The ongoing legal struggles between the SEC, Coinbase, and Ripple, have exposed the complexities of regulatory challenges in the cryptocurrency industry. On one side we see SEC’s enforcement actions, but one the other we have the financial platforms such as Coinbase that pushes for clearer regulations.

The United States Securities and Exchange Commission (SEC) will persist with its regulation-by-enforcement strategy towards the cryptocurrency industry to fulfill its objective of “choking” the sector, according to crypto exchange Coinbase.

In a May 31 filing with the U.S. Court of Appeals, Coinbase stated, “The SEC is serious about the destruction of digital assets.” This filing is part of Coinbase’s ongoing effort to compel the SEC to develop fair regulations for the crypto industry.

The exchange contends that the SEC is unwilling to establish clear and fair guidelines. “Giving the agency further opportunity to explain itself is both pointless and exquisitely undeserved,” Coinbase added.

Coinbase has argued that the SEC feels no obligation to make its rules easy to follow and thinks its regulations are “workable enough” because it has already taken legal action against several firms for breaking them. Coinbase urged the court to consider the views of other SEC Commissioners who also believe that the SEC is obstructing the digital assets industry and stifling new technology.

Hester Pierce, a pro-crypto SEC commissioner, recently suggested a cross-border sandbox program for U.S. and U.K. blockchain firms experimenting with tokenized securities. She noted that many firms seeking guidance from the SEC have found the process unhelpful, stating, “One of the problems that we’ve had is that people have tried to come into the SEC to get relief, but, you know, you sort of come in, and nothing happens. This would […] force the SEC’s hand a little bit.”

SEC downplays impact of its regulations on crypto industry

Coinbase pointed out that the SEC has tried to downplay its strict approach to the crypto industry by saying its rules only affect a small part of the market.

According to Coinbase, the SEC claims that only a “small set of market participants” might face “compliance difficulties” under certain parts of the existing rules.

The SEC sued Coinbase in June 2023, accusing the company of not registering as a broker, national securities exchange, or clearing agency, thereby avoiding the securities market’s disclosure requirements.

Coinbase has tried to get the case dismissed, but the SEC has consistently opposed these attempts.

Despite some optimism from the crypto industry and legal experts that Coinbase would succeed, it has not been able to get the case dismissed.

The SEC and Coinbase have since debated the issue online

The SEC vs. Coinbase: overview of the conflict

The conflict between Coinbase and the SEC began in June 2023, when the SEC sued Coinbase for allegedly operating without proper registrations. This lawsuit followed years of Coinbase lobbying for clearer regulations, during which they held over 30 meetings with the SEC. Coinbase criticized the SEC for its “power grab” enforcement and lack of clear guidelines.

Legal proceedings and decisions

- March 11, 2023: Coinbase’s legal team accused the SEC of failing to set up clear cryptocurrency regulations.

- Judge’s ruling: Judge Katherine Polk Failla allowed the SEC’s lawsuit against Coinbase to proceed but dismissed one claim related to Coinbase Wallet, narrowing the lawsuit’s scope.

- October 2023: Coinbase aimed to dismiss the SEC’s charges, arguing that the transactions in question did not meet the definition of investment contracts.

- January 2024: Judge Failla questioned both parties about whether certain cryptocurrencies should be classified as securities.

