being treated as enemies. Powell warned that if the bad actors are allowed to run unchecked, they could potentially wipe out the legitimate players. Powell made these statements after Kraken settled with the SEC by agreeing to discontinue staking services and pay a $30 million settlement.

Many in the crypto community have criticized the SEC for its “regulation by enforcement” approach, which has also targeted celebrities endorsing tokens on social media.

In September 2022, Powell announced that he would be stepping down as CEO and transitioning to the position of chair of the board, while Kraken’s chief operating officer, Dave Ripley, would take over as CEO.

Meanwhile, Paxos is also reportedly facing SEC enforcement action for alleged violations of investor protection laws related to the Binance BUSD stablecoin.

SEC vs Kraken’s crypto staking option

Following the settlement with Kraken, Gary Gensler, the Chair of the United States Securities and Exchange Commission (SEC), has issued a warning to other cryptocurrency companies to comply with the law.

Gensler emphasized that crypto exchanges must register with the SEC to operate within the regulations of the U.S. He claimed that many companies in the industry are deliberately avoiding registration. Gensler pointed out that the business models of many crypto projects are full of conflicts and urged them to separate bundled products. Gensler stressed the need for time-tested rules and laws to protect investors and prevent companies from misusing their customers’ funds. He warned companies against having their “hand in the customer’s pocket.”

Gensler made this statement in response to the SEC’s settlement with Kraken, where the exchange agreed to cease staking services and programs for its U.S. customers and pay a $30 million settlement.

Kraken announced that it would still offer staking services to non-U.S. users through a subsidiary.

The SEC’s actions have been met with criticism from many in the industry, who argue that firms are being punished for operating in a regulatory environment with unclear guidelines.

SEC Commissioner Hester Peirce has criticized the regulator’s actions, calling them “lazy and paternalistic,” and pointing out that the staking program had been beneficial to its users.

by Iulia Vasile | Feb 13, 2023 | Cryptocurrency, News

The recent SEC lawsuit against Paxos over Binance USD (BUSD) has caused confusion and debate among the cryptocurrency community.

The U.S. Securities and Exchange Commission (SEC) issued a wells notice to Paxos. They claim that BUSD is an unregistered security, which resulted in the New York Department of Financial Services (NYDFS) ordering the halt of BUSD issuance.

This has led to a range of reactions from the crypto community, with some members dismissing it as fear, uncertainty, and doubt (FUD), while others view it as an attack on the Binance exchange.

The community is split on their thoughts about the situation, with some saying that those who bought the stablecoin were not expecting it to increase in value.

The crypto community on Twitter started to talk about this controversy, but they seem to agree that nobody would buy a stablecoin and anticipate a profit. Others expressed confusion about the development, questioning how BUSD can be considered a security and asking their followers if they expected its value to reach $2.

Some even took it more personally, attacking SEC chairperson Gary Gensler, suggesting that he is on an “unhinged, unchecked crusade against crypto.”

However, some dismissed the news as FUD and pointed out that BUSD is fully backed and the halt in issuance by Paxos will not affect existing tokens. They encouraged everyone to stay informed but advised against making emotional decisions. A few voices have also pointed out the urgent need for a stablecoin registry framework.

Bitcoin analyst Tedtalksmacro also expressed similar thoughts, suggesting that BUSD may not meet the criteria of a security. The analyst hinted that the situation might just be a way to target Binance.

It’s important to understand that despite stablecoins being designed to have a fixed value, their holders can still generate profits through methods such as arbitrage, hedging, and staking.

What is BUSD?

BUSD is a stablecoin co-founded by Paxos and Binance. Paxos leverages blockchain technology to provide its Stablecoin as a Service product to other companies.

The company has also previously developed a stablecoin backed by gold, known as PAX Gold (PAXG). Both BUSD and PAXG tokens fall under the jurisdiction of the New York State Department of Financial Services.

BUSD is a fiat-backed stablecoin, pegged to the U.S. dollar. Paxos holds an equivalent amount of U.S. dollars in FDIC-insured banks or backed by U.S. Treasuries, serving as the reserves for the total supply of BUSD.

The price of BUSD adjusts in equal amounts to the changes in the value of the U.S. dollar.

Binance’s CEO still supports BUSD

Binance CEO Changpeng Zhao, also known as “CZ,” announced that the exchange would continue to support Binance USD (BUSD), despite the announcement made by the SEC that argues that BUSD is an unregistered security.

Changpeng Zhao (CZ), CEO of Binance, has reassured users that their funds are secure despite regulatory enforcement.

However, he stressed the fact that Paxos, regulated by NYDFS, fully owns and manages BUSD.

Paxos will continue to manage BUSD, including redemptions, and its reserves have been audited by multiple parties, according to Zhao. He acknowledged that the enforcement action might cause a decrease in BUSD’s market cap over time. But Binance will consider alternative non-USD-based stablecoins.

Despite this, Binance will remain supportive of BUSD on the exchange, though it acknowledges that some users may switch to other stablecoin tokens due to the enforcement.

CZ also explained that Paxos, the issuer of the Binance USD (BUSD) stablecoin, is regulated by the New York State Department of Financial Services. He has made assurances of its reserves, which have been audited by multiple parties.

Zhao also acknowledged that the actions taken by the SEC and NYDFS could have a significant impact on the future development of the cryptocurrency ecosystem. He warned of the potential implications if BUSD is ruled as a security by the courts.

Given the regulatory uncertainty in certain markets, Binance may also review other projects to ensure the safety of its users. This comes after a number of cryptocurrency service providers, and tokens have faced enforcement actions by American regulators, including Ripple’s ongoing legal battle with the SEC over XRP being an unregistered security. Kraken also ceased its staking services to U.S. clients and paid a $30 million settlement to the SEC for failing to register its crypto asset staking program.