What is Etherium Classic?

According to the Etherium Classic website:

Ethereum Classic (ETC) is a smarter blockchain, it is a network, a community, and a cryptocurrency that takes digital assets further. In addition to allowing people to send value to each other, ETC allows for complex contracts that operate autonomously and cannot be modified or censored.

Ethereum Classic facilitates smart contracts by providing the advantage of decentralized governance. There’s not any necessity or chance of any outside disturbance, tracking, manipulation, or censoring the functioning of these programs.

Ethereum Classic appeared as a fork version of the Ethereum‘s Blockchain. The fork happened following a hack Ethereum in June 2016, which resulted in a $50 million worth of capital stolen.

How was Etherium Classic born?

The conflict involving Ethereum and Ethereum Classic is both a moral and ethical one. Before we begin explaining the simple difference between both let us dig a little into the background.

The Formation of The DAO

The entire ecosystem of Ethereum works on the basis of smart contracts.

Smart contracts are essentially the way that things get done on the Ethereum eco-system.

The DAO (Decentralized Autonomous Organization) was an intricate smart contract that was going to reevaluate Ethereum forever. It was essentially going to become a decentralized venture capital fund that was going to finance all future DAPPS produced in the eco-system.

In the event that you wished to have any say in the management DAPPS that could get financed, then you may need to purchase “DAO Tokens” in exchange for Ether. The DAO tokens were an indication that you’re now formally a part of this DAO system.

How were DAPPS likely to be established and a method y which they would be approved? Primarily they will need to be whitelisted by curators, who’ve essentially known figureheads from the Ethereum world. If the proposal receives a 20% acceptance from the vote, then they are going to find the funds to start.

The possibility of DAO and its versatility, the control and total transparency which it provided was unprecedented; folks jumped into receiving their share of this pie. Within 28 days of its creation, it gathered around $150 million worth of ether at a crowdsale. At that moment, it had 14% of ether tokens issued thus far.

That is all great but how can one get out from this DAO? Imagine if some DAPP becomes accepted that you’re not a massive fan of, just how can you get out of this DAO then?

With this function, you’d return the ether you’ve spent and, in the event that you so wanted, you might even make your personal “Child DAO.” In reality, you can split off with numerous DAO token holders and make your Child DAO and begin accepting proposals.

But, if you decided to get out of the Dau, you would have to keep your Ether for 28days before you could use them. This was the condition of the contract. But there was just one small issue. A good deal of folks saw this potential loophole and pointed out it. The DAO founders promised this wasn’t likely to be a matter. The only issue is that it has been, which generated the whole storm which divides Ethereum to Ethereum and Ethereum Classic.

The DAO Attack

On 17th June 2016, a person exploited this loophole from the DAO and derailed 30% of the DAO’s funds. That is roughly $50 million bucks. The loophole the hacker(s) found was fairly straightforward.

If you wanted to get out of the DAO, then you could do this by sending a petition. The dividing function will then follow the next two steps:

- Give the user back his/her Ether in exchange for their DAO tokens.

- Register the transaction in the ledger and update the internal token balance.

What the hacker did was that they left a recursive function from the petition, so this is how the dividing purpose went:

- Take the DAO tokens from the user and give them the Ether requested.

- Before they could register the transaction, the recursive function made the code go back and transfer even more Ether for the same DAO tokens.

This went on until $50 million value of Ether were removed and stored at a Child DAO as you’d expect, pandemonium went throughout the total Ethereum community.

Note: The hack occurred due to an issue from the DAO not due to any problems from the Ethereum itself. Ethereum runs in the background whereas DAO runs onto it.

As Gavin Wood, the co-founder of Ethereum puts it, blaming Ethereum for the DAO hack is like saying “The Internet is broken” every time a website goes down.

The aftermath of the DAO Attack

While Ethereum is in no form or shape to blame for what occurred with the DAO, the episode shattered the people’s beliefs in cryptocurrency.

Though the hacker did eliminate $50 million in value on Ether, it was sitting at the child DAO, and he could not yet access them since the DAO intelligent contract specifically said that any of those spent ether taken from the DAO would not be available for 28 days. With this in mind that the Ethereum team and community chose to do it and three possible answers were pointed out:

- Nobody Does Anything.

- Soft Fork.

- Hard Fork.

Nobody Does Anything

Some people contended that making any modifications will go contrary to the nature and underlying doctrine of Ethereum itself.

Many people were not pleased with this, but so the bulk voted to go with a soft Fork.

