by Iulia Vasile | Dec 7, 2023 | News

In a landmark development for Europe’s financial landscape, France’s third-largest bank, Société Générale, has made a bold entry into the digital currency domain.

A French bank is launching its euro-pegged stablecoin

The bank has unveiled its native euro-pegged stablecoin, named EUR CoinVertible (EURCV), marking a significant stride in the European banking sector’s adaptation to the evolving world of cryptocurrency.

This groundbreaking stablecoin, set to debut on the Luxembourg-based Bitstamp crypto exchange as reported by the Financial Times, is fully backed by the euro.

This move allows Société Générale’s customers to seamlessly engage with the digital asset market, opening up new avenues for trading and investment.

Jean-Marc Stenger, CEO of Société Générale Forge, has emphasized the EURCV’s pivotal role in the bank’s ongoing journey within the crypto sphere, highlighting its potential utility in settling trades involving digital bonds, funds, and various assets.

The EURCV extends beyond the confines of Société Générale, promising widespread applicability across different financial service providers.

Société Générale is also launching a crypto bond

In a parallel yet equally innovative venture, Société Générale has issued its first digital green bond as a security token on the Ethereum public blockchain.

This bond, valued at 10 million euros, carries a three-year maturity and is earmarked for financing environmentally sustainable activities. The bank stated, “This enables issuers and investors to measure the carbon emissions of their securities on the financial infrastructure.”

The bond’s digital infrastructure offers around-the-clock access to data on its carbon footprint through a smart contract, pioneering transparency in green financing.

The first licenced crypto provider in France

Société Générale’s subsidiary, Forge, has recently earned the distinction of becoming the first fully licensed crypto service provider in France.

Forge, a part of Société Générale, which is France’s third-largest bank, has become the first company in the country to get the top license for offering cryptocurrency services. This license, known as PSAN, allows Forge to hold digital assets for customers, buy and sell them for real money, and trade them against other digital assets.

On July 19, 2023, the French stock market regulator, the Autorité des Marchés Financiers (AMF), added this information to their register. According to Société Générale, this license is the highest regulatory approval possible for handling digital asset transactions.

Already, about 90 companies are licensed by the AMF.

For example, Crédit Agricole, a major rival of Société Générale, got permission for holding digital assets in June 2023.

But Forge is the first to receive this top-level approval for many different services. Business FM, a French radio station, pointed out that these tough requirements for the license favour big, established banks over smaller crypto companies.

This accreditation by the French stock market regulator, the Autorité des Marchés Financiers (AMF), signifies a high level of regulatory endorsement for digital asset transactions, setting a precedent in the French financial sector.

Société Générale has been very active in the crypto world.

It has issued euro bonds on the Ethereum blockchain, created security tokens on the Tezos blockchain, and offered Dai stablecoin loans for bond tokens.

In April 2023, Forge introduced EUR CoinVertible, a stablecoin tied to the euro, for big, institutional clients. This new digital asset is available only to investors who have gone through Societe Generale’s standard customer verification and anti-money laundering checks.

As Europe gears up for the Markets in Crypto-Assets Regulation in 2024, Société Générale’s ventures into the euro-pegged stablecoin market and the issuance of a green bond on Ethereum signify major milestones.

While France is generally open to crypto, the French branch of Binance, a global crypto company, is currently under investigation by the French finance investigation service, directed by a specialized court in Paris.

