In the vast and volatile ocean of the cryptocurrency market, there exists a creature of immense power and influence: the crypto whale. Much like their namesake in the natural world, crypto whales are entities or individuals who hold a colossal amount of cryptocurrency.

They are the big players whose investments are so significant that their trading movements can cause ripples or even tidal waves across the market, influencing prices and trends in ways that affect every other participant.

What is a crypto whale?

A crypto whale is someone who owns a huge amount of cryptocurrency. It’s called a whale as it may resemble a real whale, which s a huge creature in the ocean.

Because they have so much crypto, these crypto whales can make big moves in the market. If they decide to buy a lot of one type of cryptocurrency, the price can go up because there’s a lot of demand all at once.

If they sell a lot, the price can drop because it looks like there’s a lot of that crypto available all of a sudden.

Essentially, crypto whales are important because their actions can change the prices in the cryptocurrency market very quickly, influencing how much your cryptocurrency is worth.

Who exactly qualifies as a whale?

While there’s no exact threshold, it’s generally agreed that these are holders of enough digital currency that their buy or sell orders can single-handedly move market prices.

This might mean owning thousands of Bitcoins, millions in Ethereum, or equivalent amounts in other digital currencies.

The impact of crypto whales on the market

Many talk about the crypto whales because they can dramatically sway market prices in one direction or another.

These market movements are not just numerical changes on a screen; they can have real effects on other investors.

For instance, a sudden price drop caused by a large sale can trigger panic selling among smaller investors, further driving down the price.

On the other hand, a price increase might encourage more buying, creating a snowball effect that pushes the price even higher.

However, not all impacts of whale activity are negative or manipulative. Sometimes, whales can bring stability to a market by using their substantial holdings to prevent drastic price swings. For instance, they might buy up a cryptocurrency when its price drops to a certain level, providing a safety net that can reassure other investors and stabilise the market.

Luckily, crypto transactions are all recorded on the blockchain. That’s how we can all check the current crypto whales and observe in real-time any sudden massive crypto transactions.

Of course, we can only see the wallets belonging to these whales, but we can’t tie them to a particular person. Also, we cannot know if one or more wallets belong to the same individual. Understanding how the blockchain works will offer great insight into how to interpret the data offered by this technology.

How to identify crypto whales

Identifying the movements of crypto whales is key to understanding market dynamics, yet it requires access to specific tools and platforms designed to track and analyze vast amounts of transaction data across different blockchains.

Blockchain explorers

These platforms allow users to view real-time transactions on their respective blockchains, including the amounts transferred and the wallet addresses involved.

By monitoring large transactions, one can infer potential whale movements. For example, a single transaction involving thousands of Bitcoins or a similar magnitude of another cryptocurrency could signal whale activity.

- Etherscan.io: Offers a comprehensive look at Ethereum transactions, wallet addresses, and smart contracts.

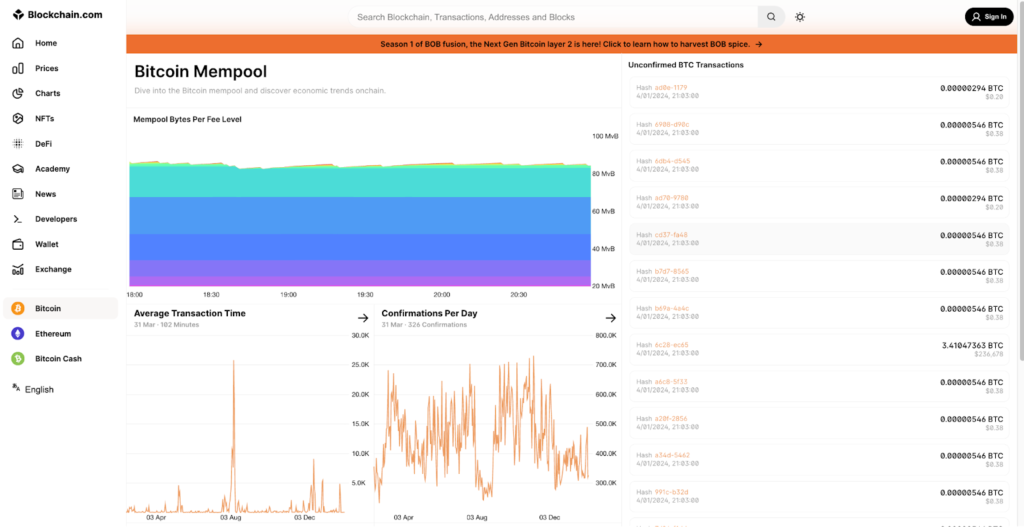

- Blockchain.com/explorer: Provides detailed information on Bitcoin transactions and has features for tracking other cryptocurrencies like Ethereum.

- Solana

- Polygon

- BSC Smart Chain

- Tron

- Tezos

Source: Blockchain.com

These are just some examples. Such a blockchain explorer exists for any blockchain. You can simply search for the “name of the blockchain” + “explorer” on Google and you will find the corresponding blockchain explorer.

Crypto analytics platforms

Specialised analytics platforms offer more nuanced insights into the crypto market, including the tracking of whale movements. These services analyse blockchain data to highlight large transactions and potentially link them to known whale accounts or institutions.

- Whale Alert (@whale_alert on X): Known for real-time alerts on large cryptocurrency transactions across various blockchains, helping to identify potential whale activities.

- CryptoQuant: Offers a range of metrics and indicators, including exchange inflow/outflow, which can indicate potential sell/buy pressure from whales.

Social media and forums

Social media platforms and cryptocurrency forums are also rich sources of information and speculation regarding whale activities.

Communities on Reddit (such as r/CryptoCurrency), X (former Twitter), and specialised forums often discuss large transactions and potential whale movements, providing context and interpretations that may not be immediately apparent from raw data alone.

Crypto wallets and transactions

Identifying a whale involves more than just spotting a large transaction.

It’s about recognising patterns over time, such as repeated transactions from the same wallet address or significant amounts moving in response to market events.

Wallets holding large amounts of cryptocurrency often belong to individuals, exchanges, or institutional investors, each influencing the market in different ways.

While the tools and platforms mentioned provide valuable insights into whale activities, interpreting this data requires a nuanced understanding of the market. Observing transaction patterns, understanding the context of large movements, and staying informed through community discussions are all crucial for those looking to navigate the crypto waters influenced by whales.

Crypto whales are important

Understanding the role of crypto whales is crucial for anyone involved in cryptocurrency.

Their actions can serve as indicators of market trends, offering insights to savvy investors who keep an eye on whale movements.

By recognising the signs of whale activity, investors can make more informed decisions, navigating the crypto market with a better understanding of its underlying dynamics.