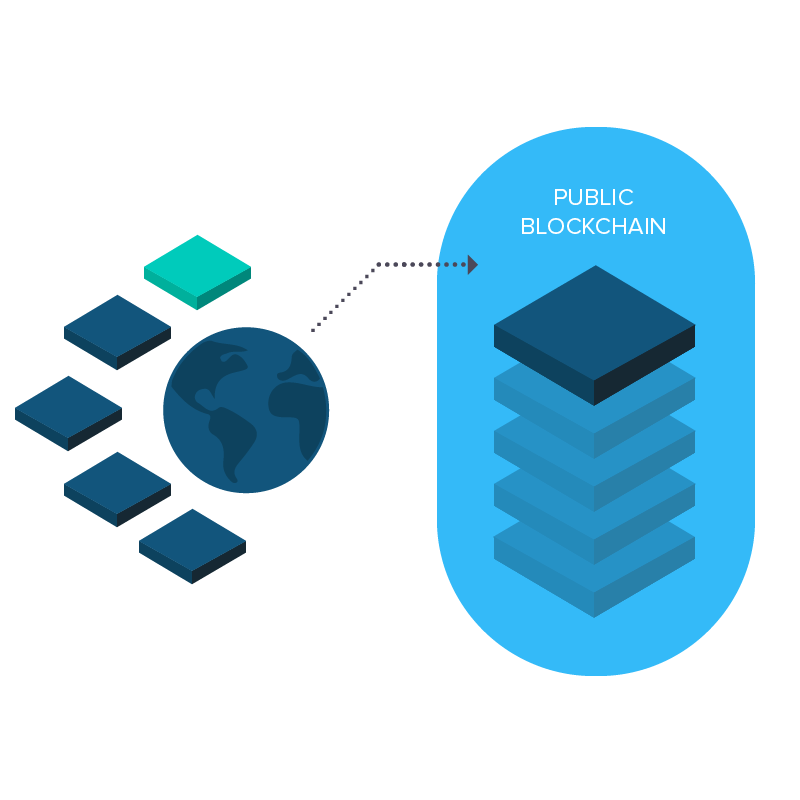

What’s a Soft Fork?

Each time a string has to be upgraded there are two means of doing this: a gentle fork or a tough fork. Think of fork as an upgrade in the program that’s backwards compatible.

What exactly does that mean? Suppose you’re in charge of MS Excel 2005 in your notebook and you wish to start a spreadsheet constructed in MS Excel 2015, you’re still able to open it as MS Excel 2015 is backwards compatible.

Image credit: Vitalik Buterin

BUT, having said that there’s a difference. Each of the upgrades which you could enjoy from the more recent version will not be visible to you in the old version. Going back into our MS Excel analogy, assume there’s a feature that allows installing GIFs from the dictionary from the 2015 variant, you will not find those GIFs from the 2005 version. So essentially, you will observe all of the text but will not find the GIF.

That’s what Ethereum intended to perform with their blockchain, a soft fork wherein it is your choice whether you would like to update or maybe not, but no matter the updated users as well as also the non-updated users might still interact with one another. The thought was to lock the ether which was stolen from the hacker by dismissing and segregating any cubes which have a transaction that will assist the hacker move round their stolen ether.

This looked like a fantastic strategy and vast majority of those Ethereum community had been on board, but a problem surfaced, a difficulty that brought the whole community into a different dilemma. Implementing a soft fork would result in a “Denial Of Service” (DoS) attack vector.

Understanding The Soft Fork DoS.

Any and all mining activities are rewarded by “Gas” in the Ethereum ecosystem. That’s the primary way by which miners are protected from DoS attacks.

Suppose someone makes the decision to flood the Ethereum network with transactions which require difficult computations. The miners could sit down and apply those computations in addition to though they do not finish them they will locate a gas score that’s equivalent to numerous computations they’ve done. So longer intensive and challenging the computation, the additional gasoline they collect, and at the specific same period, the Attacker may want to devote a great deal of the money to make these strikes.

But what occurs is the moment this fork becomes implemented the attacker will stumble upon a run throughout this specific system. The attacker can flood the neighbourhood with transactions that interact with the DAO and make the miners do boundless complex computations for little to no gasoline price and at no monetary cost to the attacker.

This meant there was only 1 way for the Ethereum community, and it was the “Hard Fork.”