by Iulia Vasile | Nov 6, 2023 | News

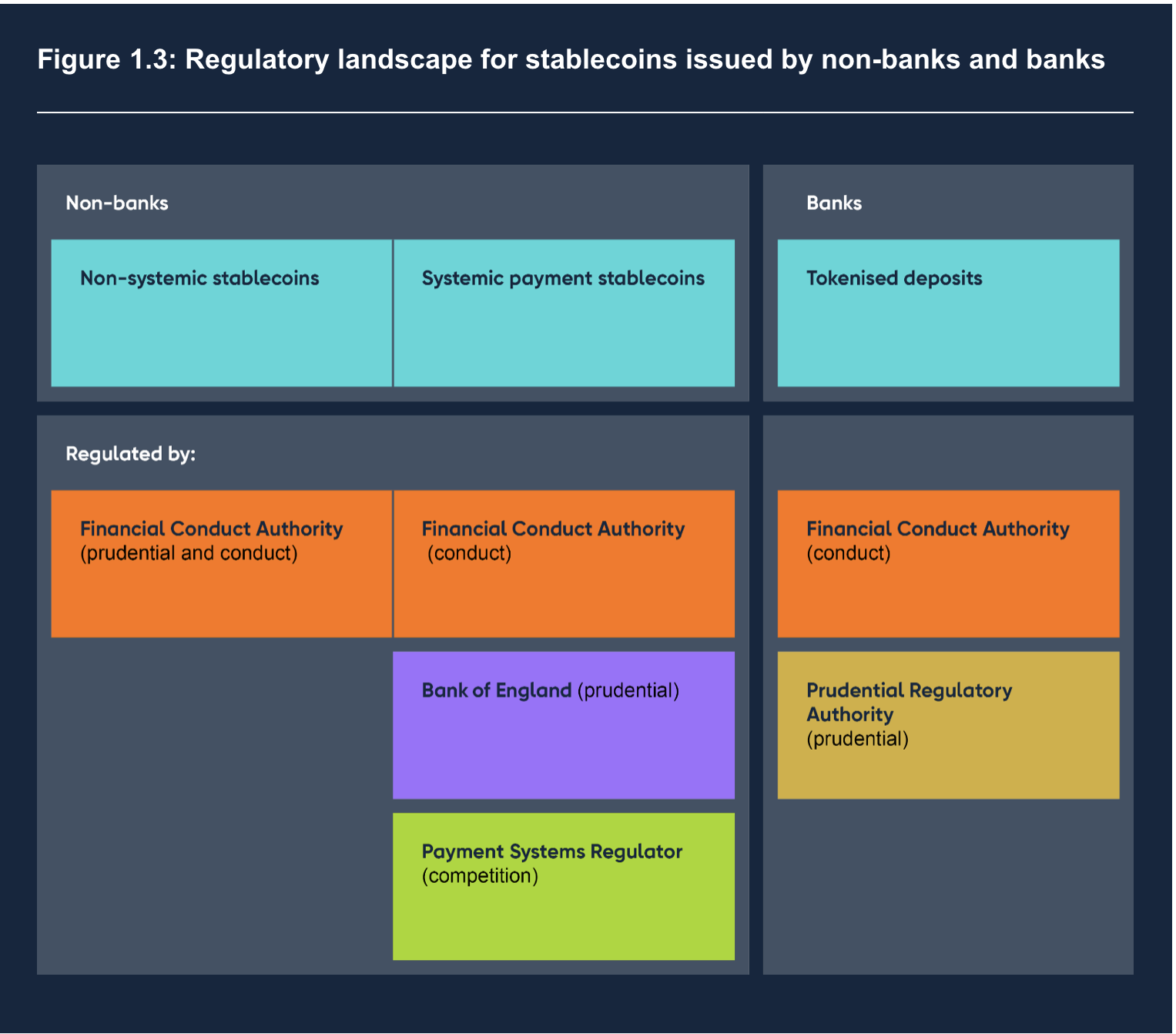

While the new regulatory framework for UK stablecoins is slated for a 2025 rollout, recent papers from the Financial Conduct Authority and the Bank of England provide an early look into the future landscape of digital currency regulation, revealing the direction and thought process of the UK’s financial watchdogs.

The UK is serious about launching a stablecoin. On November 6th, a collection of important papers was shared with the public about new rules for stablecoins, which are cryptocurrencies designed to have a stable value.

The Financial Conduct Authority (FCA), which looks after the fairness of financial markets, and the Bank of England (BOE), the UK’s central bank, both presented their ideas on the subject. Also, the BOE’s Prudential Regulatory Authority (PRA), which supervises banks, sent out a special note to the heads of banks. Moreover, the BOE created a plan to connect all these different pieces.

Before these papers came out, the UK Treasury gave us a sneak peek on October 30th of what to expect regarding new stablecoin rules. The FCA then went into much more detail, sharing their thoughts on how stablecoins could be used in day-to-day shopping and in big financial dealings, what kind of checks and balances might be needed, and how the coins and the assets backing them should be managed separately to avoid conflicts of interest.

According to the FCA, getting the regulation of stablecoins right is a critical first step towards creating a broader set of rules for all sorts of digital currencies.

