What is Monero?

Monero (XMR) is an open-source cryptocurrency. It was created in April 2014 and it concentrates on fungibility, solitude and decentralization. Monero utilizes an obfuscated people ledger, meaning anyone can broadcast or send trades, but no external observer can inform the origin, destination or amount. Monero utilizes a Proof of Work mechanism to issue new coins and incentivizes miners to guarantee the community and confirm transactions.

A short history of Monero

The implementation of CryptoNote, Bytecoin, was initiated in July, 2012.

CryptoNote = application layer protocol which fuels various decentralized currencies.

Bytecoin had a good deal of questionable things going on. It had been determined that the bytecoin blockchain will be forked as well as the brand new coins from the new series will be known as Bitmonero. Finally, it had been renamed Monero meaning “coin” in Esperanto. Within this brand new blockchain, a block is mined and added every 2 minutes.

Monero has been developed by 7 people. Only 2 of those programmers have come out publicly. They are: David Latapie and Riccardo Spagni aka “Fluffypony”. Monero is an open-source project and crowdfunded.

| Development | |

| Original author(s) | Nicolas van Saberhagen |

| White paper | CryptoNote v 2.0 |

| Initial release | 18 April 2014 (4 years ago) |

| Latest release | 0.13.0.3 / 14 October 2018(9 days ago) |

| Code repository | github.com/monero-project |

| Operating system | Windows, Linux, macOS, BSD, Solaris |

| Source model | BSD 3-Clause |

| Website | getmonero.org |

| Ledger | |

| Timestamping scheme | Proof-of-work |

| Hash function | CryptoNight |

| Issuance | Decentralized, block reward |

| Block time | 2 minutes (previously 1 minute) |

| Block explorer | xmrchain.net |

| Circulating supply | 16,250,168 XMR (as of 22 July 2018) |

Special features of Monero

The CryptoNote algorithm includes 5 properties that are special.

Property #1: Your own the currency

You’ve got total control over your trades. You’re liable for your assets. Since your individuality is personal, nobody will have the ability to find out what you’re spending on.

Property #2: It’s Fungible

As a result of its solitude, is the fact that it’s really fungible. What’s fungibility?

Fungibility = a good or asset’s interchangeability with other individual goods or assets of the same type.

Let us create the difference between what’s fungible and what’s non-fungible.

Suppose you borrowed $20 from a friend.

Should you return the cash to him with ANOTHER $20 bill, then it’s completely fine. Actually, you may even return the cash to them in the kind of 1 $10 bill and two $5 bills. It’s still fine. The buck has fungible possessions ( but this is not the case all the time ).

But if you should borrow somebody’s car for the weekend and then come straight back and give them another automobile in return, then that individual will most likely hit you in the face. In reality, in the event that you went off with a reddish Impala and came back with a different red Impala then that isn’t a done deal. Cars, in this example, are a nonfungible asset.

So, what is the deal with fungibility when it comes to cryptocurrency?

Let’s take bitcoin for example. Bitcoin has an open ledger.

However, what it also means is that every person is able to view the trades in it and furthermore, everybody is able to see the path of the trade. What this essentially means is that assume you have a bitcoin which formerly was utilized in certain prohibited trade (eg. Buying drugs), it might forever be tied in the trade details.

For some services and exchanges, these “tainted” coins won’t ever be worth as far as “blank” coins. This eliminates fungibility and is among the most frequently used criticisms from bitcoin. After all, why should you suffer if a number of the last owners of your bitcoin employed it to create some prohibited purchases?

This is the area where Monero comes from. Since each of their transactions and data is confidential, nobody can understand what trades your Monero has gone before and can they understand what has been used to get along with your Monero. Since its trade history can never be revealed, in addition, it suggests that the “trade” route is non-existent.

As a consequence of this, the idea of “tainted” Monero and “clean” Monero does not exist, and therefore they’re fungible!

Property #3: Dynamic Scalability

The Bitcoin scalability problem was a really popular topic among the crypto circles.

Bitcoin was made using a self-imposed 1 Mb block size limitation. In its early advancements bitcoin did not have some block size limitation, however, so as to stop spam trades, the size limit was enforced.

Monero, on the other hand, doesn’t have “pre-set” dimension limitation, but this means that malicious miners can clog up the machine with disproportionately huge cubes. To stop this from occurring, a block reward-punishment is assembled into the computer system.

First, the median size of the previous 100 cubes is taken that’s known as M100. Now assume the miners mined a brand new block and it possesses a specific dimension that’s known as “NBS” aka New Block Size. In case NBS > M100, then the cube payoff becomes decreased in quadratic dependency of just how much NBS surpasses M100.