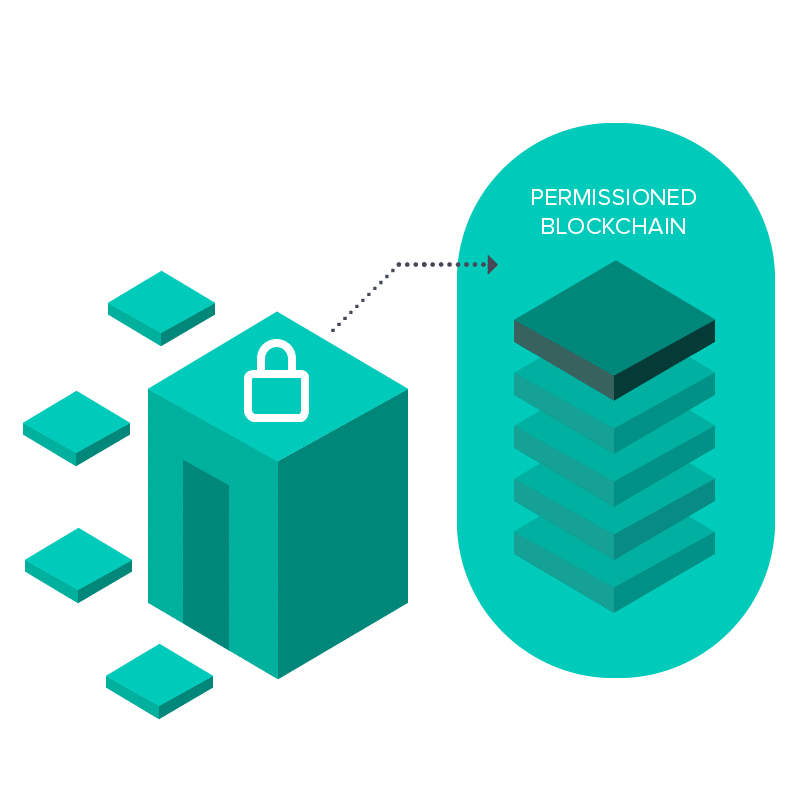

What Is A Hard Fork?

The primary difference between a soft fork and a hard fork is that it is not backwards compatible. Once it is utilized, there is absolutely no going back whatsoever.

If You Don’t update to the new blockchain, then You Don’t get access to all of the newest upgrades or interact with consumers of this new system whatsoever.

How the hard fork in Ethereum is likely to function? It’s a branch which separates from the primary block series at a specific stage (in this instance before the DAO assault ). Up till that point (block 1,920,000) the older series and also the new chain is exactly the same, but immediately following the hard fork, the 2 chains become very different entities.

This tricky fork was mostly made to repay all of the money that’s been taken from everybody by the DAO via a refund contract that had the sole purpose of “withdraw”. This suggestion caused a massive controversy in the area, and also there was a separation. The ones who had been “Anti-Hard Fork” refused to switch to the brand new blockchain and opted to stay at the older blockchain naming it “Ethereum Classic” or “ETC”.

And that is where we arrive at the battle that’s raging on in the Ethereum community because we talk, the struggle between ETC and ETH.

This conflict is intriguing since it is an ethical and ideological one. This is the moment that Gavin Wood, the co-founder of all Ethereum, has predicted “the single most important moment in cryptocurrency history since the birth of Bitcoin.”

What is Ethereum Classic? Ethereum vs Ethereum Classic

People who were opposed to the hard fork decided to stick with the original chain calling it “Ethereum Classic.” As of writing Ethereum Classic stands at $8.96 per coin (according to CoinMaketCap).

Why did people stick with an old chain when all the Ethereum heavy hitters, including founders Vitalik Buterin and Gavin Wood, moved onto the new chain?

The reply to this is a philosophical one. After Ethereum, and cryptocurrency, generally, premiered, it had been assumed to become a stance against corruption. The main reason the blockchain was created immutable was that they needed the machine to be resilient from individual whims.

This is the reason why, to numerous ETC sympathizers, the hard fork is also a handy cop-out, if you’re changing the whole series by a single hack then completely defeats the purpose of Ethereum at the first location. You’re demonstrating the blockchain may be impacted by individual whims.

And this has resonated with a lot of “crypto-idealists.” Some pretty big hitters like Barry Silbert, the CEO of Grayscale, have gotten behind ETC.

Today, all that seems good and well, however, there are a number of issues using Ethereum Classic which only can’t be ignored.