The document focused on how to ensure that the same level of risk would lead to the same regulatory treatment. It suggested taking the current rules for looking after clients’ assets as a starting point for new guidelines on how people can get their money back from stablecoins and how those coins should be safely kept.

It also referred to an existing manual for senior managers on how to set up their company’s systems and controls properly. The paper mentioned that there are already rules in place for keeping financial operations running smoothly and for preventing financial crimes, among other things.

The Financial Conduct Authority (FCA) is thinking about adjusting the current financial rules for those who issue stablecoins and look after them, with the aim of applying these adjusted rules to other types of cryptocurrencies in the future.

The Bank of England (BOE) considered how stablecoins, which are tied to the value of the pound and aimed at everyday use, could be integrated into major payment systems. It looked at how stablecoins should be transferred, what the providers of digital wallets and related services should do, and how this connects with the FCA’s ideas about issuing stablecoins and protecting deposits.

While the BOE expects to lean on the FCA to oversee those who keep stablecoins safe, it hasn’t ruled out setting some of its own rules if needed. It highlighted the challenges in regulating wallets that don’t rely on a third party and transactions that take place outside of the blockchain, especially when it comes to preventing money laundering and ensuring that businesses know their customers.

Source: Bank of England

Source: Bank of England

The letter from the Bank of England’s Prudential Regulatory Authority (PRA) made it clear that banks need to distinguish between “e-money or regulated stablecoins” and traditional deposits. They pointed out that as various new digital currencies and currency-like options become available, it’s easy for everyday customers to get mixed up if banks were to market e-money or stablecoins the same way they do with regular bank deposits.

The PRA suggested that banks should focus their creative efforts on traditional deposits and keep any activities related to issuing digital currencies or stablecoins separate, including using different branding. If a company that issues these digital assets wants to also accept deposits in the traditional sense, they should act swiftly and keep the PRA in the loop from the start. The letter also reminded these institutions that any new developments in the area of deposit-taking are still governed by existing rules and regulations.

Source: Bank of England Prudential Regulatory Authority

Source: Bank of England Prudential Regulatory Authority

The plan set out by the Bank of England includes a schedule that aims to have the new system up and running by the year 2025.

by Iulia Vasile | Aug 11, 2023 | News

After PayPal’s recent introduction of PYUSD, the market examines the prospective use cases and benefits of this new stablecoin, especially within the U.S., highlighting its potential utility within the existing financial framework.

PayPal, a leading global payments company, is making its debut in the crypto realm with a U.S. dollar-backed stablecoin named PayPal USD (PYUSD). The announcement came on August 7, 2023.

What is PYUSD?

According to PayPal’s official statement, this new crypto called PYUSD is 100% backed by USD:

“PayPal USD is designed to contribute to the opportunity stablecoins offer for payments and is 100% backed by U.S. dollar deposits, short-term U.S. Treasuries, and similar cash equivalents. PayPal USD is redeemable 1:1 for U.S. dollars and is issued by Paxos Trust Company. “

The PYUSD stablecoin, built on the Ethereum platform, will soon roll out to American PayPal customers.

This is the first instance of a premier financial service launching its own stablecoin.

With PYUSD, users have the option to transfer between PayPal and approved external crypto wallets, employ the coin for various transactions, or exchange it with other cryptocurrencies supported on PayPal, like bitcoin (BTC) and ether (ETH).

PayPal emphasized that their stablecoin is poised for adoption by an expansive and evolving network of external developers, digital wallets, and web3 platforms and is also primed for easy integration by crypto trading platforms.

Paxos Trust, a crypto financial services firm located in New York, will oversee the issuance of PYUSD.

The coin is underpinned by U.S. dollar reserves, short-term government securities, and other cash-like assets. Moreover, users can redeem it for U.S. dollars or trade it for other digital currencies available on PayPal’s platform.

At the time of the launch, PayPal’s CEO Dan Schulman remarked, “Our commitment to responsible innovation and compliance, and our track record delivering new experiences to our customers, provides the foundation necessary to contribute to the growth of digital payments through PayPal USD.”

It is expected that PYUSD to be available later on the Venmo app as well.

How will the PYUSD be monitored?

