The rehabilitation trustee of Mt. Gox has announced that repayments in Bitcoin and Bitcoin Cash will commence in July 2024. Creditors have been waiting for over a decade to recover their funds.

The long-awaited repayment process will start in July 2024 for the creditors of the now-defunct Mt. Gox cryptocurrency exchange, which lost 850,000 Bitcoin in 2014.

Mt. Gox, once a pioneering cryptocurrency exchange, handled over 70% of global blockchain trades. In 2014, the platform abruptly went offline following a security breach that led to the loss of more than 850,000 BTC, valued at over $51.9 billion at today’s prices. This event caused Bitcoin’s price to plummet to a local low of $420 in February 2014.

The exchange had suffered multiple hacks between 2011 and 2014, severely undermining its security. Although the Mt. Gox rehabilitation trustee has announced plans for repayments, the process has faced numerous delays. The most recent deadline was set for September 2023, just before the previously scheduled repayment date of October 31, 2023. Despite the upcoming repayment plans, there remains uncertainty about further delays.

Plans for repayment

The rehabilitation trustee for Mt. Gox will begin processing repayments in Bitcoin and Bitcoin Cash starting in July 2024, as stated in a notice from the exchange on June 24. According to the announcement, repayments will be made to cryptocurrency exchanges where the required information for implementing the repayments has been verified and confirmed.

The trustee has urged users to remain patient, explaining that the order of payments will depend on the completion of information verification with each cryptocurrency exchange. Users are asked to wait until these repayments are processed.

Mt. Gox owes over $9.4 billion worth of Bitcoin to about 127,000 creditors. These creditors have been waiting for more than 10 years to recover their funds after the exchange collapsed in 2014 due to multiple unnoticed hacks.

Mt. Gox wallet made transactions in May 2024

The $9.6 billion Bitcoin transfer by Mt. Gox in May was a part of the ongoing repayment process.

The exchange’s repayment plans have been among the most closely watched developments in the industry, with users waiting for over 10 years to be reimbursed for their lost BTC.

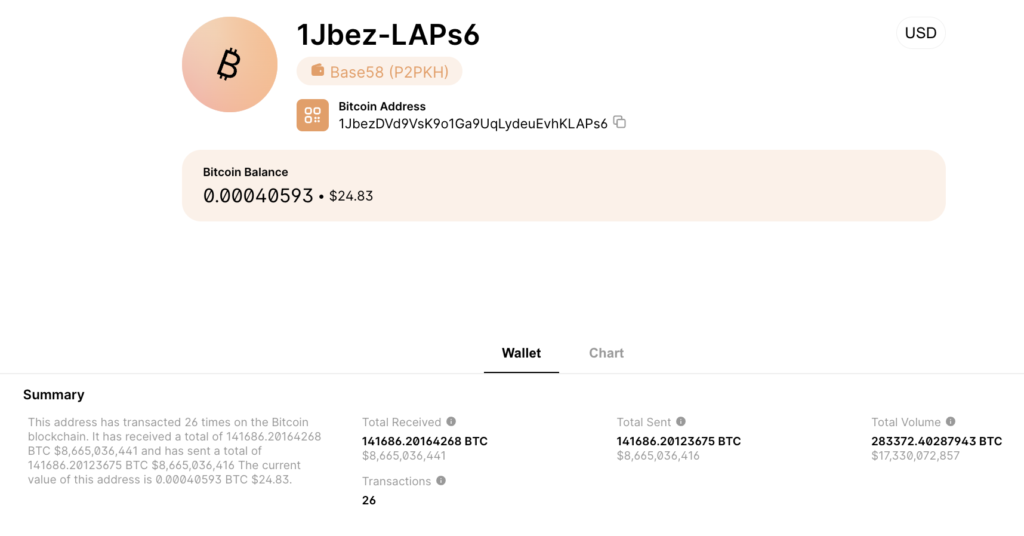

On May 28, Mt. Gox transferred 141,686 BTC, into a new wallet (1JbezDVd9VsK9o1Ga9UqLydeuEvhKLAPs6) from several other cold wallets associated with the exchange.

This marked the first on-chain movement of funds from Mt. Gox in more than five years.

After the deposits, the wallet then made several other transactions, depositing funds in other wallets.

As of the writing of this article, the said wallet holds no more funds.

Source: Blockchain.com

Following these reports, Mt. Gox rehabilitation trustee Nobuaki Kobayashi confirmed that this consolidation was part of the exchange’s repayment plans, though he did not specify when repayments would commence.

In a May 28 announcement, Kobayashi stated, “The Rehabilitation Trustee is preparing to make repayment for the portion of cryptocurrency rehabilitation claims to which cryptocurrency is allocated… As the Rehabilitation Trustee is proceeding with the preparation for the above repayments, please wait for a while until the repayments are made.”

Markets anticipate Mt. Gox repayment

After the initial batch of Mt. Gox transfers, the price of Bitcoin dropped by 2% on May 28. As of June 25, BTC has dropped by 9.75% since May 28, when the Mt. Gox wallet was active.

Source: BTC/USDT, 1-month chart. CoinMarketCap

This dip might indicate that markets are factoring in a potential repayment by Mt. Gox. Analysts think that the market has reacted to these movements with a slight bearish sentiment. This could be due to the expectation of selling pressure from creditors once they receive their repayments.

Despite the minor price decline, this is still an important moment in the timeline of cryptocurrency evolution, fixing one of the crypto industry’s most significant and long-standing issues.