This means that if NBS is [10%, 50%, 80%, 100%] greater than M100, the block reward gets reduced by [1%, 25%, 64%, 100%]. Generally, blocks larger than two *M100 aren’t permitted, and cubes = 60kB are always free from almost any block reward penalties.

Property #4: ASIC (Application Specific Integrated Circuit) Resistant

Monero isn’t just “ASIC resistant”, however, the price of fabricating ASICs to get Monero will be so large that it will not be worth it. Why is that?

Monero relies on the CryptoNote platform (making it distinctly different from bitcoins) as well as the hashing algorithm used in CryptoNote established systems is known as “CryptoNight”.

CryptoNight was made to construct a fairer and much more decentralized currency program. Cryptocurrencies which include CryptoNight can’t be mined. It had been hoped this could stop the invention of mining pools and also make the currency more evenly dispersed.

What are the properties of CryptoNight which makes it ASIC Resistant?

- Cryptonight requires 2 MB of fast memory to work. This usually means that parallelizing hashes is restricted by how much memory could be crammed in a processor when maintaining economical enough to be well worth it.

- Cryptonight is developed to become CPU and GPU friendly since it’s intended to make the most of AES-Ni instruction places. Basically, some of the work achieved by Cryptonight is currently being done in hardware when operating on contemporary consumer machines.

- There were discussions of transferring Monero on from proof-o- work algorithm to “Cuckoo Cycle” (another type of proof of work hash). If a change like this does occur, then the quantity of work spent at the R&D of Monero friendly ASICs will be moot.

Property #5: Multiple keys

The numerous keys of Monero, are among the more vexing aspects. In systems like Bitcoin and Ethereum, you just have one public key and one private key. Nonetheless, in a method like Monero, it isn’t quite as straightforward as that.

View Keys: Monero has a public view key and a private view key.

- The public key is used to create the one-time stealth public speech in which the capital will be sent to the recipient.

- The private view key is used by the receiver to scan the blockchain to find the funds sent to them.

The private view key creates the initial portion of this Monero Address.

Spend Keys: When the view key was mainly for the receiver of a trade, the spend key is all about the sender. As previously, there are just two spend keys: public spend key and private spend key.

- The public spend key will assist the sender to participate in ring trades and verify the signature of the key image.

- The private spend crucial helps in creating this crucial picture which permits them to send trades.

The people spend crucial makes the next portion of their Monero address.

The Monero address is a 95-character series that’s constructed from the public spend and public view key.

What is the cryptography involved in Monero?

Bitcoin trades occur due to public key cryptography.

A bitcoin user chooses their private key. The public key is then hashed to make a public address that’s available to the entire world. Therefore, if Alice were to send Bob a few BTC, she only must send them to his public address.

Now, there’s an issue with this system. The public address is public! Anyone around the blockchain can understand who address belongs to and because of this, take a look at their whole trade history and discover how much bitcoin they have! Even though Bitcoin is a decentralized cryptocurrency, it does not actually do a fantastic job of being a private.

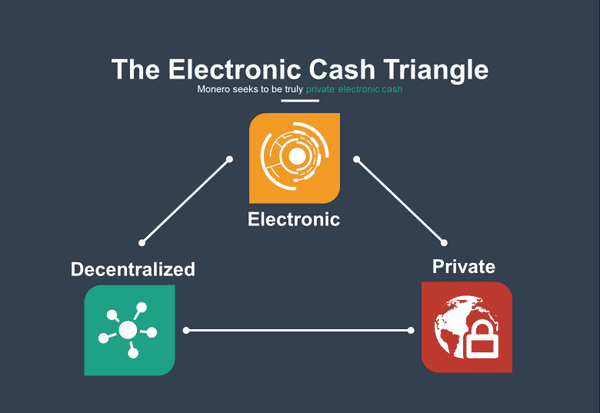

This is the “Electronic cash triangle” as the Monero team puts it:

Image courtesy: FluffyPony presentation.

As they put it, an ideal Electronic cash should fulfil three requirements:

- It should be electronic.

- It should be decentralized.

- It should be private.

With Monero, they are attempting to fulfil all these 3 criteria.

The underlying philosophy behind Monero is complete privacy and opaqueness.

- The privacy of the sender is maintained by Ring Signatures.

- The privacy of the recipient is maintained by Confidential Addresses.

- The privacy of the transaction is maintained by Ring CT aka Ring Confidential Transactions.