PayPal’s PYUSD stablecoin reserves will be monitored and verified through a multi-step process to ensure transparency and trustworthiness:

Monthly Reserve Report

Starting from September 2023, Paxos, the firm in charge of issuing PYUSD, will release a public monthly Reserve Report for PayPal USD. This report will detail the specific assets that make up the reserves backing the stablecoin.

Third-party Attestation

In addition to the monthly report, Paxos will also release a public third-party attestation on the value of the PayPal USD reserve assets. This is to double-check and confirm the validity of the reserves.

Independent Accounting Firm

The attestation process will be carried out by an external, independent accounting firm. This ensures that there’s no conflict of interest and that the process is free from potential biases.

Adherence to Established Standards

The attestation will comply with standards set by the American Institute of Certified Public Accountants (AICPA). This means the audit will follow rigorous professional guidelines, ensuring the accuracy and reliability of the information.

PYUSD is a stable issued by a regulated company

PYUSD, launched by fintech leader PayPal, is distinct from other stablecoins due to its robust regulatory framework. PayPal’s PYUSD stands out in the stablecoin landscape due to its unique position of being backed by a trust company that is stringently regulated by the NYDFS.

This sets it apart from major stablecoins like USDT and USDC.

Here’s how PYUSD is regulated:

Issued by a regulated entity

Paxos Trust, the company behind the issuance of PYUSD, operates as a trust company. This status subjects them to direct oversight by a regulatory authority.

Regulatory oversight by NYDFS

Paxos is regulated by the New York Department of Financial Services (NYDFS). This means that the entire process of issuing PYUSD, including the management of its reserves, is under the constant supervision of NYDFS.

Protection by regulator

Walter Hessert, the head of strategy at Paxos Trust, highlighted the importance of having a prudential regulator. With such oversight, every activity linked to PYUSD’s issuance is monitored. For token holders, regardless of their location worldwide, this ensures that they benefit from the protection and guidelines established by New York’s regulatory framework.

Bankruptcy safeguard

One of the significant rules established by the NYDFS concerning PYUSD is the protection against bankruptcy risk. Should Paxos face bankruptcy, the assets of PYUSD token holders are safeguarded. The NYDFS would intervene, ensuring that PYUSD is excluded from the bankruptcy process. Consequently, token holders would not become involuntary creditors during a bankruptcy, and their funds would be promptly returned.

Clear differentiation from other stablecoins

Both USDT (issued by Tether) and USDC (jointly issued by Circle and Coinbase) dominate the stablecoin market. However, as Hessert pointed out, both these coins are unregulated, albeit transparent in their operations. In contrast, PYUSD’s regulatory structure offers an additional layer of security and trust for its users.

Why did PayPal decide to issue a stablecoin?

PayPal’s decision to issue the PYUSD stablecoin is emblematic of its substantial influence and strategic positioning in the financial sector.

While there’s undeniable regulatory uncertainty surrounding cryptocurrencies in the U.S., PayPal’s stature enables it to not only navigate but also potentially influence these regulatory decisions.

Companies like Coinbase and Circle may have paved the way in the crypto regulation space, but major entities like PayPal are sending a clear message: they can effectively handle and even counteract regulatory pressures.

At its core, PayPal’s move is driven by the prospect of profitability. The issuance of PYUSD isn’t a minor endeavor, requiring collaboration across several of PayPal’s departments, from compliance to communications.

However, this decision wasn’t born out of altruism. Instead, it’s a calculated business move, made in response to a rapidly evolving digital financial landscape, reinforcing PayPal’s dominant position and highlighting its confidence in seizing new lucrative opportunities.

What’s the use case for PYUSD?

The use case for PYUSD appears to be in its infancy, and its exact utility for the average consumer remains somewhat ambiguous.

Introduced via Venmo, PYUSD essentially provides another avenue for banked Americans to transact using a digital representation of the U.S. dollar, aligning with how most PayPal products have functioned since the company’s inception.

However, one distinct feature is that PYUSD can potentially be sent outside of PayPal’s proprietary ecosystem using the Ethereum network.

This capability hints at a use case where individuals barred from Venmo or PayPal could potentially transfer their funds via an Ethereum-based PYUSD withdrawal.

Yet, this use case might be limited, given the centralized nature of the stablecoin.

In essence, while the stablecoin could offer a mechanism to navigate around restrictive banking scenarios, its primary use cases might lean more towards backend financial operations that institutions can leverage, rather than direct consumer applications.