Bitcoin miners are nearing capitulation due to shrinking profit margins and increased BTC sell-offs. Since the halving, miners have seen a 63% drop in daily revenues. As a result, miners are forced to sell their reserves.

According to CryptoQuant, a market intelligence firm, Bitcoin miners are showing signs of giving up, similar to what happened after the FTX crash in late 2022. This could mean that Bitcoin (BTC) might be reaching a low point.

Miner capitulation means some miners are reducing their operations or selling some of their Bitcoin to stay in business or manage their risks.

During this time, Bitcoin’s price dropped by 13%, from $68,791 to $59,603. One major sign is a drop in Bitcoin’s hash rate, which is the total computing power that secures the Bitcoin network.

Source: Network True Hashrate Drawdown (%), CryptoQuant

This situation is very similar to late 2022, when the market hit rock bottom after the FTX crash.

The CryptoQuant graphic shows several signs that miners are struggling. One major sign is a 7.7% drop in the hash rate since the halving, indicating that it’s becoming harder for miners to continue their work. The hash rate, which measures the total computing power of the Bitcoin network, usually falls when the market is doing poorly. Now, the hash rate has reached a four-month low of 576 EH/s after hitting a record high on April 27.

This suggests that miners might face even tougher times ahead, but it could also mean good opportunities for investors looking to buy Bitcoin at a lower price.

Early signs of miner capitulation

When bitcoin miners start to give up, savvy investors often see it as a good time to buy. This is because when miners have to sell their BTC to cover costs, it pushes the price down.

However, this sell-off can also mean the market is hitting its lowest point, setting the stage for a possible recovery. Data from CryptoQuant shows that miners are selling their Bitcoin reserves faster than before.

Daily BTC outflows from miners’ wallets are at their highest since May, showing a big sell-off.

This trend suggests that miners, struggling with falling revenues, would rather sell their assets than keep operating at a loss.

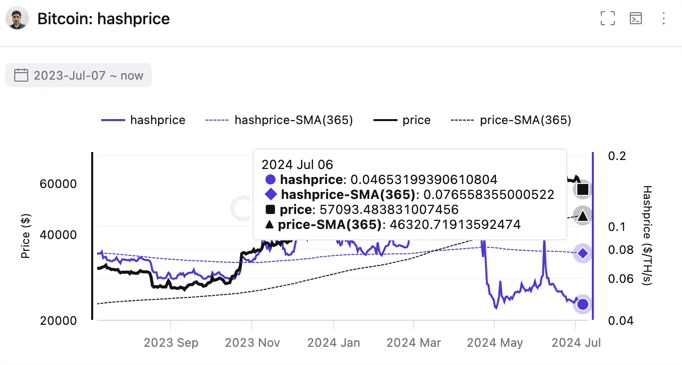

The “hash price,” which measures how much miners earn per unit of computing power, has also fallen to very low levels. Right now, the average revenue per hash is $0.046 per EH/s, just slightly above the all-time low of $0.045.

This drop in profitability makes things even harder for miners, forcing them to shut down operations and sell their bitcoins, adding more pressure on the market.

As miners give up, bitcoin might find a new bottom before bouncing back.

Bitcoin’s hashrate decline

Notably, the 7.7% decline in hashrate is similar to what happened in late 2022, when Bitcoin’s price hit a low of $15,500 before rising over 300% in the next 15 months.

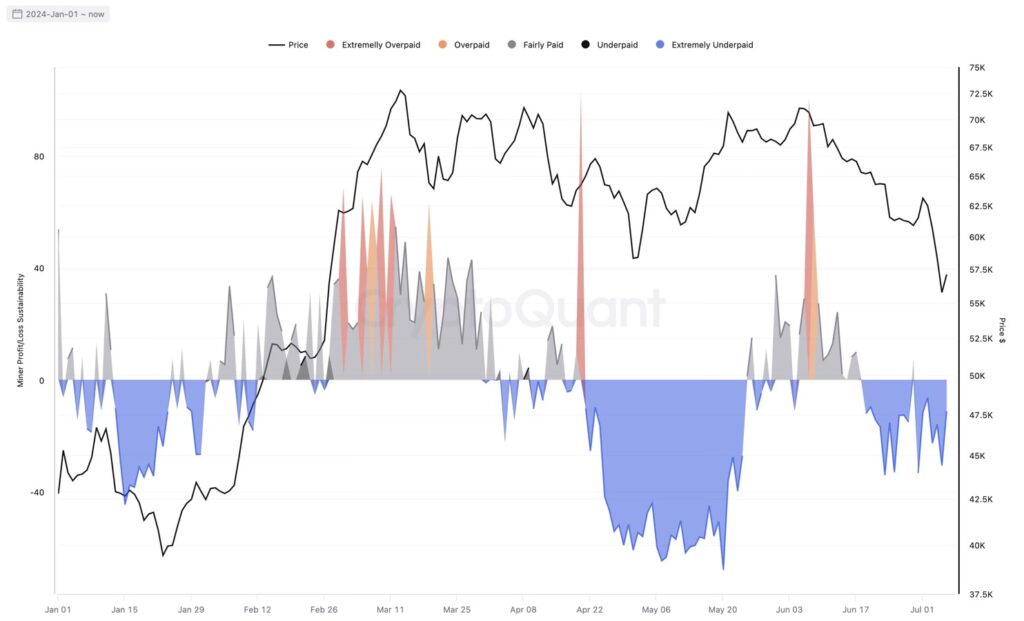

The CryptoQuant report mentioned that since the halving, miners have been extremely underpaid, as shown by the miner profit/loss sustainability indicator.