The Problems with Ethereum Classic

The main problem with the ETC is the lack of backward compatibility with the Ethereum Hard Fork. All the heavyweights of the Ethereum community have moved on to the new chain, which means that anyone who is part of the ETC won’t be able to access any of the updates done by the ETH.

The perfect example is ETH’s move from Proof Of Work (PoW) To Proof of Stake (PoS). ETC won’t be able to implement that because their software simply doesn’t allow the use of updates.

But more that’s not the end of it; there are far more nefarious problems with ETC some of which borders on conspiracy. Many consider ETC to be an attack against Ethereum itself. What does that mean?

Post hard fork when the community was split and vulnerable, many say that the anti-Ethereum camp openly supported ETC, just to cause disruption in the community. Even more, prominent bloggers like David Seaman have reported that:

Classic is an insecure orphan chain being promoted in a way that would be illegal if Ethereum were a publicly traded company, which it could eventually be.

Ethereum Hard Fork (ETH)

ETH is the result of the hard fork and what is now considered the “new Ethereum.” As of writing, ETH stands at $197.42 (according to CoinMarketCap).

The market cap for ETH currently stands at a staggering $20 billion and is currently the 2nd most expensive cryptocurrency in the world behind bitcoin.

ETH is the new form of Ethereum. The original heavy hitters are all part of the system, and ETH also happens to be the one going through the most revolutionary changes (like the aforementioned switch from POW to POS).

ETH was formed for one reason and one reason alone – to return the funds stolen by “the DAO attacker” back to the rightful owners.

ETH represents so much more than what it appears to be on the surface; it represents a victory for the Ethereum community. They came together after facing the worst hack in cryptocurrency history, stuck together and made something that is stronger than its predecessor.

But having said that, as we have mentioned before, there is one problem with ETH, and according to Pro-ETC fans, it is an ideological one.

Problems with ETH

The formation of ETH goes against the idea of the immutability of the blockchain and the philosophy of “code being law.” In the eyes of anti-ETH folks, the hard fork was a cop out from Ethereum, and they should have accepted the main blockchain for what it was.

Another issue that was raised was how was anyone going to know for sure that no more hard forks were going to take place in the future subject to human whims? What if there are multiple hard forks creating different versions of Ethereum? What if there are hundreds of different versions of Ethereum running at the same time? Won’t that greatly devalue it and cryptocurrency in general? (Even though a majority vote of the Ethereum community would be required to make such monumental changes).

PROs and CONs of both Ethereum Classic & Ethereum

Ethereum Classic

Pros

- Stays true with the philosophy of the immutability of the blockchain.

- Has recently got the backing of a few big players

Cons

- Doesn’t get access to all the new updates made in the ETH chain (e.g. The move from POW to POS).

- All the heavyweights of the Ethereum have moved on to ETH.

- Considered an insult and an attack on the Ethereum community.

- Is know to be full of scammers.

Ethereum

Pros

- Is growing at an exponential pace.

- Has the majority of the original founders who have created Ethereum in its corner.

- Has reversed the DAO hack and given back the stolen money to its rightful owners (the DAO token holders).

- Is being constantly updated with the latest changes.

- Has a higher hash-rate than ETC.

- A powerful example of what the Ethereum community is capable of when it comes together to solve a problem.

- ETH is backed by a powerful group of over 200 corporations called the Enterprise Ethereum Alliance (EEA) which aims to use the blockchain technology to run smart contracts at Fortune 500 companies. Members include: Microsoft, JP Morgan, Toyota, ING, etc.

Cons

- Goes against the policy of immutability.

Conclusions on Ethereum vs Ethereum Classic

Ethereum has made a spectacular comeback from an absolute disaster, and it looks like it’s going to fulfil all the expectations that people had had in it when it started. More than anything, the true power of Ethereum lies in its full scope. It is not just a currency; it is a platform on which people can build projects which will dictate the future. If decentralization is indeed the future, then Ethereum is going to be in the front and centre of it.

Now, this begs the question: What does this mean for ETH and ETC? ETH has all the lead developers on its side and is going to grow from strength to strength. Now with the backing of the EEA, it is only going to get better. The value of any currency comes from the trust that people has on it, and because of all these factors, the trust in ETH is only going to grow. A lot of experts are predicting that ETH will be the first cryptocurrency since Bitcoin to break the $1000 barrier.

For ETC, unfortunately, the same can’t be said. In the eyes of the people, ETC is always going to be black sheep of the Ethereum family. As of right now, ETH is nearly 15 times more valuable than ETC, and it really isn’t going to get any better.