Binance and other big centralized exchanges plan to use the Proof of Reserves as an auditing technique to reassure their customers of the safety of their funds.

As trust in its accounting of billions in assets disappeared, crypto exchange FTX went bankrupt at the beginning of November 2022.

Some critics have slammed the existence of centralized exchanges, such as FTX. Its CEO, Sam Bankman-Fried, posted many messages on Twitter trying to convince his customers that he had made a terrible but honest mistake that he would try to repair. However, CEX customers are now all wondering just how safe their assets are on any of these exchanges. And the truth is that without total transparency from the exchanges, the FTX collapse could happen again at any given time.

The controversy has brought back the debate about a possible solution. It is called proof of reserves, or PoR. This method shows, without any doubt or ambiguity, how many tokens are on each exchange that uses the technique. Proof of reserves, if in place at FTX, could have, in theory, stopped customers’ money from being moved to places it shouldn’t. In this case, the assets wouldn’t have moved to Bankman-Fried trading firm Alameda Research.

Binance, the largest cryptocurrency exchange in the world by volume, has shared its wallet accounts and said it would conduct a proof of reserves snapshot within the next few weeks. Other CEXs that made similar statements include Gate.io, KuCoin, Poloniex, Bitget, Huobi, OKX, Deribit and Bybit.

What is proof of reserves?

Proof of reserves is an audit technique that confirms assets in custody. It is used by stablecoin issuers Paxos to show they have enough assets backing their tokens. Exchanges like BitMEX use the technique to prove that customer deposits correspond with assets in custody.

Sergey Nazarov, the co-founder of Chainlinks Labs, stated that the use of this auditing solution could have made it possible to avoid all of this: “It would have been quite a solvable problem if there had been more transparency in the balance sheet.” Chainlink offers the proof of reserves (PoR) auditing mechanism as a product. Their PoR solution already powers multiple stablecoins and gold coins.

How does proof of reserves work?

An entity can prove its assets reserves in a variety of ways. These include traditional third-party audits that are performed by companies such as Armanino, to Merkle tree proofs (cryptographic verification using data structures called Merkle branches).

There are also methods that blockchain analytics companies employ. Chainlink is an example of a company that separates proof-of-reserve implementation into two categories: on-chain and off-chain.

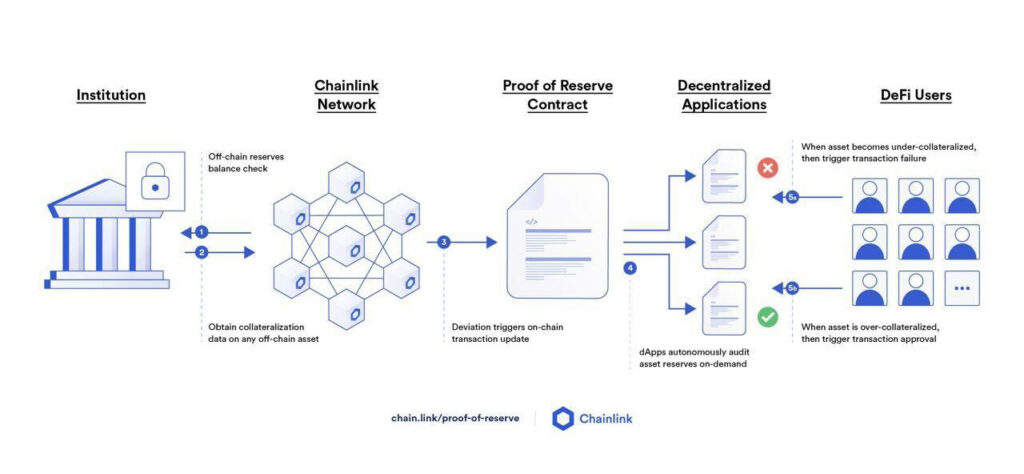

An off-chain alternative is a third-party provider, such as Chainlink, that receives API access (application programming interface) from an exchange. This allows the auditor or custodian to verify the exchange’s holdings.

Off-chain proof of reserves (Chainlink)

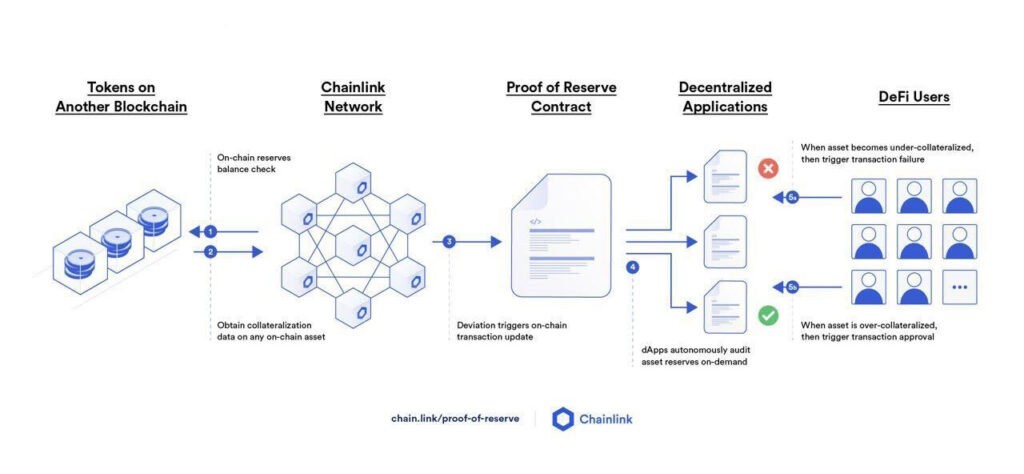

On-chain routing is a proof of-reserves smart contract on one network (usually Ethereum). It receives data feeds from Chainlink’s Oracle network (on a block-by-block basis) about a provider’s on-chain wallet balances in another network (e.g., Bitcoin). This empowers users and allows them to check whether the company or the exchange actually has the assets they claim to have.

On-chain proof of reserves (Chainlink)

Should proof of reserves be used?

Investment brokers that offer services to retail customers are already producing regular reports to show the client’s assets and liabilities. But this is done because of the harsher regulations that are already in place for them. For the most part, cryptocurrency exchanges remain unregulated financial services, and customers have nobody to lean on when it comes to a lack of liquidity or bankruptcy.

A first step may be self-regulating services that may regain the trust of customers. Authorities might also be willing to adapt their regulations to the crypto industry when existing exchanges collaborate.

Over the last few years, many exchanges have collapsed, causing crypto investors to lose a lot of money. While many never got their funds back, this also caused existing services to practice much better security and transparency.