Source: Miner Profit/Loss Sustainability, CryptoQuant

As a result, miners have seen a 63% drop in daily revenues since the halving when both Bitcoin’s block rewards and transaction fees were higher.

Total daily revenues have decreased from $79 million on March 6 to $29 million now.

Additionally, revenue from transaction fees has dropped to only 3.2% of the total daily revenues, the lowest since April 8.

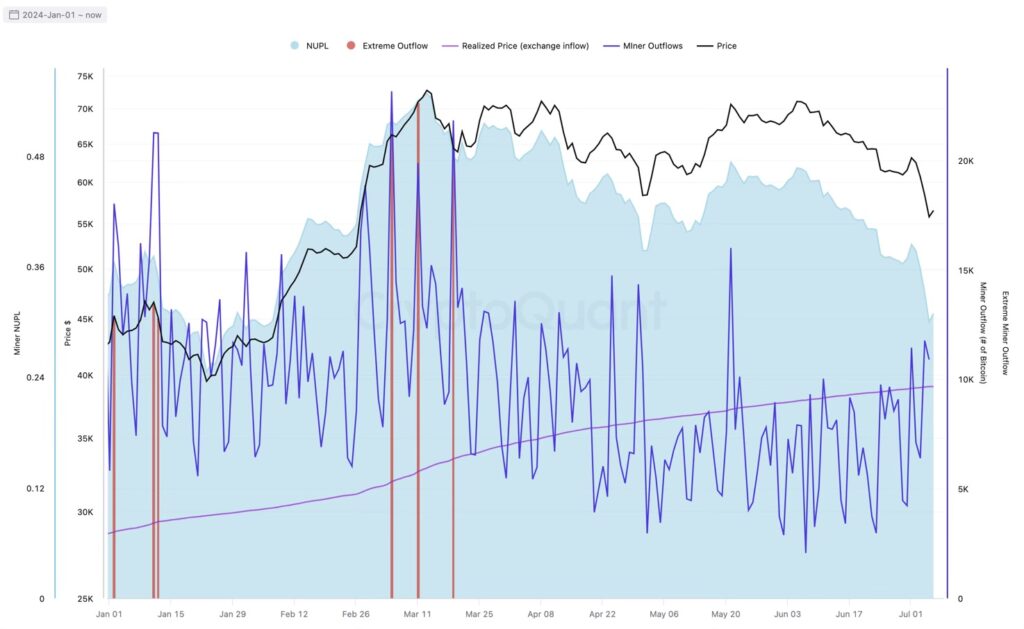

Source: Daily Bitcoin miner outflows, CryptoQuant

Due to these decreased revenues, Bitcoin miners have had to use their reserves to earn yield. Daily miner outflows have surged to the highest level since May 21, suggesting they might be selling their BTC reserves.

This sell-off by miners, along with sales from Bitcoin whales and national governments, has contributed to Bitcoin’s recent price drop, reaching a four-month low of $53,499 on July 5.

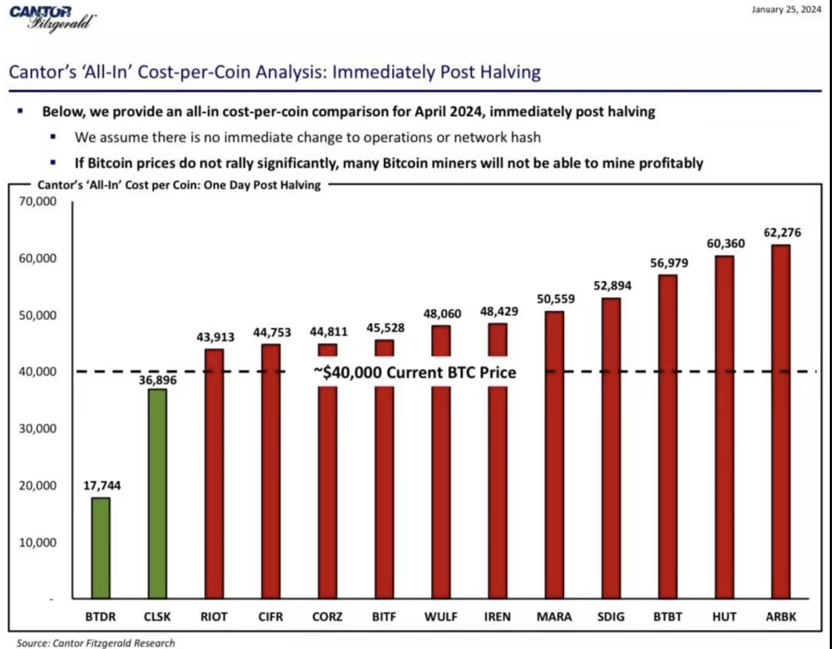

Source: Cantor Fitzgerald Research

An earlier report by financial services firm Cantor Fitzgerald noted that some of the world’s largest mining companies might be forced to give up if Bitcoin’s price falls to $40,000, highlighting the tough situation for the mining industry.