Monero Vs Bitcoin

The contrast between Monero and Bitcoin can’t be avoided.

Bitcoin prides itself on its receptive transparency. The blockchain is an open ledger that anybody, anywhere can get the blockchain and also read up on all previous transactions. Bitcoins are comparatively straightforward to get and utilize.

Each of the trades is completely confidential. Monero can be somewhat complex to comprehend and accessibility to novices.

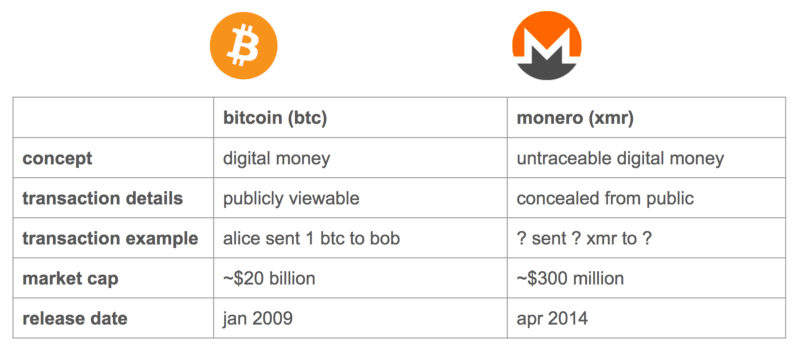

The next table by Lindia Xie in her Medium article makes a fine comparison between bitcoin and Monero:

Current market cap for BTC is $111,910,565,444 and the current market cap for Monero is $1,777,830,240 (October 2018)

The PROs and CONs of Monero

The PROs of Monero

- The very best privacy attributes on almost any cryptocurrency.

- The trades aren’t linkable.

- The trades aren’t traceable.

- The blockchain does not have a block limitation and it’s scalable.

- Even if the Monero distribution runs out there’ll be a constant 0.3 XMR/min source to incentivize the miners.

- Has attained staggering expansion financially.

- It’s selectively transparent. Everyone can create their trades visible to their individual of selection eg. An auditor by providing them with their personal opinion essential.

- Has a very capable and strong developmental team leading the charge.

The CONs of Monero

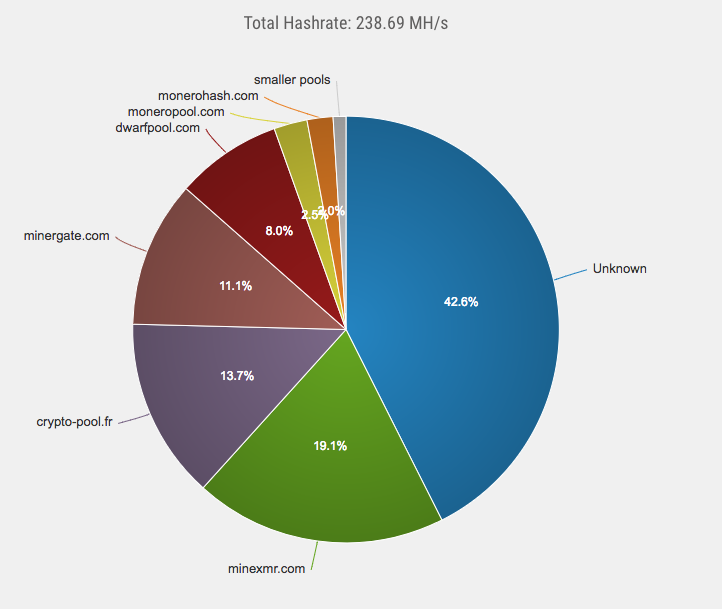

Although Monero was Created ASIC resistant to Reduce centralization, ~43% of hashrate of Monero is Possessed by 3 mining pools:

Image Courtesy: Monero Hash.

- Monero trades are significantly larger than other cryptos such as bitcoin due to the sum of encryption included.

- There isn’t much wallet compatibility for Monero. In reality, there aren’t any hardware pockets compatible with Monero

- It isn’t beginner friendly and hasn’t been widely embraced and accepted.

- Since it isn’t a bitcoin-based coin, Monero has faced challenging problems in the sense it is more difficult to add it.

The future of Monero

There’s not any doubt that as the future becomes much more open and decentralized, Monero is becoming increasingly more attractive due to the privacy it gives.

What’s especially interesting is the fact that it’s among those very few non-bitcoin based coins that have the capacity of really making it large. Interesting times lie ahead for Monero, and together with the staggering expansion it has already gotten, the future seems quite bright indeed.