SEC vs Coinbase: Arguments

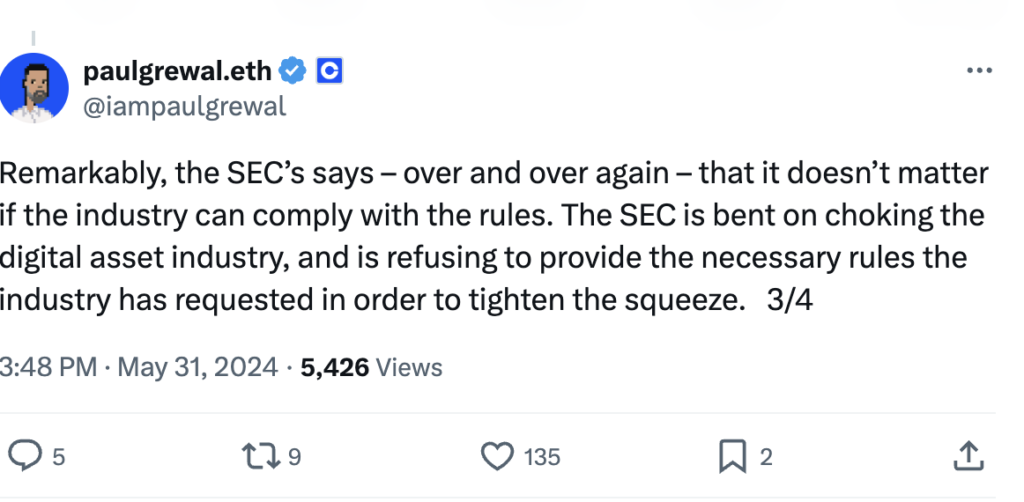

- Paul Grewal (Coinbase CLO): Criticized SEC Chair Gary Gensler for misrepresenting crypto tokens and hindering the digital assets industry. Grewal also highlighted the need for Congressional involvement in crypto regulation.

- Gary Gensler (SEC Chair): Emphasized the need for compliance with securities laws, citing scams and fraud within the cryptocurrency market. Gensler maintained that current laws are sufficient for regulating crypto securities markets.

Coinbase Chief Legal Officer Paul Grewal recently criticized SEC Chair Gary Gensler, accusing him of “misrepresenting” crypto tokens. Gensler had previously asserted, “Many of those tokens are securities under the law of the land, as interpreted by the US Supreme Court. We follow that law.”

On Monday, May 6, Gensler emphasized the impact of scams and fraud within the cryptocurrency market.

He noted that although crypto is a small part of the overall financial market, it disproportionately contributes to illegal activities due to non-compliance with securities laws.

Gensler stated that the crypto industry needs to make proper disclosures, especially for tokens classified as securities, so that investors can make informed decisions.

Meanwhile, Paul Grewal criticized the SEC for issuing a Wells notice to Robinhood Markets concerning its cryptocurrency operations. This dispute arises amid reports that the SEC is investigating whether Ethereum (ETH) is a security.

Broader industry impact

- Ripple’s involvement: Ripple’s legal team, along with Coinbase’s, raised concerns with Treasury Secretary Janet Yellen about the lack of clear oversight in cryptocurrency.

- Community and legal support: The crypto community, digital asset associations, and policymakers have shown support for Coinbase, highlighting the need for new legislation from Congress.

The battle between Ripple and SEC continues

On May 20, 2024, the SEC filed its response to Ripple‘s Motion to Seal, requesting the court deny Ripple’s request to seal financial and securities sales information. The SEC argued that these documents are ‘judicial documents’ and essential to the arguments in the remedies-related motions.

This push for transparency contrasts with the SEC’s efforts to keep internal documents related to William Hinman’s 2018 speech, where he stated that Bitcoin (BTC) and Ethereum (ETH) were not securities, from becoming public.

Hinman’s connection to Simpson Thacher, a firm promoting Enterprise Ethereum, has been controversial. Documents revealed he continued meeting with Simpson Thacher despite SEC Ethics Division warnings. Hinman returned to Simpson Thacher after his SEC tenure.

An ongoing investigation into alleged crypto conflicts of interest within the SEC could disrupt the SEC’s plans to appeal against the Programmatic Sales of XRP ruling. In February, watchdog group Empower Oversight announced that the Office of Inspector General was nearing the conclusion of its investigation into these conflicts, particularly focusing on Hinman’s financial ties to Simpson Thacher.

If the investigation uncovers evidence of conflicts of interest, the SEC could face significant scrutiny from lawmakers and may abandon its appeal plans to avoid further controversy. This scenario could positively impact XRP’s market perception.

Additionally, in January, the SEC filed a Motion to Dismiss its charges against Debt Box after a court order questioned the SEC’s conduct. However, Judge Robert Shelby denied the Motion to Dismiss in March.

The end of the SEC’s plans to appeal the Programmatic Sales ruling could be beneficial for XRP, potentially boosting investor confidence and market stability.

SEC vs Coinbase: Important developments

In December 2023, the SEC rejected Coinbase’s petition for new rules for digitally traded securities. Coinbase appealed this decision, seeking a court order to compel the SEC to establish clearer regulations.

As a response, Coinbase launched the #Crypto435 campaign, encouraging Americans to advocate for supportive crypto legislation, and filed a petition in federal court to demand clearer regulatory guidelines from the SEC.

Is Coinbase legal?

The ongoing legal battles and regulatory challenges faced by Coinbase highlight the urgent need for clear and fair guidelines for the cryptocurrency industry.

As the largest crypto exchange in the U.S., Coinbase’s fight against the SEC is pivotal in shaping the future regulatory landscape for digital assets.

The resolution of this conflict will significantly impact the broader crypto industry and its regulation.