Pump-and-dump schemes, prevalent in over 90,000 Ethereum projects, are eroding confidence in the DeFi sector by exploiting liquidity and inflating profits, casting a shadow on the cryptocurrency industry’s integrity.

The world of cryptocurrency is like the Wild West, but it’s slowly becoming more like traditional finance. But in decentralized finance, or DeFi, it’s still pretty wild. People often trade in risky ways, leading to scams and unfair trading.

In a scam called a pump-and-dump, someone or a group lies to make people excited about buying a token. They say things that aren’t true to make people afraid of missing out. Then, while others start buying, they sell their own shares for a higher price.

So far, people have created over two million different cryptocurrencies. But many of these are no longer used.

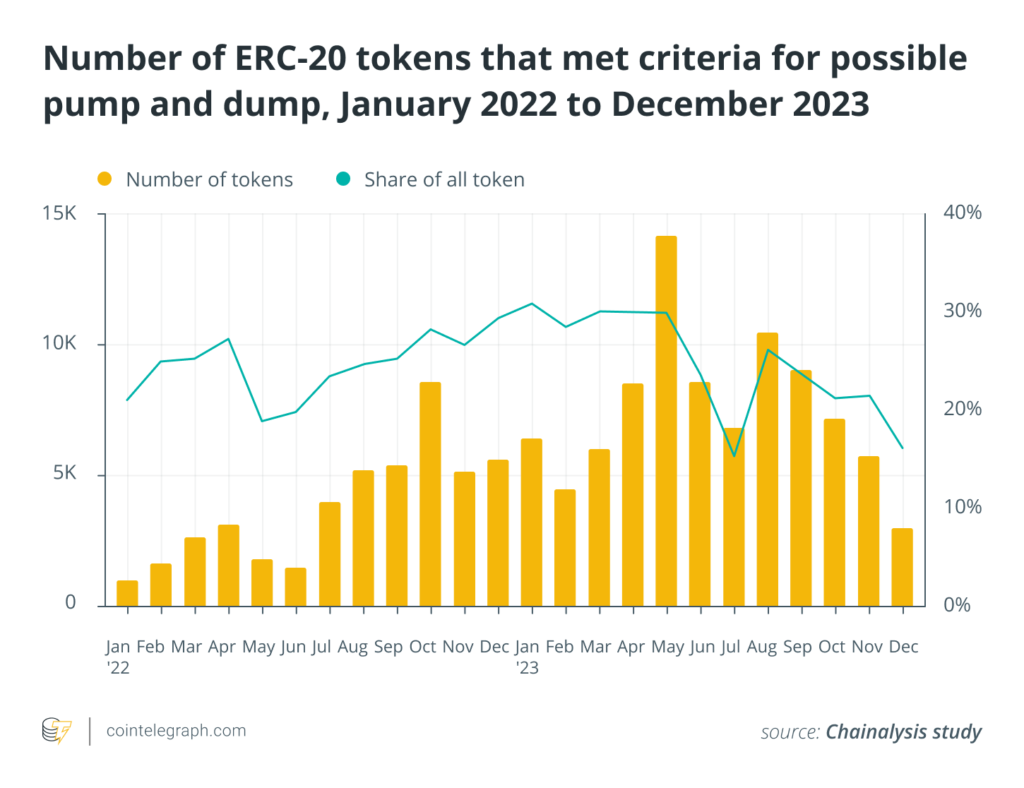

According to a Chainalysis report, in 2023, more than 370,000 new tokens were created just on the Ethereum network. Out of these, 168,600 were listed on decentralized exchanges, where people can trade them.

The report found that many Ethereum tokens show signs of being messed with in the market.

Usually, less than 1.4% of new tokens get more than $300 in trading activity right after they launch. Only 5.7% of the tokens started in 2023 on Ethereum have done better than this.

Also, the research points out that about 90,408 tokens didn’t get more than $300 in trades. And there was at least one case where someone took out more than 70% of a token’s trading money in one go, after buying it five times before.

While this doesn’t prove these tokens were all used in scams, it does show how experts can use the data from the blockchain to find fishy patterns.

The entities that launched these tokens made around $241.6 million in profit in 2023.

This doesn’t include the costs to set up and start their projects. Some of these people launched many tokens. For example, one person started 81 different tokens and made about $830,000.

How can unfair trading stop?

- Make cryptocurrency rules clearer to prevent unfair trading.

- Understand that crypto trading happens across many platforms, not just one, requiring a broad view for effective regulation.

- Regulators should learn how the crypto market is evolving to better combat insider trading.

- Increase oversight in the crypto space, similar to the stock market, to deter unethical practices.

- Crypto exchanges should provide clearer warnings to their users about the risks of insider trading.

- Develop and implement stricter regulatory measures for both centralized and decentralized exchanges.

- Encourage transparency and ethical practices among those launching new tokens, especially with memecoins.

- Consider the long-term impact of allowing pump-and-dump schemes on the credibility and stability of the crypto market.

Crypto integrity and oversight

Many can see how all these events, such as DeFi scams and unregulated trading, can hurt the crypto world’s reputation.

A solution would be to have an independent or clear third-party check for bad practices.

It’s hard to catch wrongdoers in crypto because the laws are not clear.

People choose crypto to avoid traditional banks, which they might not trust. But if crypto faces the same problems as banks, people might go back to banking. To gain more users, the crypto community must stop these bad practices.

Depending on your geographical location, you might have laws that have your back.

Laws like the European Union’s Markets in Crypto-Assets Regulation (MiCA) can help. They set rules and punishments to prevent wrongdoing, which could reduce fraud in the industry.

The rise of the influencer-led crypto projects

Unlike startups that need time to grow before offering shares, memecoin projects can explode overnight, often inspired by online jokes or trends.

Insiders might use secret tips to make fast, large profits by buying before big news breaks, pushing up the price of their holdings.

Services like Lookonchain can spot these activities, such as a case where someone turned a small investment in Solana’s token into $2 million by trading just five minutes after market launch.

Some crypto influencers push hasty decisions that can lead to losses, as they may profit from hyping certain projects. Regulators try to control this by targeting promoters, but often, the main culprits remain untouched.

The U.S. Securities and Exchange Commission has taken legal action against celebrities, like Kim Kardashian, for unauthorized crypto promotions, with the SEC’s Chair warning against such activities in 2023.

How to avoid pump-and-dump schemes in crypto

Despite efforts, regulators struggle to control crypto pump-and-dump and insider trading.

Chainalysis’s study shows gaps in enforcement. This might mean that the regulators could try to apply traditional finance protections to crypto. However, unclear laws and guidelines hinder this.

Authorities usually track back from victims, but social media complicates matters. Catching and prosecuting wrongdoers is necessary to stop them from exploiting the system.

The good news is that a simple blockchain analysis can trace stolen funds. However, setting up a capable regulatory team remains a challenge.

On-chain analysis can reveal who owns most of a token, which might indicate a scheme. Overall, transparency, which is unique to blockchain, can assist in monitoring.

Preventing scams requires investor education and skepticism. Self-research and cautious investing are essential. The sector’s growth relies not just on big firms entering but on protecting individual investors in DeFi. Always exert caution, especially with new, quickly rising tokens.